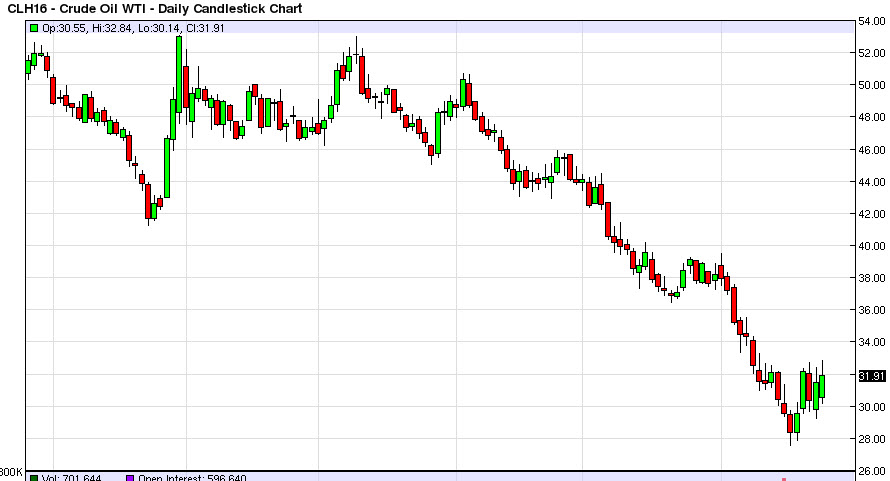

WTI Crude Oil

The WTI Crude Oil market rose during the course of the day on Wednesday, as we broke above the $32 level. However, we did pullback slightly from there and it now looks as if the market is still going to continue to struggle in this general vicinity. Even if we break higher, I feel that this market will more than likely find plenty of resistance all the way to the $36 handle, so having said that I have no interest whatsoever in buying this market. I believe that the sellers will return sooner or later, and we will either get a selling opportunity off of an exhaustive candle above, or a complete turnaround on short-term charts as we should see a break down to resume the longer-term downtrend that has been so strong in this market.

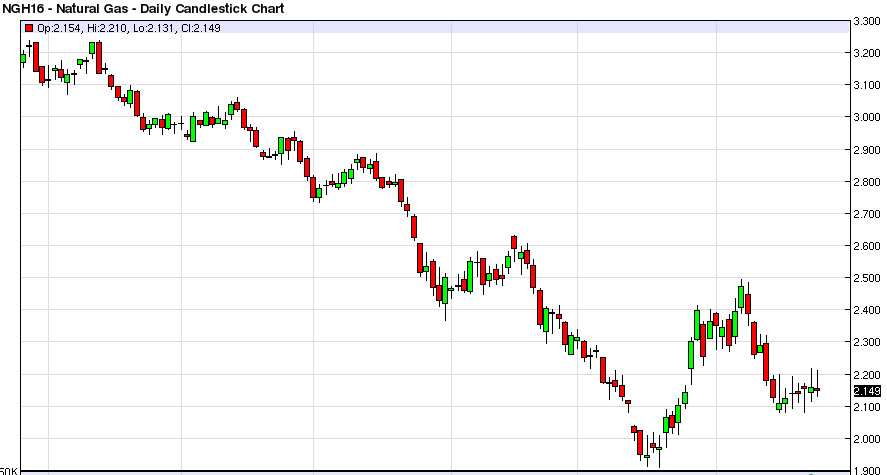

Natural Gas

Natural gas markets tried to rally during the session as well, as the $2.20 level offered resistance again. By doing so, the market ended up forming a shooting star, which of course is a very negative sign. I believe that the selling pressure will continue to be very strong, so any time we rally will more than likely see sellers on short-term charts. The shooting star that formed for the day is just another one in a long line of bearish candles over the longer term, so I believe that it’s only a matter time before we break down below the $2.09 handle. Once we do that, the market should go much lower, perhaps reaching towards the $2 level next.

Any rally at this point in time should end up being sold off, even if we break above the top of the shooting stars of the last couple of sessions. The supply is simply too strong for natural gas to gain any real significant amount at this point, so selling sell again is what I’m doing.

Leave A Comment