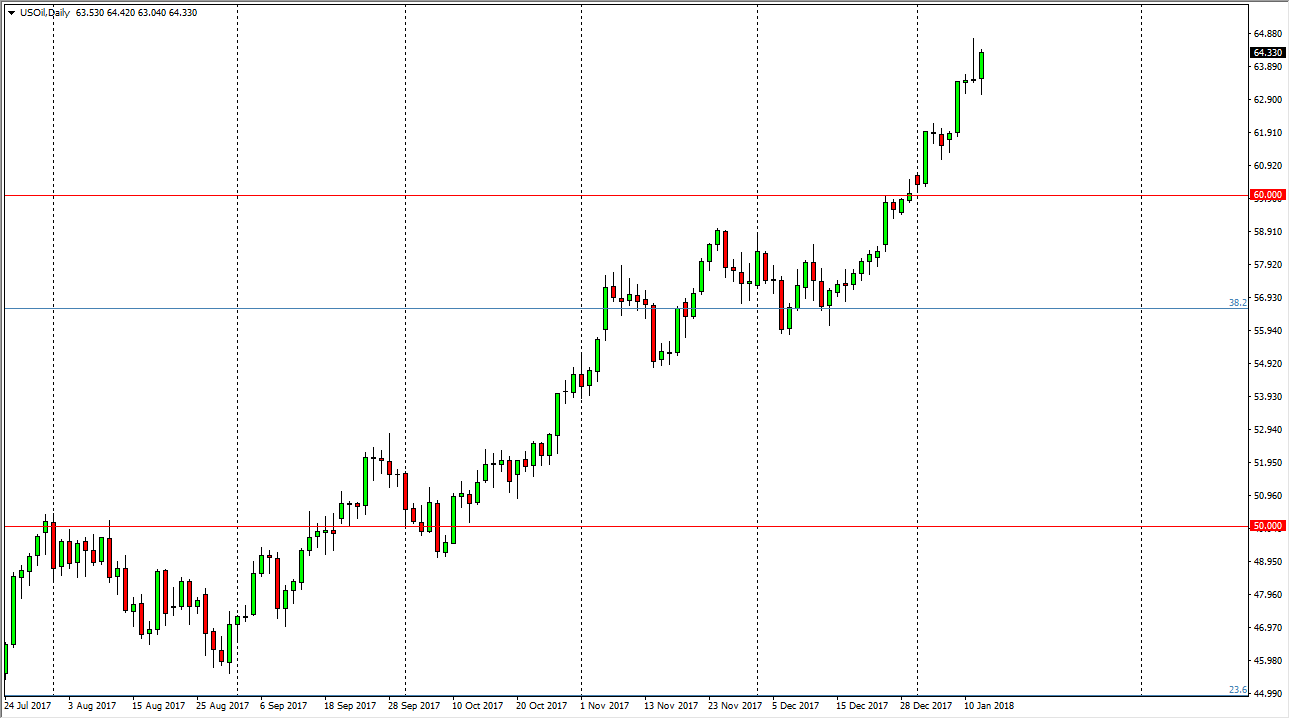

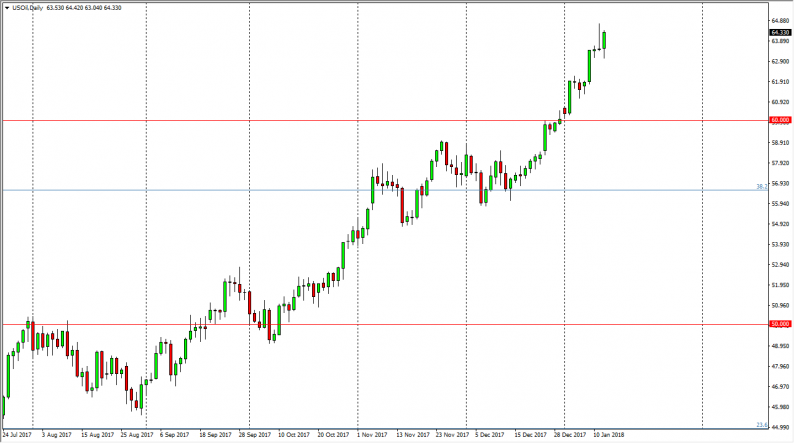

WTI Crude Oil

Oil markets initially fell during the day on Friday, and as we had formed a shooting star on Thursday, it looks like we may be getting a bit of a pullback. However, we turned around and rallied significantly as the US dollar fell. It now looks as if the market is going to try to reach towards the $65 level above, a psychologically important level. I think pullbacks continue to be an opportunity to take advantage of the overall uptrend, but I recognize that we are getting overextended to say the least. I would much prefer to see a significant pullback that a wind look at as a value play, and with the Baker Hughes Oil Rig Count figures extending American production, I think that although we are bullish, you will have to be very tight with your stops. A break above $65 opens the door to the $67.50 level.

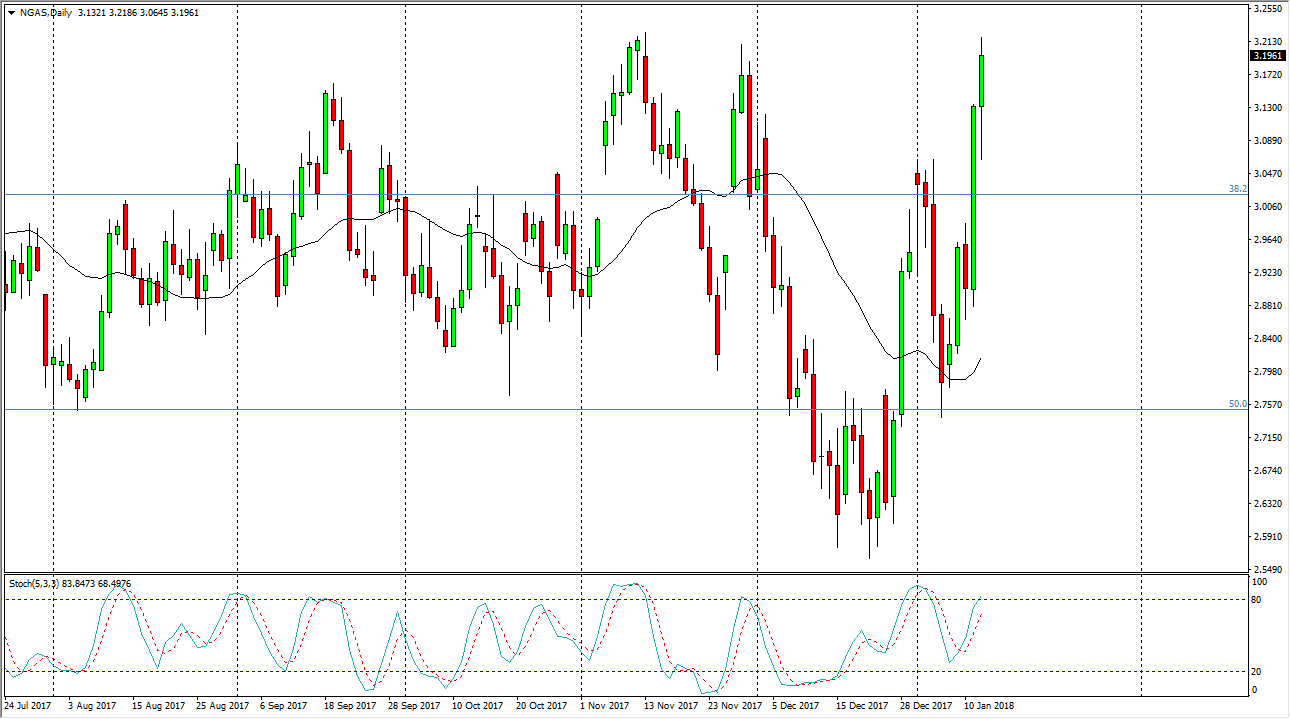

Natural Gas

Natural gas markets initially fell during the trading session on Friday, but then extend gains towards the $3.20 level. However, this is an area that offers a lot of resistance historically, and I think it’s only a matter of time before the sellers get involved. When I look at the weekly chart, we are entering an area that causes a lot of resistance, as the oversupply is well documented. Color temperatures in the northeastern part of the United States continue to push natural gas markets higher in the short term, but this has been consolidation over the longer term, and we are getting to the top of that range. I will wait until we get some type of exhaustive daily candle to start selling again. In the meantime, I will stay on the sidelines.

Leave A Comment