WTI Crude Oil

The WTI Crude Oil market fell significantly on Friday, breaking down below the bottom of a hammer. That hammer is now a “hanging man”, showing signs of real weakness. Ultimately, there is a lot of concerns when it comes to demand destruction after the hurricanes, and of course refineries being quiet. The strength of the bearish candle suggests that we will continue to go lower, perhaps looking towards the $46 level. Once we break below there, the market could go looking towards the $47.50 level. I think the sellers come back, and it’s likely that the market is ready to start selling off yet again. Longer-term fundamentals do not look good for crude oil, and the short-lived rally from concerns of the hurricane wiping out production is now over.

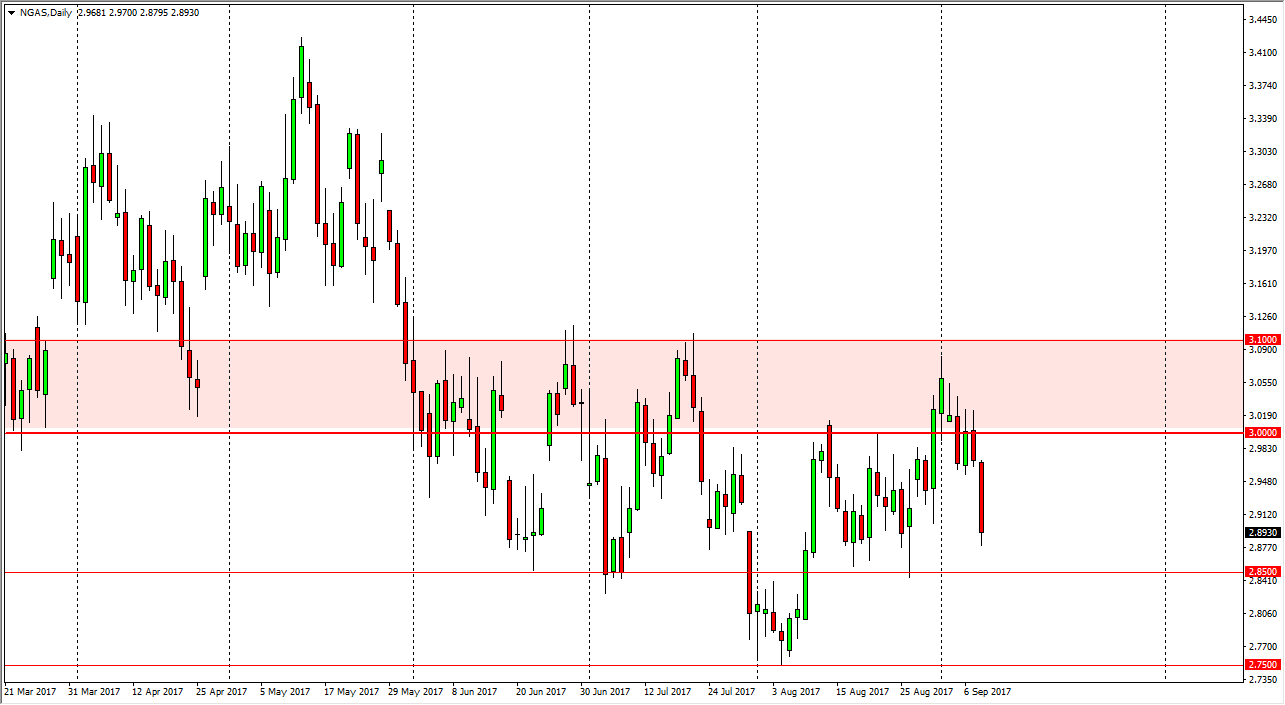

Natural Gas

Natural gas markets fell significantly during the day, reaching towards the $2.90 level. There is a significant amount of support underneath, extending down to the $2.85 level. Ultimately, I think that we could get a little bit of a rally from here, bouncing for a short time, but I think given enough time the sellers will most certainly come back. Natural gas markets have been range bound for some time, and the $2.85 level has been very solid, and should continue to be. While I am bearish of this market, I prefer to sell rallies instead of jumping in the market down here. If you’ve been watching, you know that the area between $3 and $3.10 continues to be a massive barrier that the market cannot overcome. With hurricanes missing most of the natural gas infrastructure, and the temperatures cooling off in the United States, demand for natural gas has dropped rather significantly, and should continue to do so.

Leave A Comment