Video length: 00:01:36

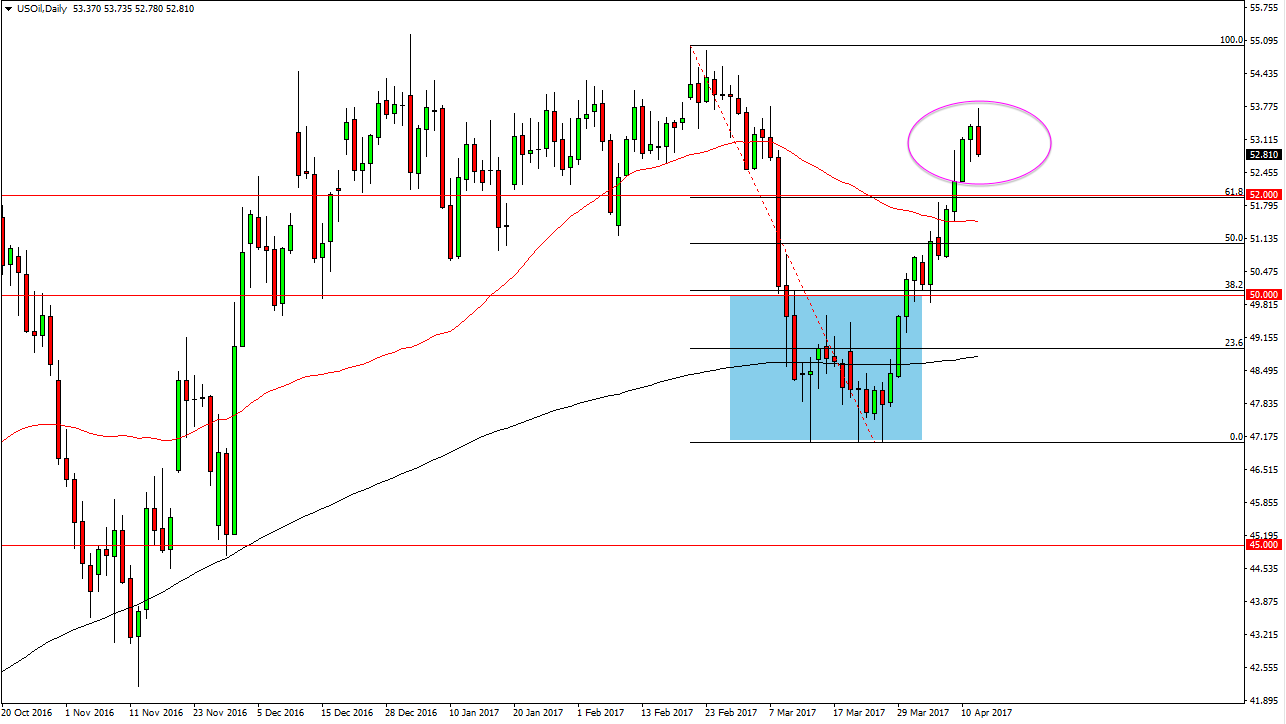

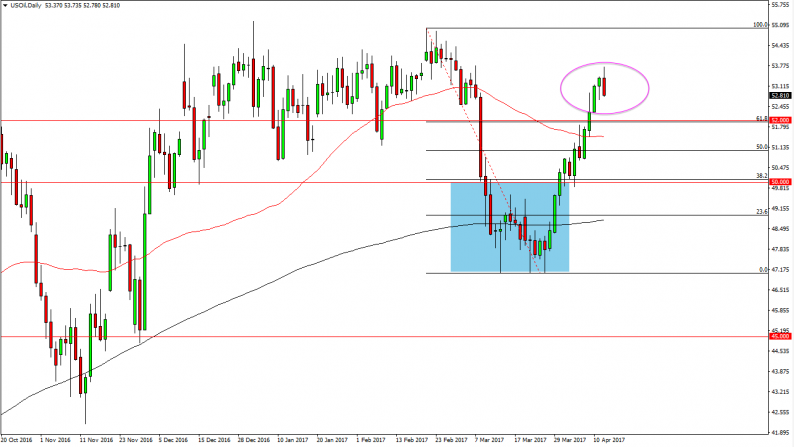

WTI Crude Oil

The WTI Crude Oil market initially tried to rally again during the day on Wednesday, but found enough resistance after the bearish inventory to turn around and form a rather negative candle. I still see a significant amount of support below though, so I suspect that there is probably going to be a buying opportunity below, closer to the $52 level. After all, the markets have been focusing on OPEC led production cuts more than anything else, and although we still have a glut of oil longer-term, currently the markets have been focusing on OPEC and OPEC only. Because of this, I still expect this market will try to reach towards the $55 level but I would anticipate that there would be a lot of resistance in that area.

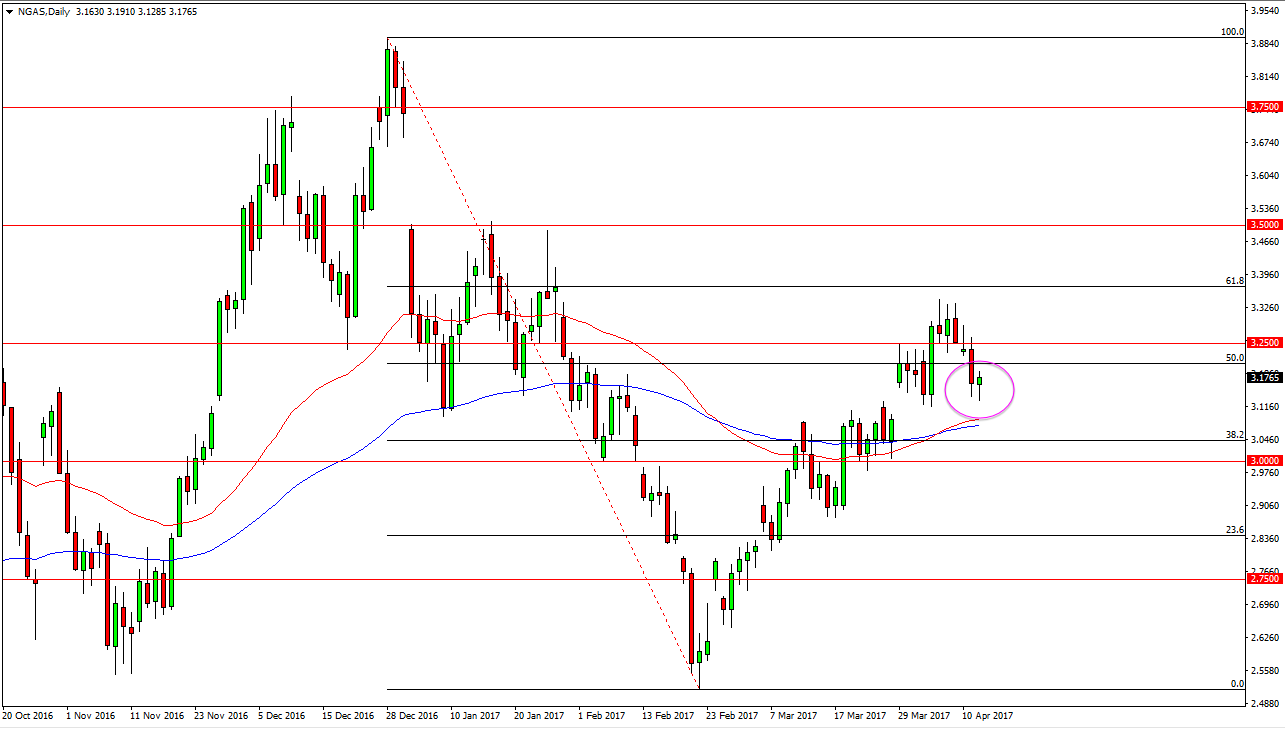

Natural Gas

Natural gas markets fell during the day, but found enough support at the previous gap to turn around and form a hammer. A hammer is of course a bullish candle, so I believe that the buyers will probably jump back into the marketplace. We also have the 50-day exponential moving average, pictured in red on the chart, crossing above the 100-day exponential moving average, pictured in blue, and that of course is a longer-term bullish sign. The gap obviously provide support as well, so I think a break above the top of the range for the day will more than likely send this market towards the $3.35 level again.

That’s not to say that this is going to be an easy move, but I do believe that the upward momentum is still there. In fact, I believe that we will reach the highs again, and perhaps even break above there towards the $3.50 level after that. It is not until we break below the moving averages that I would consider selling this market.

Leave A Comment