WTI Crude Oil

The WTI Crude Oil market initially dropped a bit at the open on Wednesday, but found plenty of support and continued the rally that we have seen over the last couple of sessions. Being preceded by 2 hammers, this should not have been a huge surprise, and I think at this point were going to go looking for the $50 level. That would be a continuation of the move after the downtrend line break, but I think there is going to be a significant amount of resistance near $50. Short-term traders will be far too tempted to test the area and not to go long, but I need to see a daily close above $51 to get bullish longer term. Even then, we probably have a ceiling somewhere closer to the $55 level.

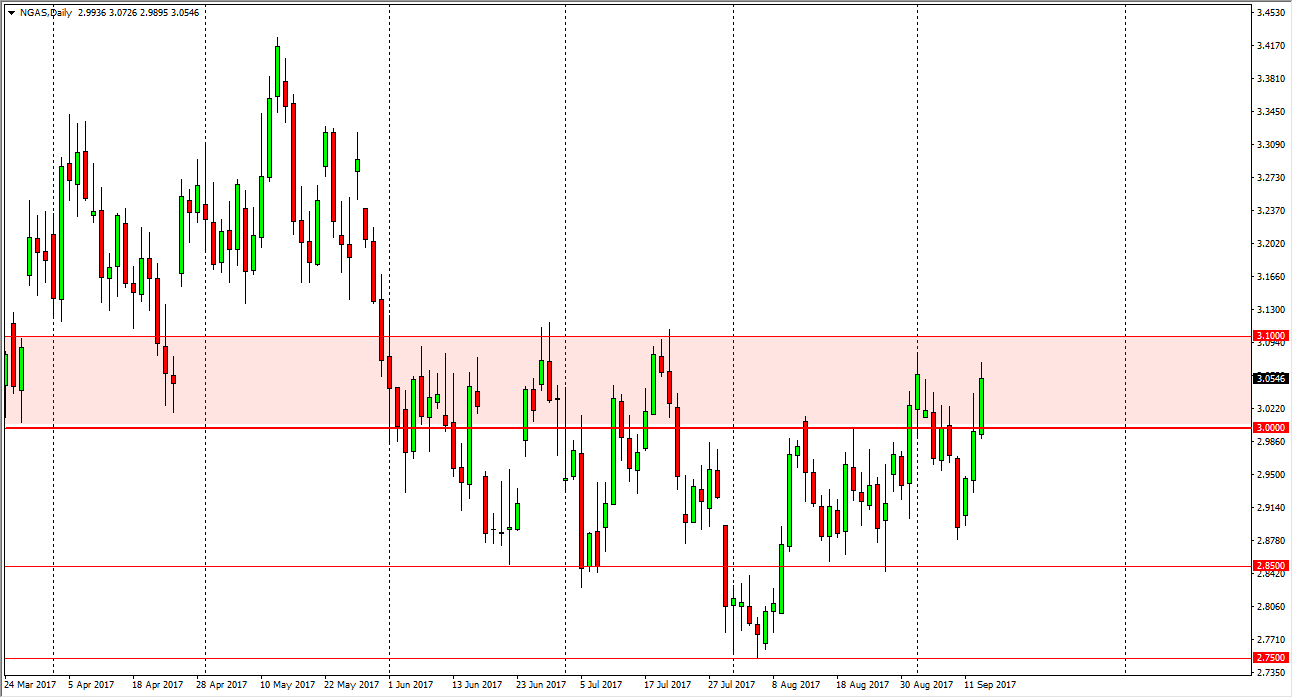

Natural Gas

Natural gas markets have been extraordinarily volatile as of late. When you look at the last couple of weeks, it has literally been back and forth. With today being inventory day in the United States, it’s likely that we will see more volatility. The $3.10 level above continues to be massive resistance, and I think if we can break above there and more importantly close above there, that would be a very bullish sign. It would be a bottoming pattern of roughly $0.35, meaning that we should extend the move to the $3.70 level, but probably would take several months to get there. Alternately, and I believe a scenario that might be easier, we find far too much in the way of resistance just above, and start to roll over. However, keep in mind that the inventory numbers don’t come out until 3:30 PM GMT, so it may take a while to get the reaction that will tell us where we are going next.

Leave A Comment