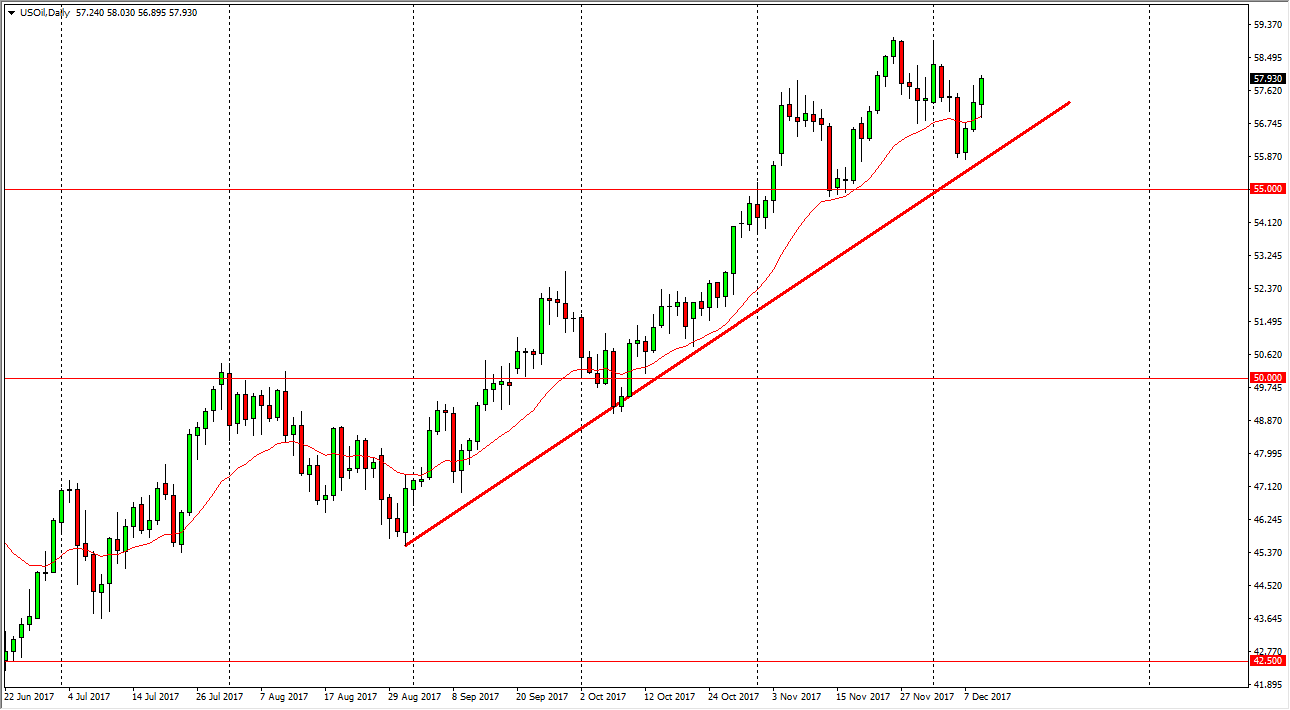

WTI Crude Oil

The WTI Crude Oil market continues to be bullish longer-term, even though it is rather noisy in general. You can see that I have a nice uptrend line that I have marked on the chart, and it has in fact offered support again. We will probably go looking toward $60 over the longer term, and I believe the pullbacks will continue to offer buying opportunities, but I also recognize that there will be a lot of noise. If we were to break down below the $55 handle, that should send this market down to the $52 handle, and I think that the volatility will continue. Pay attention to the US dollar, with the Federal Reserve speaking on Wednesday and the statement having a massive influence on the greenback, we could see an inverse correlation to crude oil suddenly. Overall, I think the choppiness continues.

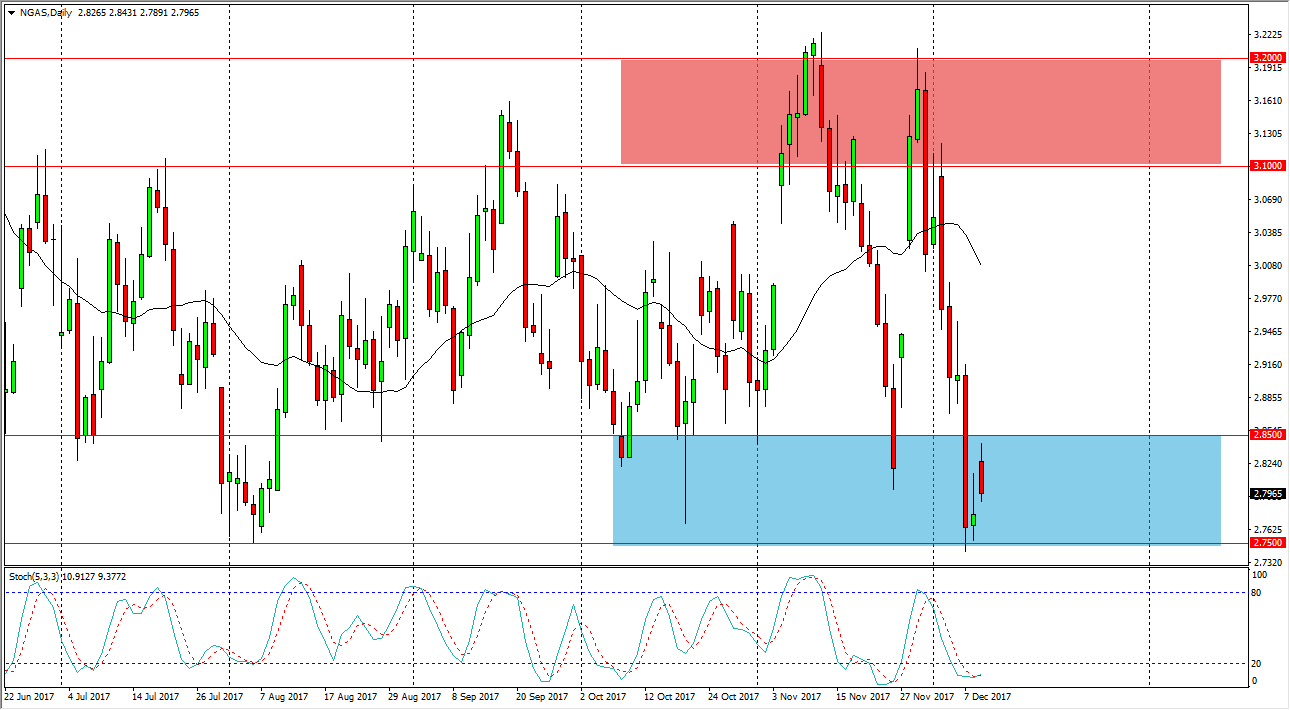

Natural Gas

Natural gas markets gapped higher at the open on Monday, but found the $2.85 level to be a bit too resistive to continue going higher. If we can break above the $2.85, the market should then go to the $3.10 level. In general, I think that the market continues to see a lot of volatility in back and forth action, so that being the case I think that range bound traders will continue to favor buying in this general vicinity, as it has been so supportive in the past. Beyond that, this time a year is typically bullish for natural gas, so I think that the buying opportunities will present themselves on a breakout, as colder temperatures are coming to the northeastern part of the United States. However, there is a significant amount of resistance above the $3.10 level, as there are massive amounts of supply, so I believe rallies are short-lived.

Leave A Comment