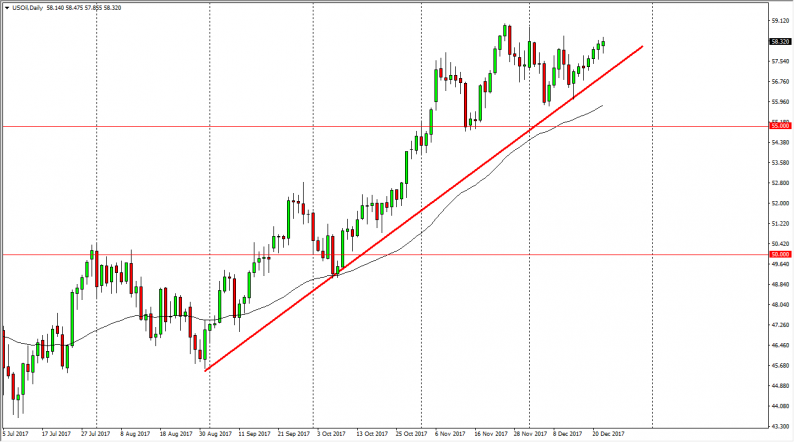

WTI Crude Oil

The WTI Crude Oil market fell slightly during the session on Friday, but turned around to form a hammer yet again. This looks as if it is a market that is trying to grind its way to the upside, and I think that given enough time we are going to go looking towards the $60 level. The uptrend line underneath continues to offer support, and I think that pullbacks will be bought in the short term. Whether we can break above the $60 level is a different situation altogether, but I think in the short term the buyers are looking to push the market. Volume will be an issue over the next several sessions, so don’t expect much as most of the major players won’t even be involved. However, if we break down below the uptrend line, I think we would probably go down to the $55 level.

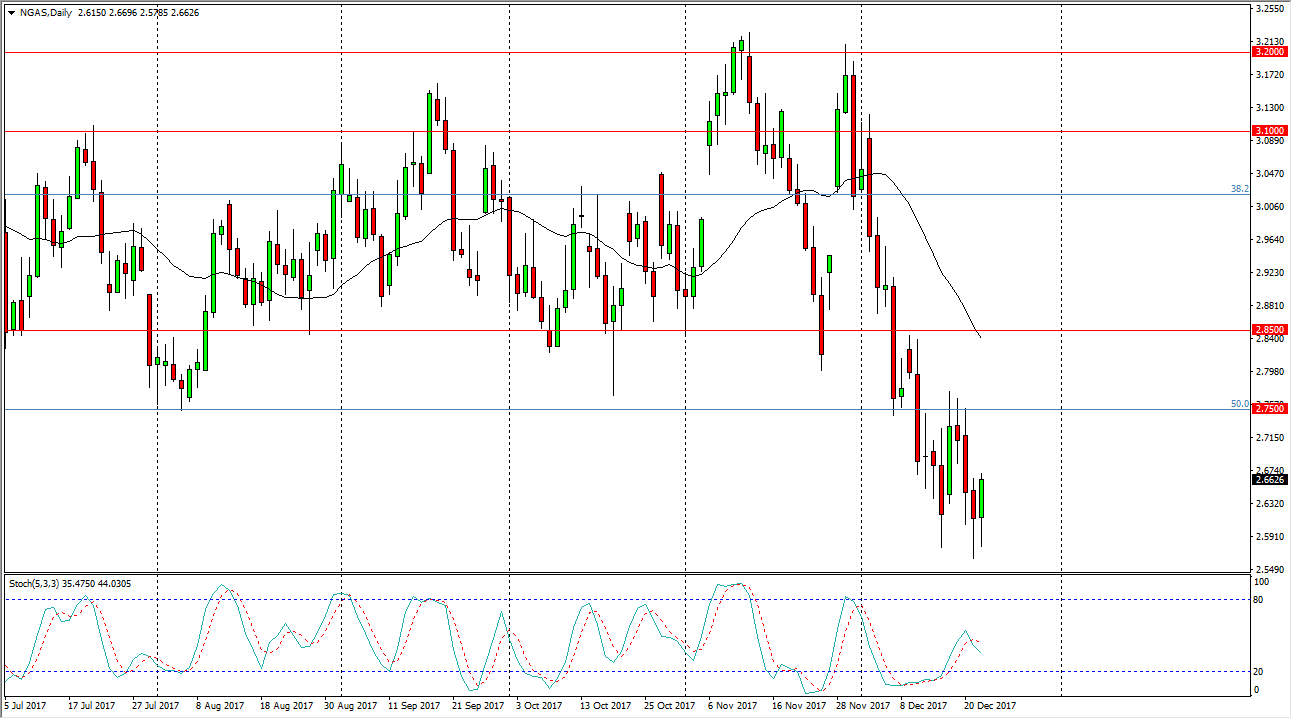

Natural Gas

The natural gas markets pulled back slightly during the trading session, but then bounced significantly. I think that the market has a significant amount of resistance above though, as the $2.75 level should be massively resistive. I think at that area, we would see a lot of sellers coming into the marketplace, and even more so at the $2.85 level. What I find interesting is that the $2.50 level underneath is massively supportive, and if we can break down below there, this market will come unwound and collapsed. Either way, I think the best way to play this market is from the downside, but we have seen a significant amount of bearish pressure as of late, and I think that perhaps a bounce is necessary. That bounce should offer short-sellers another opportunity to get involved before it’s all said and done though.

Leave A Comment