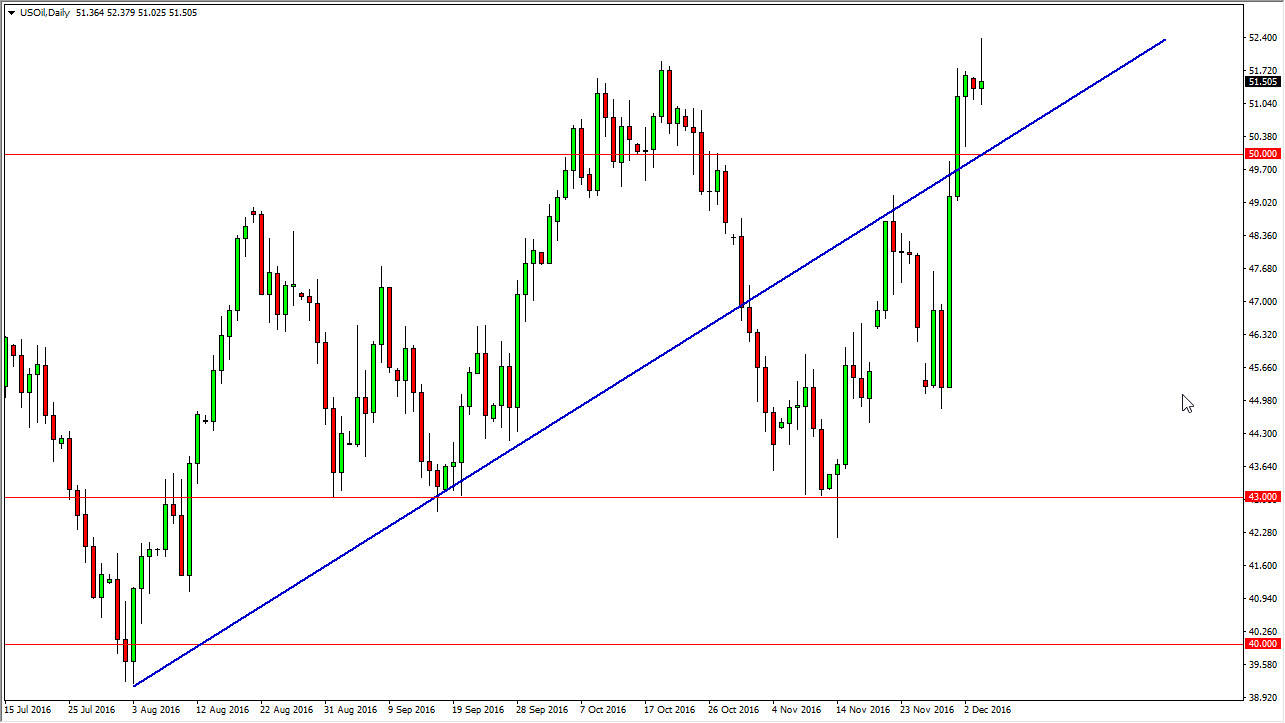

WTI Crude Oil

The WTI Crude Oil market rallied on Monday, testing the $52 region. This area offered enough resistance to turn things around and form a shooting star. This was preceded by a hammer though, so I think what we’re going to see is a consolidation in this area. The $50 level below should continue to offer a bit of a floor but if we can break down below there, the market will then break down significantly. Until then, I believe that we still have upward potential and a break above the top of the shooting star for the Monday session would be reason enough to expect the WTI market to reach towards the $55 handle.

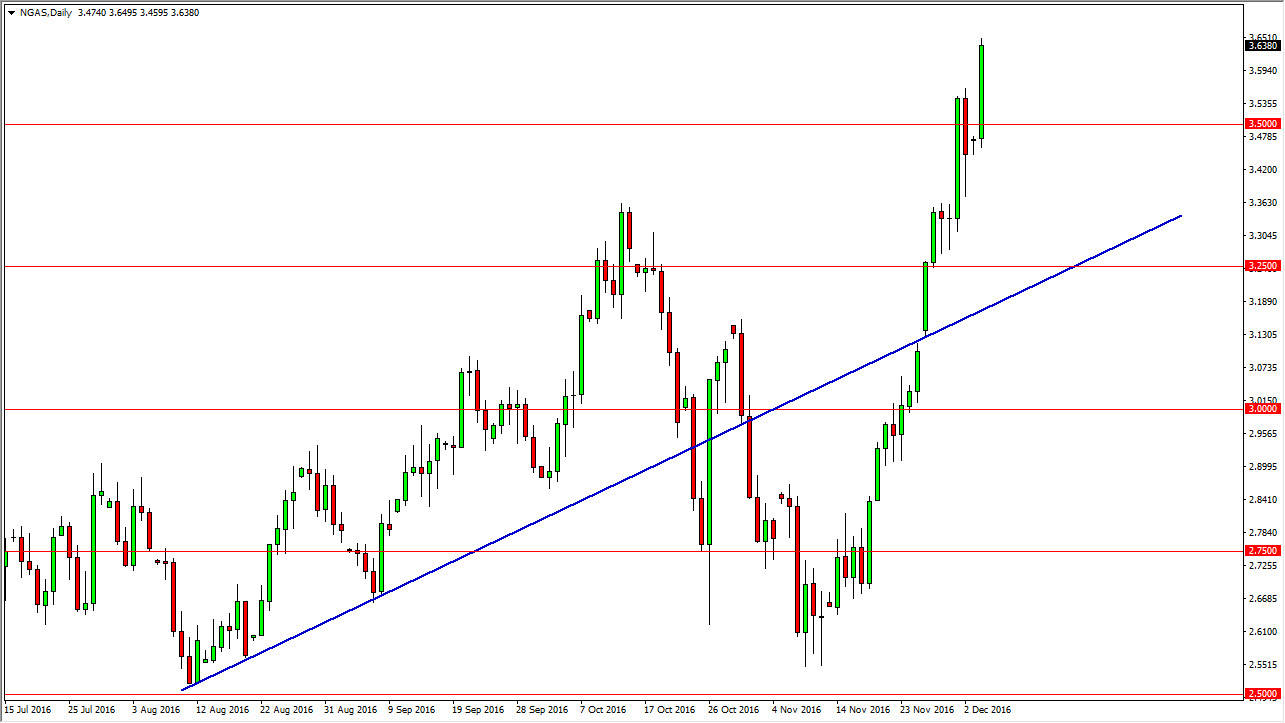

Natural Gas

Natural gas markets exploded yet again during the day on Monday, as we have reached above the $3.60 level. That’s an area that serves no real significant resistance, so I think that the market is probably going to continue to go higher in the short-term. However, we are far overbought, so it’s almost impossible to continue the upward move at this rate. We desperately need a massive correction, and we obviously haven’t had it yet. I think sooner or later we will, and the previous uptrend line would be an excellent place to see a supportive candle after that in order to go long. The $3.50 level should be supportive as well though, so a short-term pullback to that area could offer short-term buying opportunity. I’ve no interest in selling currently, although I do recognize that longer-term we will see massive resistance above that derives itself from the oversupply of natural gas longer term.

Currently though, it appears that the market is in a bit of a frenzy, so it’s almost impossible to go against it. As soon as we get a negative weekly candle though, I’m willing to jump back in on the short side.

Leave A Comment