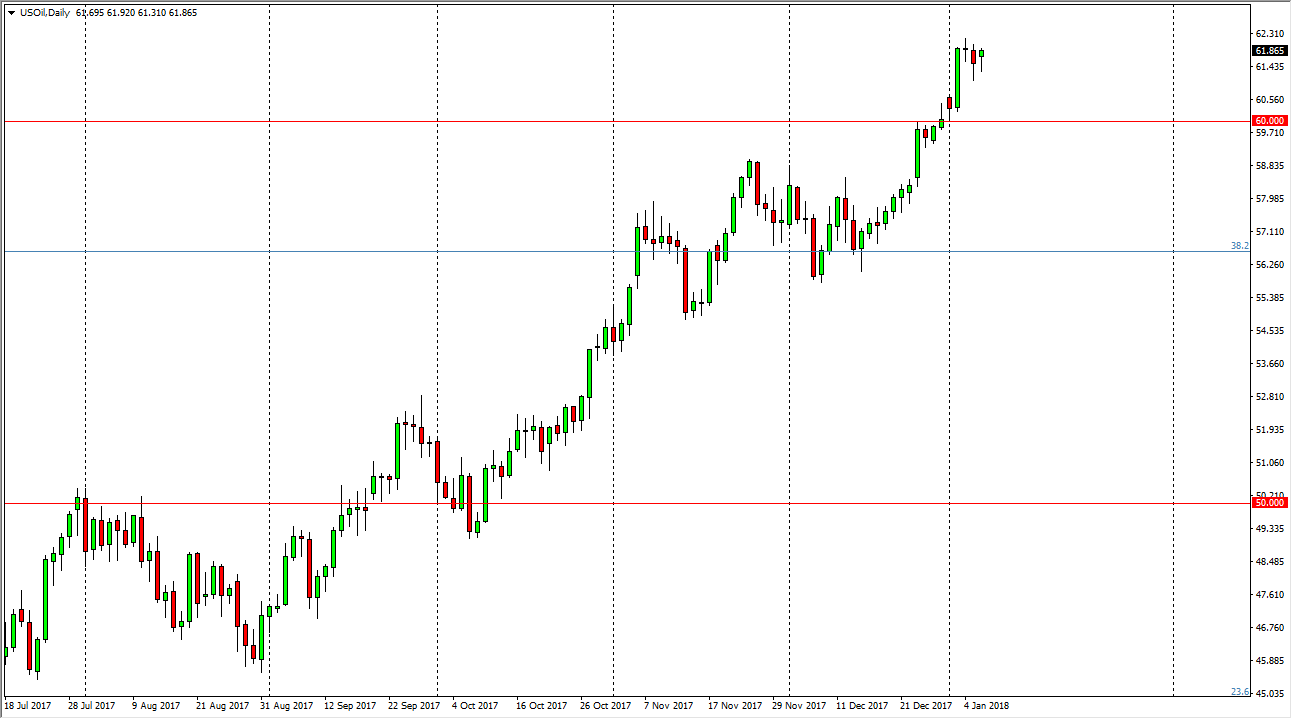

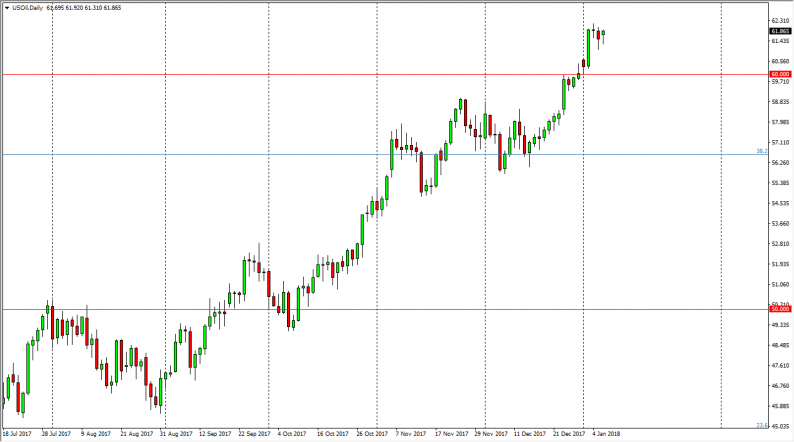

WTI Crude Oil

The WTI Crude Oil market initially fell during the trading session on Monday, but as you can see turned around to form a hammer like candle, and it shows that we are going to continue to see buying opportunities on dips. I believe that the $60 level underneath is massive support, and it’s likely that we will continue to see buyers jumping into the marketplace, perhaps reaching towards the $65 level longer term. I recognize that it might be rather choppy of the next several sessions, but certainly, it seems as if the buyers are ready to jump in and push to the upside. It’s not until we break down below the $60 level that I would be concerned about selling, and even then, I would be a bit cautious. I believe that the buyers will continue to be attracted to this market as tensions in the Middle East rise.

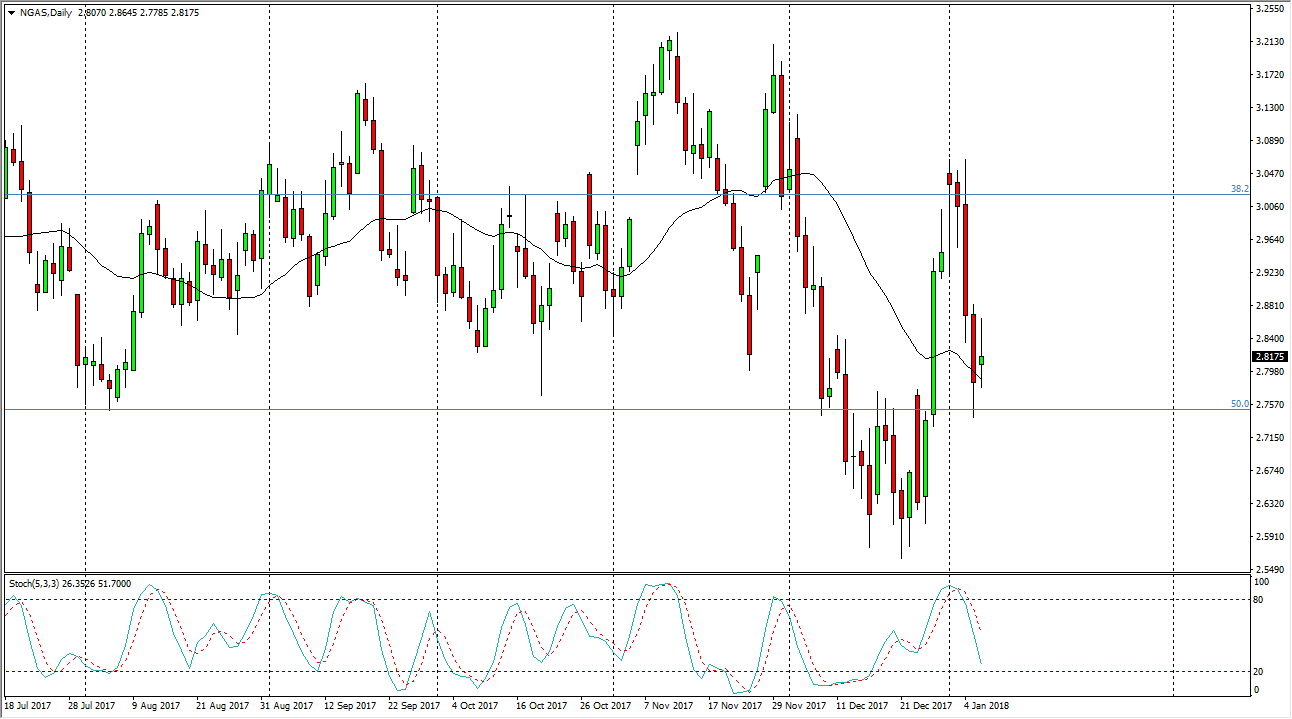

Natural Gas

The natural gas markets went back and forth after initially gapping higher on Monday. Because of this, I think we continue to see a lot of volatility, but the $2.75 level looks to be rather supportive. If we can break down below there, I think the market then goes to the $2.65 level. Otherwise, we could bounce from here, but I look at that as an opportunity to start selling from higher levels. I have no interest in trying to go long of this market, because we have struggled to keep gains for so long, that I don’t see that changing anytime soon. After all, we have sold off a couple of times during the winter trading already, and if you can’t keep the gains in the natural gas markets during the winter, when can you?

Leave A Comment