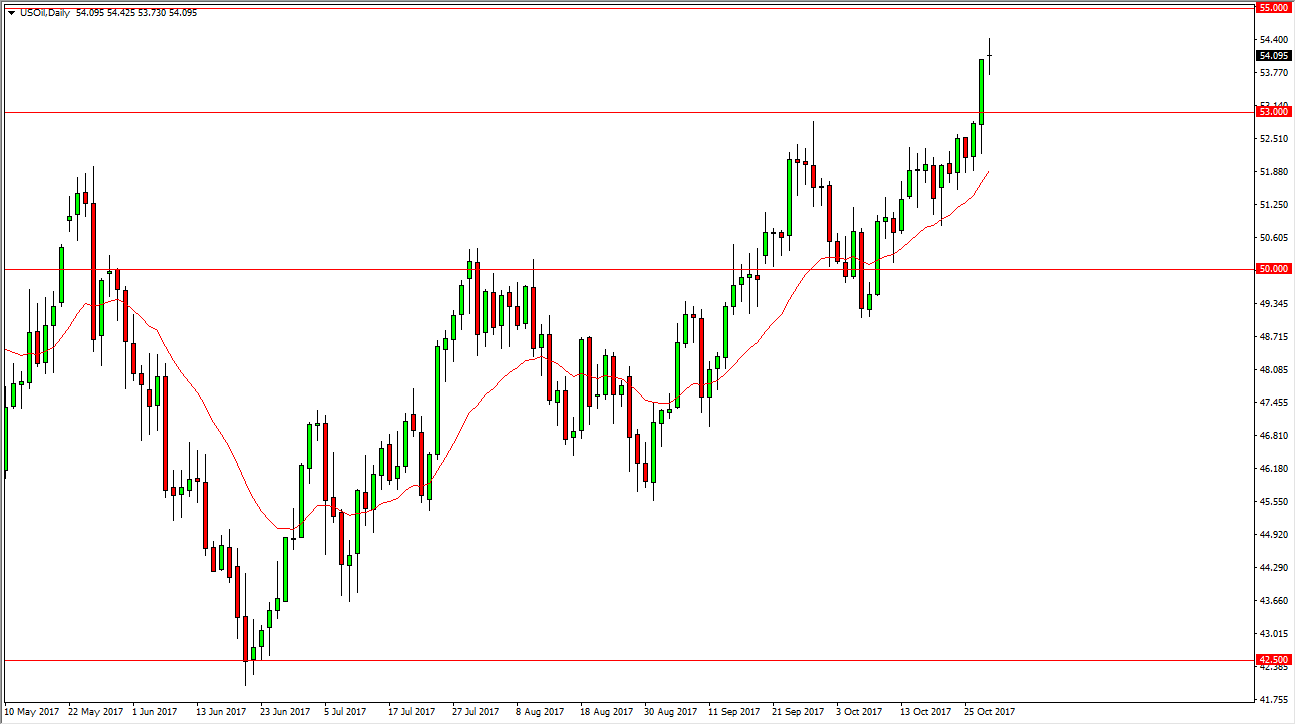

WTI Crude Oil

The WTI Crude Oil market was very choppy during the Monday session, going back and forth and forming a bit of a doji. This is a neutral signal, but I think what we are probably going to see is some type a pullback, followed by buying pressure. The $53 level should now be supportive, and I think that we will go looking towards the $55 level above. Ultimately, we should break above there, and extend the gains. However, if we were to turn around and break down below the $53 level, that would be negative and send this market looking for the $51.50 level, and then eventually the $50 handle. Overall, this is a market that will remain choppy and volatile, but it seems as if most of the hedge funds that I am in contact with our feeling more confident about crude oil in the short term.

Natural Gas

Natural gas markets rallied slightly during the day, but the $3.00 level has offered resistance, as the market rolled away from that massively resistive area. This is a market that should continue to be difficult to go long, as it is so overly bearish and of course oversupplied. I think that given enough time, the sellers will return as natural gas markets continue to struggle with a massive supply, and suppliers are willing to flood the market as soon as we get close to this area. The $2.85 level underneath should continue to be supportive, and therefore I think it’s likely that we stay in the range bound trade, and therefore as we are so close to the upside, I’m willing to start selling. I don’t necessarily want to buy near the $2.85 level, but I have several friends who have been doing both and doing quite well.

Leave A Comment