Video length:00:01:29

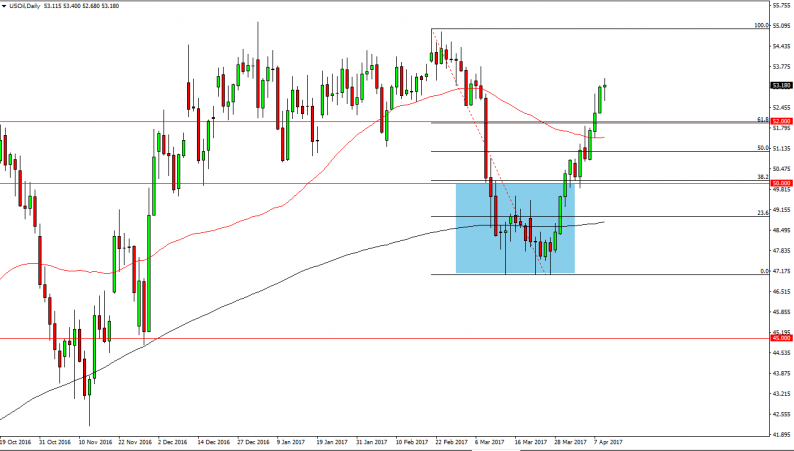

WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Tuesday, but found enough support underneath to turn things around and form a hammer. This was mainly due to reports that Saudi Arabia was looking to extend the production cuts again. I still think there’s plenty of support below, especially near the $52 handle. Because of this, I am a buyer of dips, but I also recognize that we are overextended by just about any metric you can measure this by. Ultimately, the market looks as if it is going to try to reach towards the $55 handle, and that’s my longer-term target. Short-term “buying the dips” will probably be the best way to play this commodity going forward.

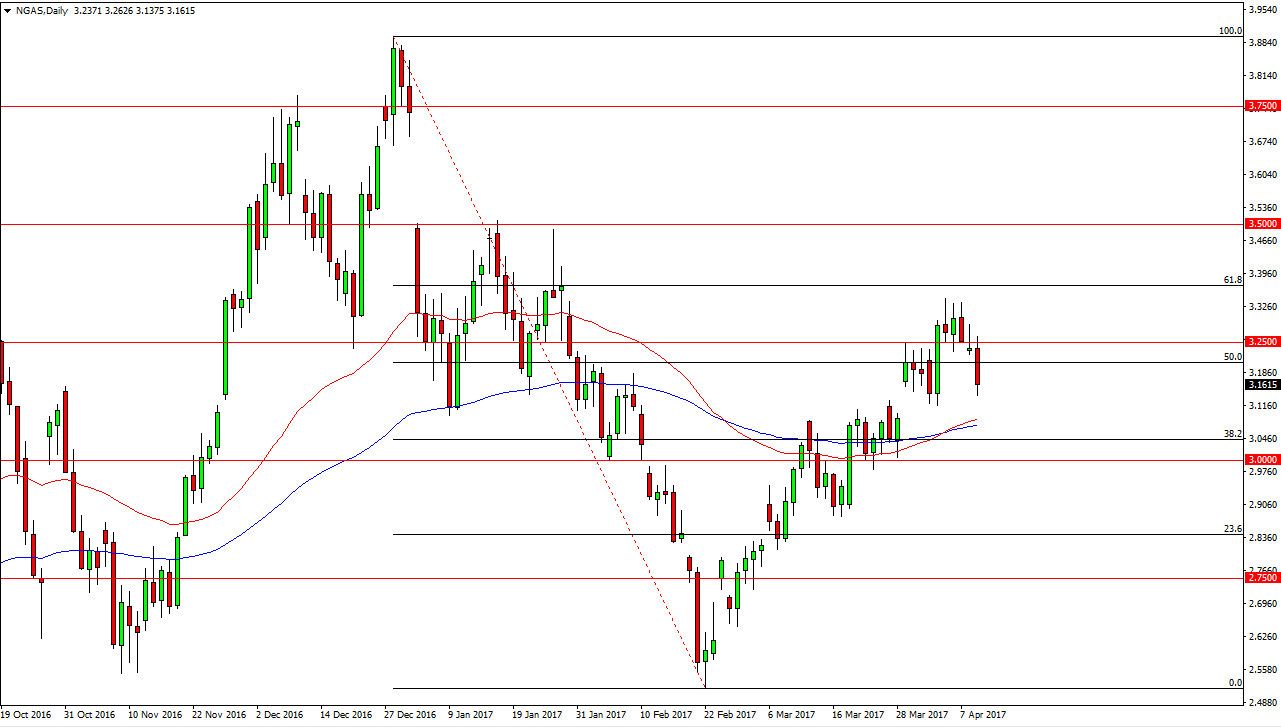

Natural Gas

Natural gas markets had a brutal session as we try to break above the $3.25 level and then broke down rather significantly. Ultimately, it looks as if the gap below should be supportive, and as a result I think that given enough time we will have a supportive candle that we can start trading. In the meantime, I think short-term sellers are probably going to run the show. The red 50-day exponential moving average below has crossed above the 100-day moving average, and that’s a longer-term bullish signal. Because of this, I suspect that sooner rather than later buyers will get involved. I don’t have any interest in trying to short this market longer term now, there seems to be far too much in the way of support to breakdown.

I think longer-term we will have fundamental reasons to start shorting this market, but currently right now it’s likely that the export situation coming out of the United States will probably continue to take center stage, which has been rather bullish. Because of this, short-term I believe the buyers will continue to push this market higher after a slight pullback.

Leave A Comment