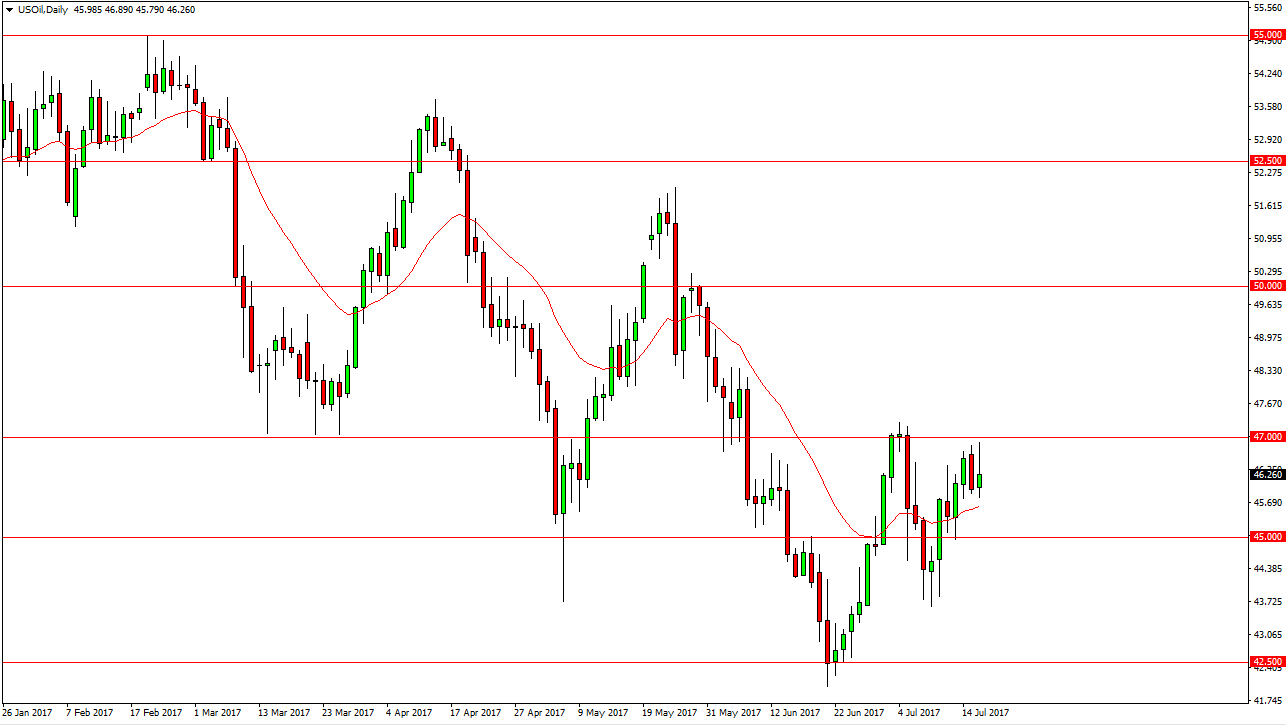

WTI Crude Oil

The WTI Crude Oil market initially shot much higher during the day on Tuesday but found enough resistance near the $47 level to turn around and form a shooting star. I believe that a lot of traders stepped out of the market as we await the Crude Oil Inventories announcement coming out today. Simply put, this will be a volatile session but I believe longer-term I still have quite a bit of bearish pressure in this market. With that being the case, I look to sell rallies, especially if they feel near the $47 level again. A break above the $47 level could send this market towards the $48.50 level. Alternately, I suspect that we are going to go down to the $45 level, possibly even lower.

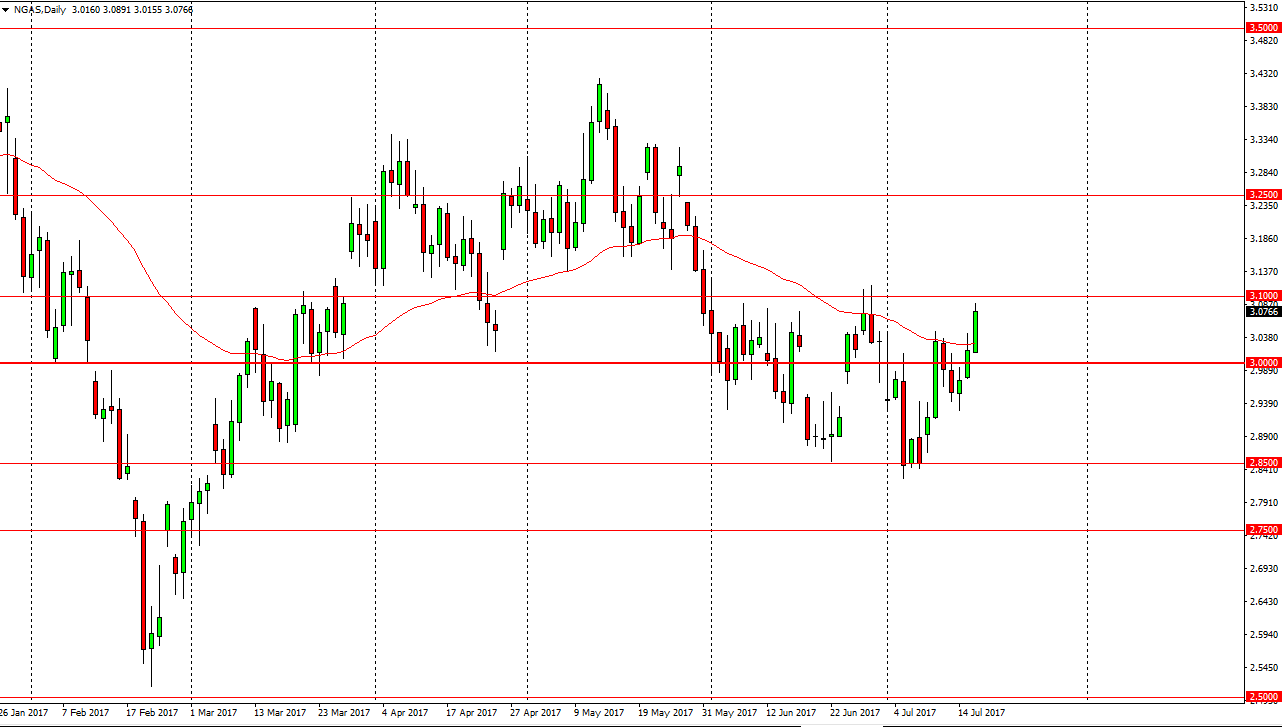

Natural Gas

The natural gas markets exploded to the upside during the Tuesday session but remain below the all-important $3.10 level. That’s an area where I expect to see significant resistance, and therefore I am looking to sell this market on signs of exhaustion from short-term charts. If we did break above the $3.12 level, I think we then go looking for the $3.25 level above. I think we will aim for the $3 handle underneath, and more than likely break below there. Once we do, I’m looking for the $2.90 level, and then the $2.5 level. Longer-term, I believe that the natural gas markets continue to have an overhang of supply, so it’s only a matter of time before the sellers return on rallies. I have no interest in buying this market, I believe that simply being patient and waiting for the market to roll over is the best way to trade this market as you short it.

Leave A Comment