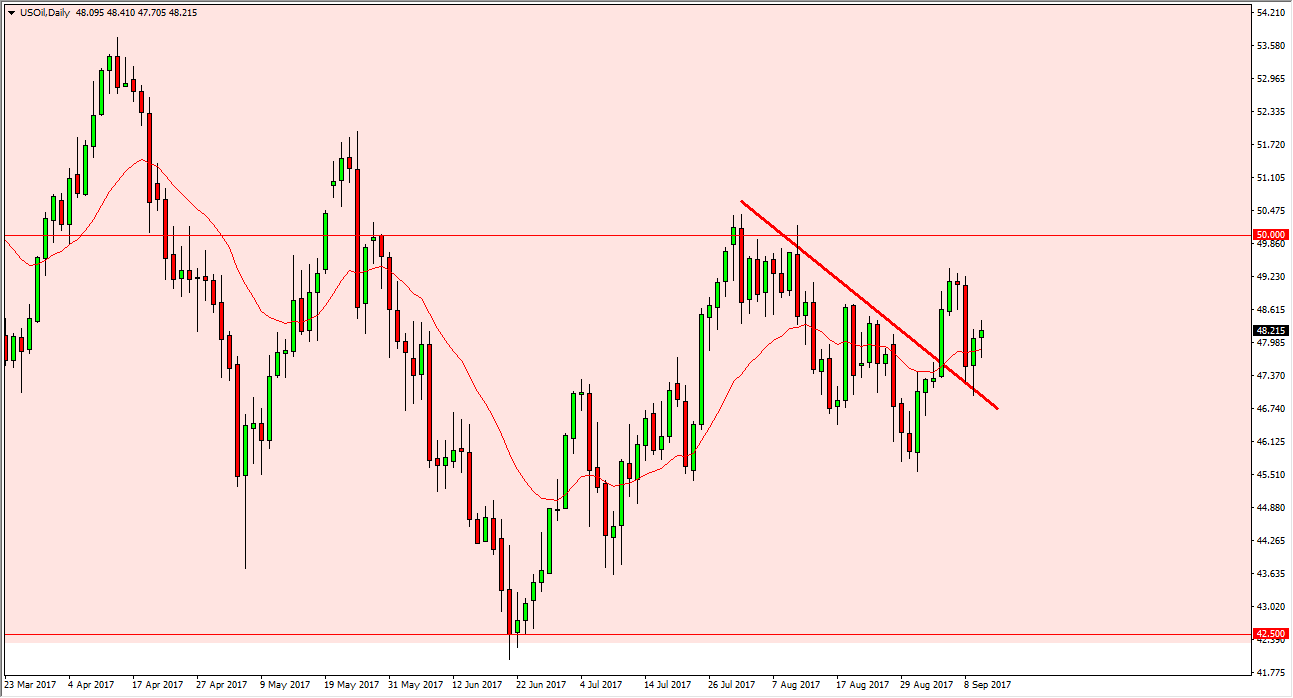

WTI Crude Oil

The WTI Crude Oil market had a slightly negative open to the session on Tuesday, but turned around and formed a hammer to reinforce the hammer from the Monday session. We have the Crude Oil Inventories announcement coming out today, and that will obviously have an effect on this market. With that being said, I think that there is a significant amount of resistance above, especially once you get close to the $50 level. I am looking to fade a rally that show signs of exhaustion. Alternately, if we break down below the $47 level, I think this market will drop towards the $45.50 handle. Between now and the announcement though, this is a market that is probably going to tread water and essentially do nothing.

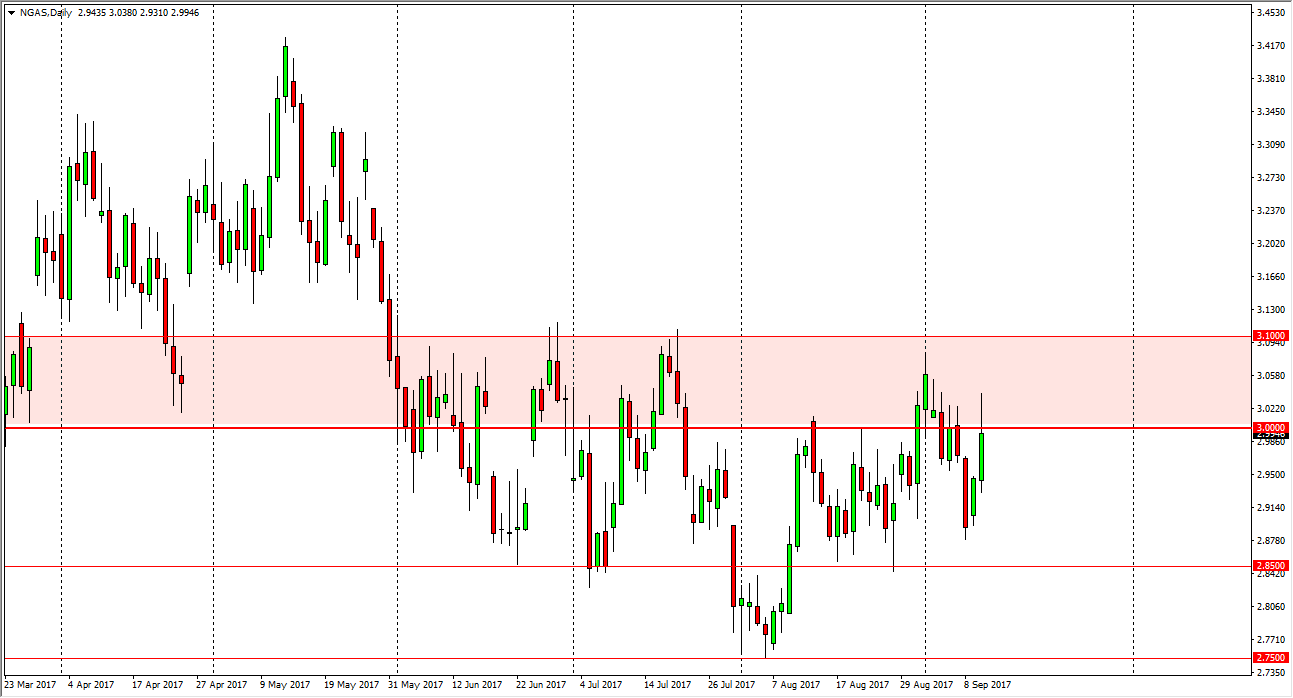

Natural Gas

Natural gas markets had a wild ride during the day, breaking well above the $3.00 level, only to find plenty of sellers in that region. Because of this, the market looks likely to continue to find that area to be far too resistive to continue grinding higher, and therefore I believe that we are going to roll over yet again. I believe that the market will target the $2.90 level over the next couple of sessions, and I believe that rallies are to be sold going forward. It is very difficult to imagine a scenario in which I would be comfortable buying this market below the $3.10 level, so at this point I look at short-term charts that show signs of exhaustion as nice opportunities to short this market yet again. If we did break above the $3.10 level, then I think everything changes and we eventually go looking towards the $3.25. However, that seems to be the least likely scenario, especially after the market gave back so much late in the day.

Leave A Comment