We recently discussed how the strength of the US Dollar has left no market safe, and now fundamentals are weighing on Oil. Most notably, an overnight API inventory report showed crude stockpiles had risen by 6.3m bbl vs. most estimates of a rise by 1.3m bbl. This inventory build was not encouraging for a market that is trying to figure out if the demand will pick up relative tosupply when supply continues to overwhelm the market. The market outcome of the large API crude inventory build was a 2-week low and the 6th straight down day. The last time we had sixstraight down days was in March when we subsequently bounced over 30% from ~$42bbl to ~$62bbl.

Currently, two key levels very close to each other stand out on crude oil. First, the 61.8% Fibonacci Support On WTI / Crude Oil of the August-October range sits at $42.76. The 61.8% Fibonacci pull-back is common, but if a bounce doesn’t materialize or worse a break and daily close below this level, then we could soon be looking for a move toward the lows seen near the end of August. The other level is the low from 2-weeks ago at $42.57. A break below $42.57, the late October low, would likely quiet Bulls for some time and rightfully so. Immediate targets on the downside would register near the 78.6% Fibonacci support of the August-October range at $40.54. A short-term encouraging sign for the bulls would happen if the 61.8% Fibonacci support and $42.57 2-week low could hold, and we saw a break above the recent higherlow of $45.09, which is the weekly opening range high.

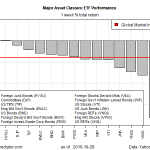

The recent failures to push higher tell us the market isn’t willing to go bid yet, but looking at other commodity markets delivers an important message. The message is that base metals, precious, and energy are all sitting near some significant support. Should that support hold, a bounce could soon materialize. However, as discussed in the analysis of the US Dollar, there is little reason to bet against such a strong US Dollar given the present evidence. This USD story issignificant because there is a common occurrence of USD strength and commodity weakness in markets. Therefore, if little changes in the story of dollar strength or rising inventories providing oil weakness, the charts will likely continue to point to lower prices ahead. T.Y.

Leave A Comment