RBOB gasoline is at a 25-month high (and WTI has a $45 handle) as all attention is focused on the duration and impact of the storm (i.e. how long refineries will be closed?). Inventory and Production data this week will be of limited help to traders as it occurred before Harvey struck but API confirmed the crude draw, gasoline build trend overnight, and DOE data shows the same pattern – crude draw, gasoline (and distillates) build and both WTI and RBOB dipped on the print.

Before we get to the numbers, we note the following…

“The next couple of weeks, I don’t know if you should try to read very much into it just because it’s subject to such impact because of Harvey,” Kyle Cooper, director of research with IAF Advisors, told Bloomberg.

“It’s going to take a long time for the infrastructure to get back to order”

API

DOE

The previous week’s data calmed fears of gasoline builds, but API overnight showed a decent build (and at Cushing). DOE however shows this week with notable crude draw and product builds once again…

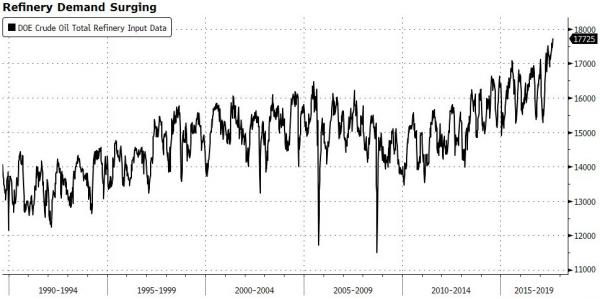

No wonder gasoline inventories rose: Bloomberg notes that refineries have been eating up crude like it’s going out of fashion. Inputs rose to a record last week.

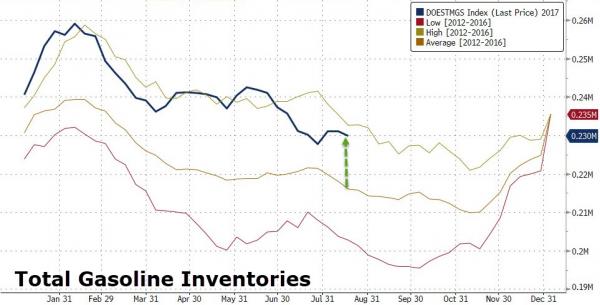

Here’s where nationwide gasoline inventories were before Harvey hit the Gulf Coast – significantly above average for the time of year but below their peak. That’s going to change markedly in the coming weeks as the full impact of refinery outages plays out in physical markets.

As we noted earlier, around 4mm b/d in refining capacity is potentially offline due to Harvey and thus dominates the market’s view for now… That amount of offline capacity could reduce U.S. fuel production to the lowest since Hurricane Ike shut several refineries after striking the Texas coast in 2008.

Leave A Comment