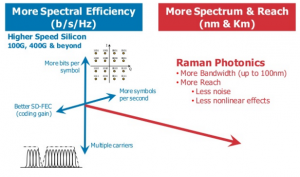

Xtera (NASDAQ: XCOM) provides long-range high-capacity optical networking systems. Company claims that they are unique because they simultaneously offer very high speed *and* long distance solutions. In the past most customers wanted one or the other – now everyone wants both.

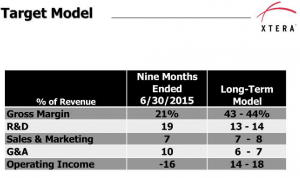

XCOM is growing rapidly but is still fairly small. They should do about $60M in revenues this year – on which they will lose about $5M. The company is offering 5.5M shares at a $10 mid-point. Once public the market cap would be just under $200M or about 3x sales.

Investing in the latest optical network product cycle has been difficult since the last one ended in tears back in the late 1990’s. The problem is the lack of pricing power and consistent margin expansion. The industry is capital-intensive and very competitive. Even if we give Xtera the edge in capabilities right now, companies like Alcatel-Lucent, Ciena and Infinera ZTE are right at their heels. So Xtera can win but often must deal with aggressive pricing actions and give up margin to close a deal. FWIW trading multiples for some of these are 4x for INFN, 1.5x for CIEN and 1x for ALU.

In defense of the margin pressure the company claims that over the life of a contract they can make up some additional margin and ultimately see mid-50’s gross margin once a customer fully deploys. If the company can defend their position and capture a significant share of additional cards for their own platform, profit margins can be good.

It’s somewhat puzzling that the long-term model shows a gross margin target of 43-44% which seems low based on the commentary above. In presenting the target model the CFO stated that because they have 3x the number of channel cards per chassis their gross margins will be better than competition and lower operating expenses will allow more of it to flow to the bottom line.

The scale required in this business suggests that the most likely long-term exit for Xtera will be an acquisition by one of the larger industry players. Handicapping the most likely companies to buy Xtera is a little tricky since they are both a hardware and a services/solution provider. They will take on a turn-key proposal for a terrestrial or under-sea network. Most companies are either independent integration firms *or* hardware suppliers. Xtera does both. We have seen some evidence of this as a trend. For example Digi International (NASDAQ: DGII) has shifted to this strategy with some notable success.

Leave A Comment