Good Monday morning and welcome back to the land of blinking screens. With the Fed meeting on tap this week and traders possibly on hold until then, let’s start the week with a review of our major stock market indicators. The goal of this exercise is to set aside our subjective views of what we think might be happening in the markets and focus on a disciplined, unemotional review of what actually “is” happening in the market.

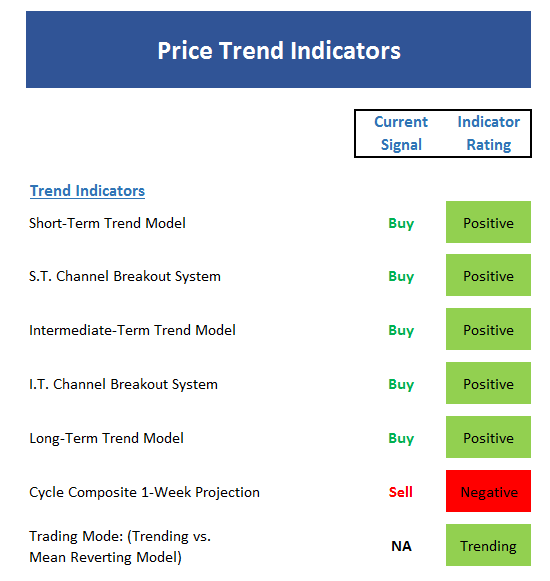

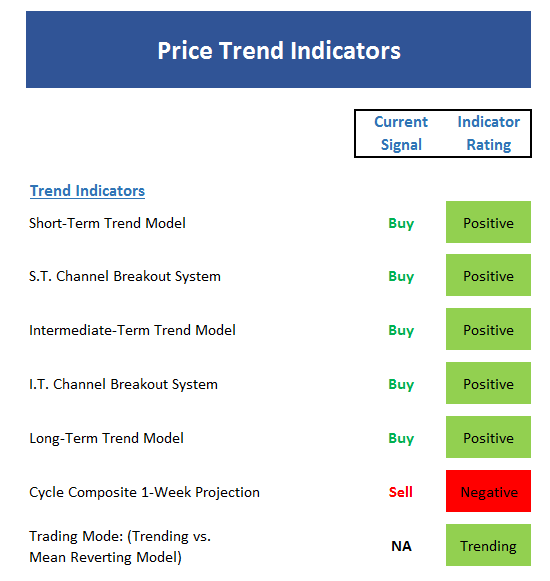

The State of the Trend

We start with a look at the “state of the trend” from our objective indicator panel. These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

Executive Summary:

It is said that the most bullish thing a market can do is make new highs. ‘Nuf said.

The Trend board is universally bullish except for the Cycle projection, which suggests a modest pullback this week

It is worth noting that the Nasdaq 100 continues to lag the rest of the major indices due to the rotation game that is seeing money move out of the “FANG’s”

The Trading Mode indicator has flipped to positive, albeit begrudgingly so

The degree to which price is above its long-term moving average is becoming extreme

The short-term Channel Breakout sell signal currently stands back at 2187

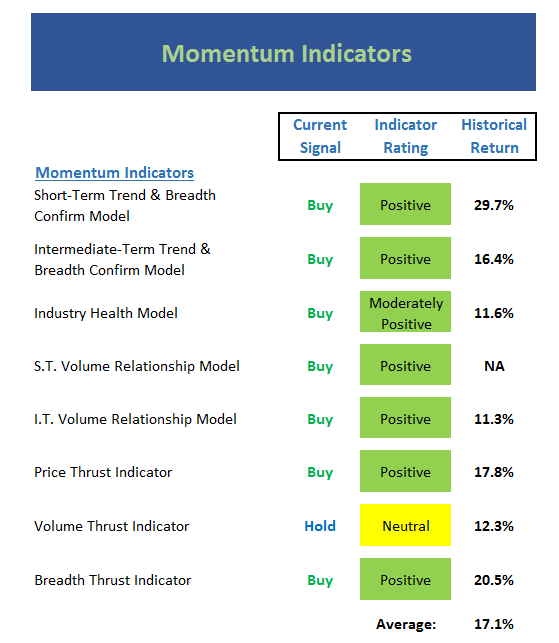

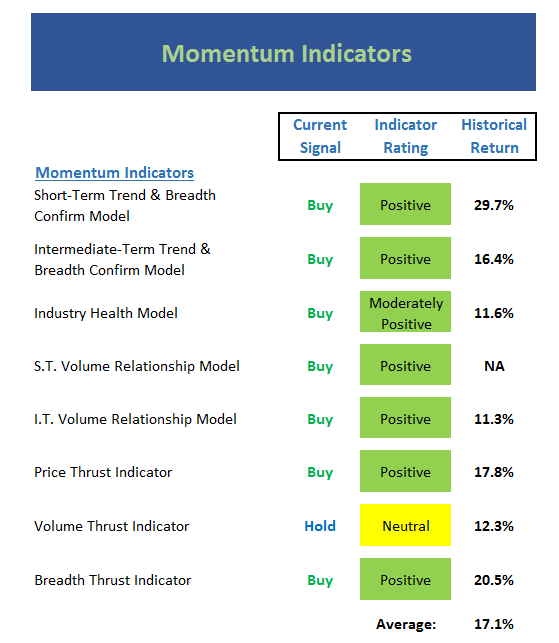

The State of Internal Momentum

Now we turn to the momentum indicators…

Executive Summary:

The Momentum board also sports a bright shade of green to start the week

In its current mode, the Short-Term Trend & Breadth confirm model has seen annualized gains of nearly 30% per year. However, when viewed since 2008, the annualized return for the indicator is -11.3%.

The Industry Health model is getting close to the outright positive zone. A move into the green would be a positive confirmation of the current run for the roses.

Volume Relationship indicators are in great shape

The only thing that isn’t green is the Volume Thrust indicator. But while neutral, the indicator sports an annualized return of 12.3%, which is above the historical norm.

The Breadth Thrust indicator moved up to positive last week

The average annualized return for the market with the board in its current state is 17.1%

Leave A Comment