I suppose it’s only fitting that Janet Yellen would weigh in on Bitcoin at her final press conference as Fed Chair.

Central banks the world over are scrambling to figure out what to make of something the crypto crowd has variously suggested is a substitute for the trillions in paper money rolling off the government printing presses. As I noted in a new piece out this afternoon for DealBreaker, “there’s still a sizable contingent of crypto crazies who insist their love for make-believe space tokens is at least partly attributable to an inherent disdain for central bank profligacy.”

Asked about Bitcoin by CNBC’s Steve Liesman on Wednesday, Yellen said she “certainly agrees” it’s important for the Fed to understand emerging risks to financial stability but argued that Bitcoin risks look “limited.” For the time being, she added, there doesn’t appear to be significant exposure for financial institutions. Of course, the introduction of futures could change that.

Yellen also called Bitcoin “highly speculative”, “not a stable store of value” and opined that it doesn’t constitute legal tender. Here’s the video:

There you go.

The cruel irony there for the crypto crowd is that eventually, central banks will simply co-opt the technology, create government-controlled digital currencies, and either regulate the “competitors” so heavily as to render them useless or make them illegal by decree.

Of course, that’s not Janet Yellen’s problem now. She’ll get to watch the drama unfold from the sidelines.

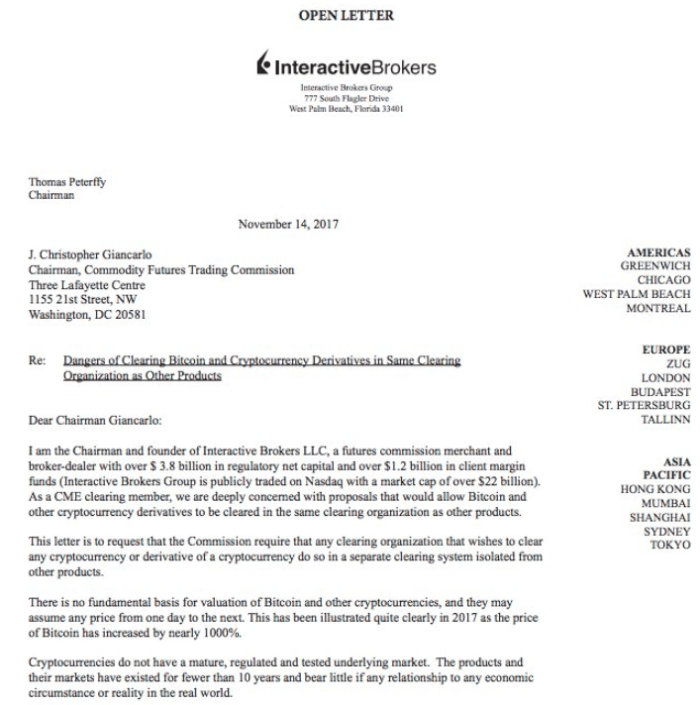

Oh, and in case you forgot, below we’ve reprinted the letter from Thomas Peterffy to the CFTC explaining how Bitcoin could indeed become a systemic risk that will ultimately need to be subject to stricter oversight…

Leave A Comment