In Janet Yellen’s semi-annual testimony on Capitol Hill yesterday, she made reference to the ongoing strength of employment as one of the reasons for continuing to “normalize” monetary policy by lifting interest rates and reducing the existing bond holdings of the Federal Reserve. To wit:

“Since my appearance before this committee in February, the labor market has continued to strengthen. Job gains have averaged 180,000 per month so far this year, down only slightly from the average in 2016 and still well above the pace we estimate would be sufficient, on average, to provide jobs for new entrants to the labor force. Indeed, the unemployment rate has fallen about 1/4 percentage point since the start of the year, and, at 4.4 percent in June, is 5?1/2 percentage points below its peak in 2010 and modestly below the median of Federal Open Market Committee (FOMC) participants’ assessments of its longer-run normal level.”

However, while the Fed is talking about normalizing interest rates, to a level of 2% which would be in-line with their long-term economic growth forecasts, the issues with employment likely don’t support such a move.

Note: What is often missed in this discussion is that while the Fed talks about the “economy growing at a moderate pace,” that pace of growth is at the lowest average rate since WW-I.

While Ms. Yellen remains focused on the “official unemployment rate” as a reason to continue her rate hiking campaign, there are several reasons she might want to reconsider her aggressiveness. Furthermore, this also goes to the very reason why sub-5% unemployment rates aren’t leading to surges in wage growth or economic prosperity.

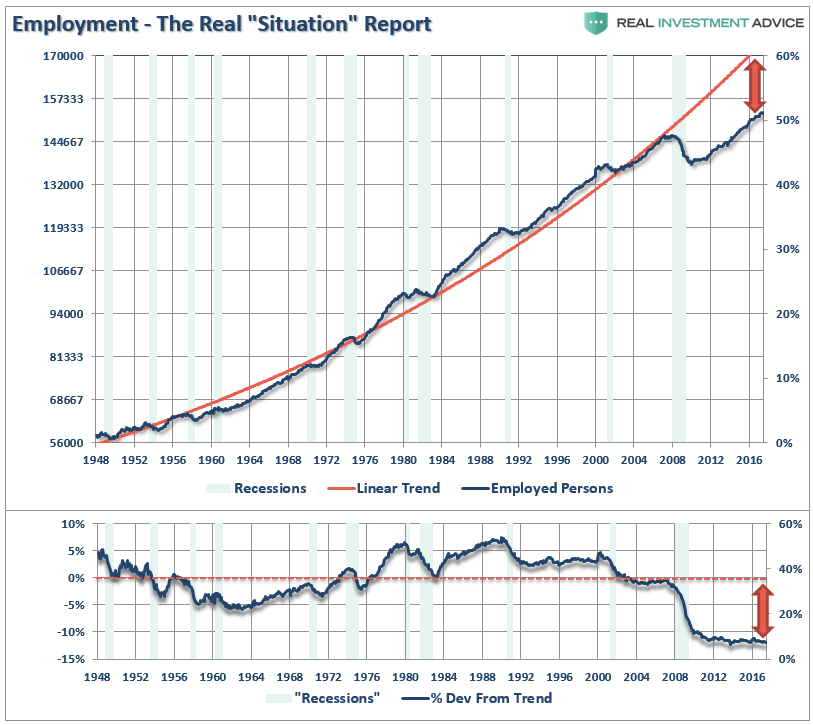

The chart below shows the “real situation” with respect employment.

Has there been “job creation” since the last recession? Absolutely.

If you take a look at the actual number of those “counted” as employed, that number has risen from the recessionary trough. Unfortunately, employment remains far below the long-term historical trend that would suggest healthy levels of economic growth. Currently, the deviation from the long-term trend is the widest on record and has made NO improvement since the recessionary lows.

Leave A Comment