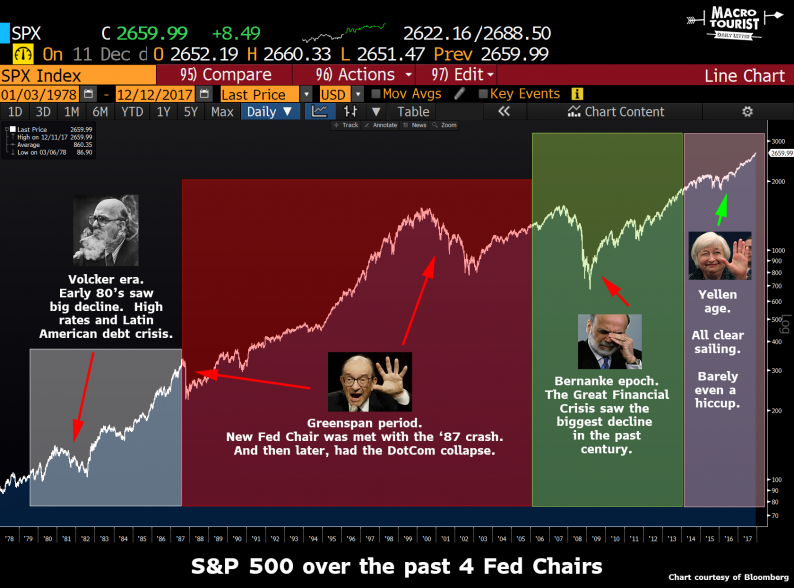

The past three Fed Chairs before Yellen all had their own crisis to deal with. Volcker had the disaster of the early 1980’s as he struggled to tame inflation with double-digit interest rates. That helped contribute to the Latin American debt crisis and the subsequent global bear markets in stocks. He handed over the reins to Greenspan in the summer of ‘87 and within months, the new Fed Chairman faced the largest stock market crash since the 1920’s. That trial by fire was invaluable for Greenspan, as he faced a second crisis when the DotCom bubble burst at the turn of the century. His successor, Ben Bernanke also did not escape without a record-breaking financial panic when the real estate collapse hit the global economy especially hard in 2007.

But Yellen? Nothing. Nada. She has presided over the least volatile, most steady, market rally of the past century. Was she lucky? Or was this the result of smart policy decisions? I tend to attribute it more to luck, but it’s tough to argue that she made any large mistakes. Sure you might quibble about the rate of interest rate increases. And her critics will argue that economic growth, and more importantly, wage increases have been especially anemic under her watch, but to a large degree, those variables are out of her hands.

I don’t want to argue about Yellen’s legacy. Chances are your view is heavily influenced by your opinion about proper monetary policy. I doubt I could change your mind, but more importantly, it won’t help us decide where the markets are headed even one little bit.

Yellen’s last meeting

Yet the lack of a market crisis under her watch might play an important influence on the last meeting she chairs.

Think about what she is leaving for Jerome Powell. It is quite clear that the ‘animal spirits’ have been ignited. All you need to do is look at the price of Bitcoin, or the last eleven months of gains in global stocks.

Leave A Comment