The New Zealand Dollar swooned after the government lowered economic growth and budget surplus projections a month before a general election. That leaves less room for a fiscal policy boost even as weaker performance might have called for a public spending pickup. Traders seemed to read the news as limiting scope for RBNZ tightening.

The sentiment-sensitive Australian and Canadian Dollars weakened while the anti-risk Japanese Yen traded higher even as most Asia Pacific stock exchanges strengthened. The markets seemed to read that as merely reactive following a spirited bounce on Wall Street, focusing on weakness in FTSE 100 and S&P 500 futures as a more forward-looking indication of where risk appetite trends are heading.

The mood appeared to sour as US President Donald Trump spoke at a rally in Phoenix, Arizona. The embattled commander-in-chief threatened a government shutdown if funding for his proposed wall along the US/Mexico border was not approved. Speaking on the nascent renegotiation of the NAFTA trade agreement, Trump said he doesn’t expect a deal will be made and predicted the pact might be terminated.

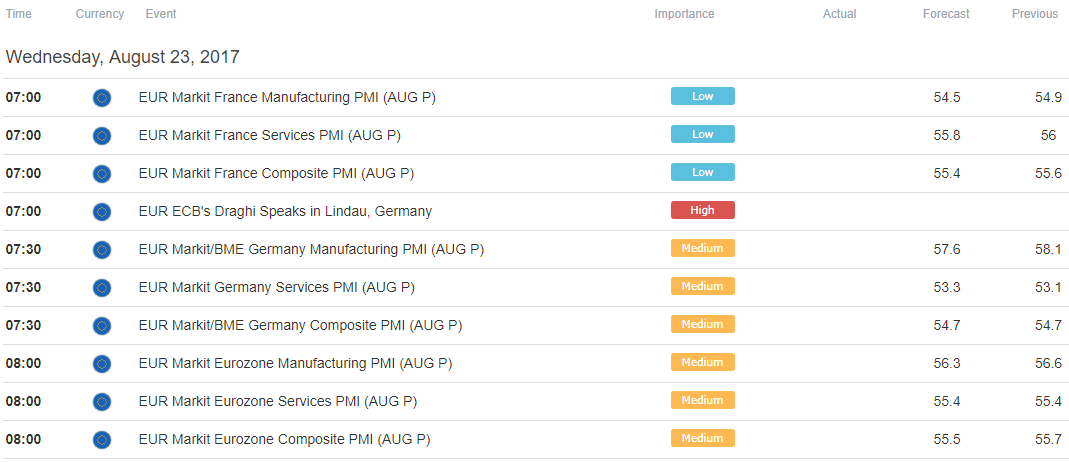

August’s PMI surveys from the Eurozone and the US headline the economic data docket. The pace of manufacturing- and service-sector growth is expected to slow in the currency bloc and accelerate across the Atlantic. Follow-through from the Euro and the US Dollar may be lacking however as markets look to speeches from the heads of the ECB and the Fed at the Jackson Hole symposium on Friday.

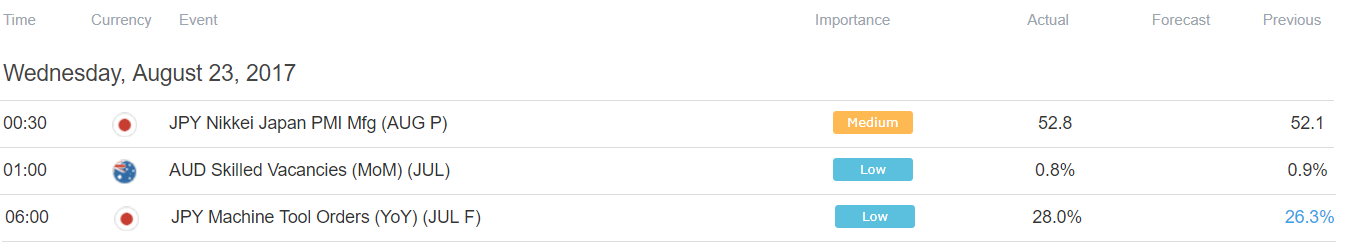

Asia Session

European Session

Leave A Comment