The Japanese Yen outperformed in Asian trade as regional shares followed Wall Street downward, boosting demand for the perennially anti-risk currency.

The New Zealand Dollar proved weakest on the session as risk aversion predictably punished the highest-yielding currency in the G10 FX space.

Geopolitical tensions in the aftermath of last week’s surprise US missile strike on Syria appear to account for investors’ dour mood. US Secretary of State Rex Tillerson travels to Russia to meet his counterpart there today, which sets the stage for a diplomatic clash that may keep markets on edge.

While tensions appear to be firming, the possibility for something of a “grand bargain” appears to exist. Tillerson seemed somewhat dismissive of the crisis in the Ukraine even as he hardened official rhetoric on Russia’s support for Syrian leader Bashar al-Assad at a G7 foreign ministers’ meeting earlier in the week.

This may yet set the stage for an accommodation where the US trades an easing of Ukraine-related Western pressure for a reduction of Russian support for the Syrian regime. Clues hinting at such a deal may boost risk appetite, punishing the Yen and sending the US Dollar higher alongside higher-yielding currencies.

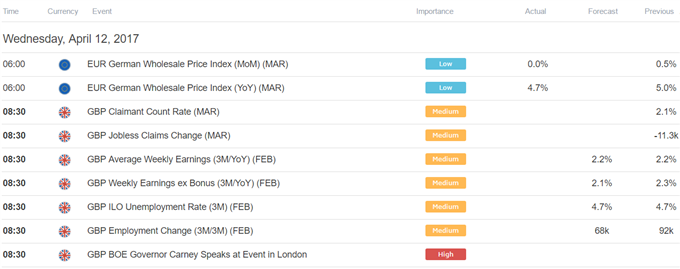

Comments from BOE Governor Mark Carney headline an otherwise quiet European calendar. A familiarly dovish tone is likely as officials delay action on the highest inflation in nearly four years on Brexit-related grounds. That is hardly novel, but saying so again may still weigh on the British Pound in the near term.

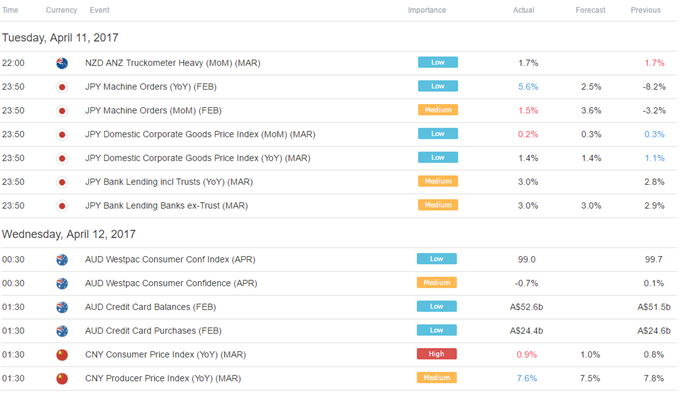

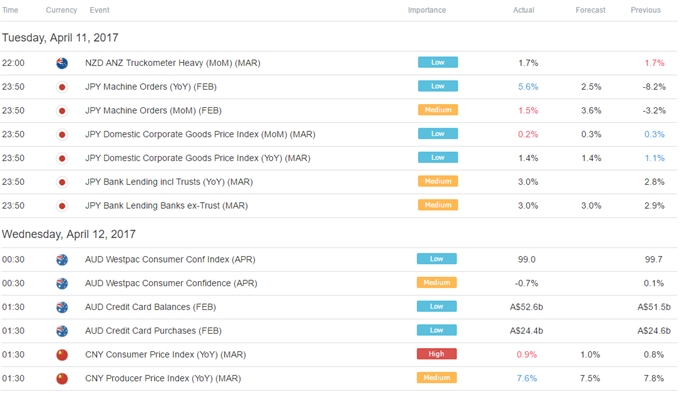

Asia Session

European Session

Leave A Comment