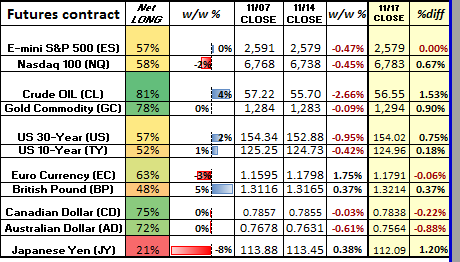

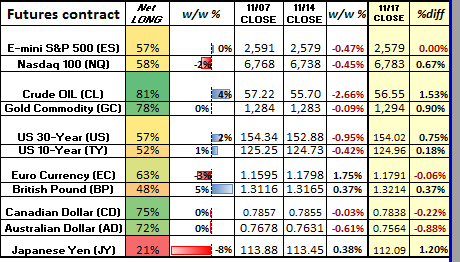

The Japanese yen rallied off recent lows amid a risk-off tone that marred global markets at the end of last week. Equities pulled back off recent record levels as traders rotated into under-performing small cap stocks and other safe havens such as gold. Meanwhile, the US dollar struggled on the back of falling yield differentials as a flatter yield curve has caused some concern. Elsewhere, short-term momentum traders continue to buy the USD except vs the Aussie, while speculators maintain extreme bullish stance on Crude oil.

The trade-weighted Japanese yen managed to recover last week, marking a potential turning point for the beaten-up Asian currency. The yen was able to climb from recent yearly lows amid the risk-off feel that marred global markets towards the end of the week. The USD/JPY, which had been on the move up since September, clearly failed to clear key resistance at 114.33, leading to a test critical support beneath 112.00 on Friday. Potentially fueling this move are developments in two key populations of traders. First, according to the latest COT report, large (non-commercial) speculators increased their short exposure vs the Japanese currency, marking the largest net short position for the year. This suggests that the yen carry trade is and has been very crowded for some time which could provide ample room for the yen to rally. Secondly,recent retail FX positioning data points out that the retail population have turned from net buyers to net sellers of the yen. These short-term momentum type traders are often caught fighting the move, which also hints of addition gains for the yen.

A sustained loss of support in the 111.72/90 region (USD/JPY) would clearly indicate a shift in momentum to the downside and would re-open critical support at the 111.00 level. That said, Friday’s move (USD/JPY) felt a little exhaustive and also highlights oversold conditions (daily chart). The 112.89/96 area, however, will need to be cleared in order for dollar bulls to reclaim momentum.

Speculative euro positioning by non-commercial traders pulled back slightly, according to the latest CFTC positioning data. While this highlights a pullback from the largest net long position by (non-commercial) speculators on record, the large increase in long positions marks only the second time that gross longs have reached the 200K threshold. Meanwhile, the EUR/USD managed to break out of 2-week base in the 1.16 region pattern last week, which has negated a series of minor lower tops and could put the 1.19 handle within reach. According to retail FX trading data, the retail population sold into last week’s spike in the euro, extending the recent move in euro pessimism by short-term momentum players. While this is typically viewed as a bullish indicator, if, however, the 1.1820 range midpoint continues to cap on a daily closing basis, then the 1.17 area would quickly come back into play.

Leave A Comment