In this missive, we are just going to focus on the “WTF!” moment of this past week. In order to do this properly, I need to start with last week’s missive where we asked the question “Did Something Just Break?” In that article we addressed very specific concerns about interest rates and the problem they were going to cause.

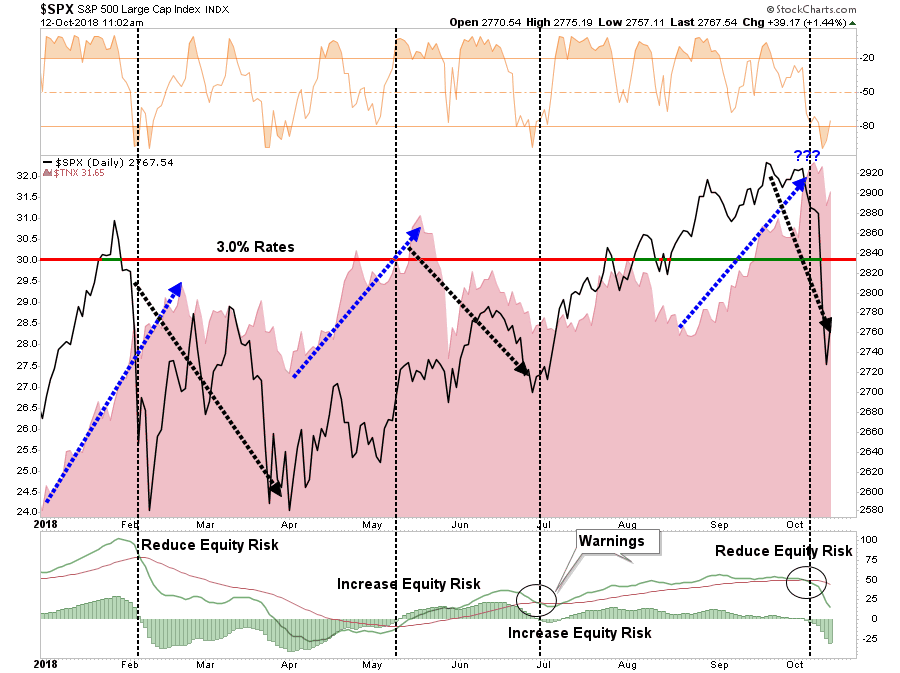

“Speaking of rates, each time rates have climbed towards 3%, the market has stumbled.”

Chart updated through Friday.

“If you note in the chart above, a short-term ‘warning signal’ has been triggered which suggests that if rates remain above 3%, stocks are going to continue to struggle. The last time this occurred was in May when rates popped above 3%, stocks struggled and bonds outperformed.”

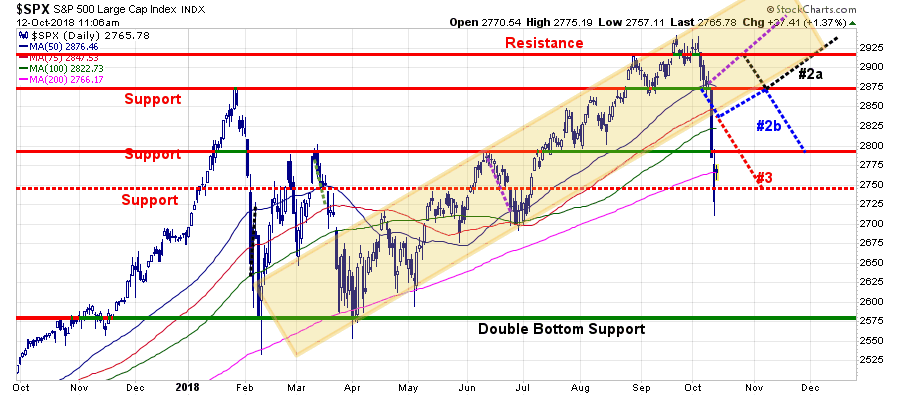

We also updated the pathway analysis for the highest probability outcomes over the next couple of months.

Chart updated through Friday – pathways remain unchanged.

While the majority of the pathways accounted for a continued corrective, consolidation, process through the end of the year. It was Pathway #3 which came to fruition.

“Pathway #3: The issue of rising interest combines with a break in the economic data, or another credit-related event, and sends the market heading back to test supports at 2800 and 2750. This would likely coincide with a more severe contraction in the economic data which is not an immediate threat. Nonetheless, we should always consider the risk of an unexpected, exogenous, event. (10%)”

The recent sell-off coincides with the rising concerns of higher rates coupled with deterioration in economic growth heading into 2019. To wit:

“As such, our best initial take is that yesterday’s repricing of US growth was an overdue gut-check following last week’s monetary and oil supply shocks.”

In other words, as we have been repeatedly stating, the underlying economic growth story, outside of one-time events and natural disasters isn’t nearly as strong as reported. My friend, Danielle DiMartino-Booth, concurs with my assessment:

” Against that backdrop, it’s becoming clear that many companies are rushing to secure products and materials before prices rise regardless of current demand. You could say they are in panic-buying mode. The upside is that this behavior bolsters economic growth in the short term. The downside is that there is likely to be a nasty hangover. The noise in the economic data will be amplified by the rebuilding from Hurricane Florence. The estimates of the storm’s damage span from $20 billion to $50 billion.”

Of course, you can now add Hurricane Michael to the list. But don’t forget the current spate of economic growth this year was from the 3-massive Hurricanes in 2017.

But here is her conclusion:

“In the event you’re hoping the virtuosity of panic buying can become a permanent prop to the economy, you might want to rethink your thesis.

Rather, artificial, tariff-driven panic buying pumps up GDP growth in the short term but ensures it will disappoint in the future. Look for fourth quarter estimates to be revised upwards and then look out below into the first of the year. And no, the first-quarter disappointment will not be the seasonal anomaly many economists typically ascribe to economic growth in the first three months of the year. In other words, it could be that much worse.”

More Than Just Rates

But it isn’t just the rise in interest rates, and the threat of slowing economic growth, that is most concerning for the outlook of investors going forward. Both of those issues also translate into weaker earnings growth as well.

“As stated, the risk to current estimates remains higher rates, tighter monetary accommodation, and trade wars. More importantly, year over year comparisons is going to become markedly more troublesome even as expectations for the S&P 500 index continues to rise.”

“With the number of S&P 500 companies issuing negative EPS guidance is now the highest since 2016, it is only a function of time until we see forward estimates into 2019 begin to revised substantially lower.”

The issue of earnings, combined with higher rates, tariffs, and valuations, will likely continue to way on asset prices as we move into 2019.

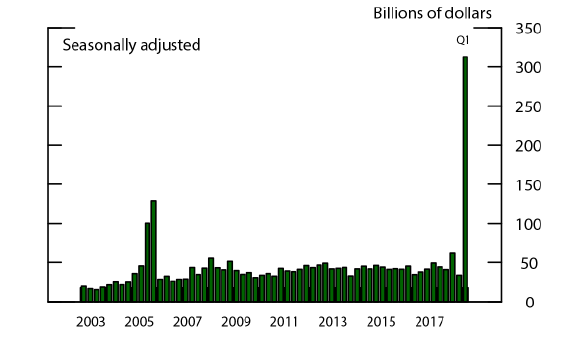

The one bright spot going into the end of this year is that corporations have been in a “blackout” period for buying back their own shares heading into Q3-earnings reporting period.

“Given a large bulk of the surge in earnings was due to the “one-time” repatriation of overseas profits of $300 billion which flowed directly into share buybacks.”

By the beginning of November, that restriction will be lifted and the markets will likely get some support from an acceleration of buybacks headed into year end. However, as stated, that growth will become much more muted.

Leave A Comment