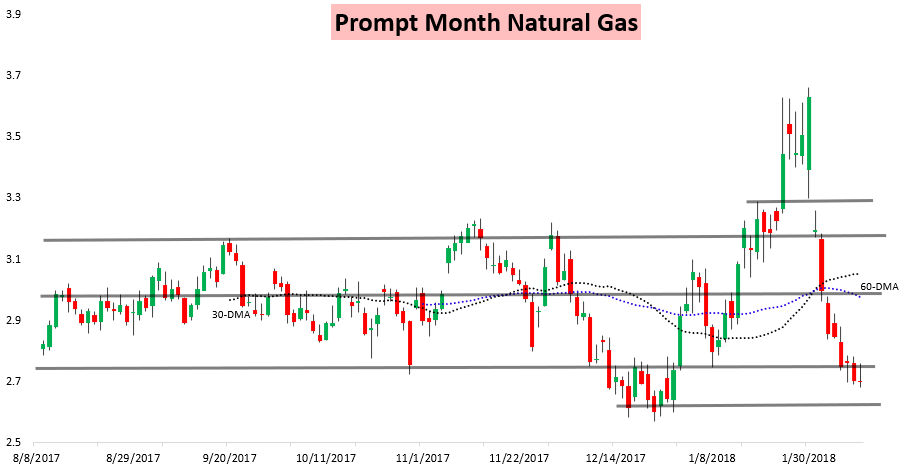

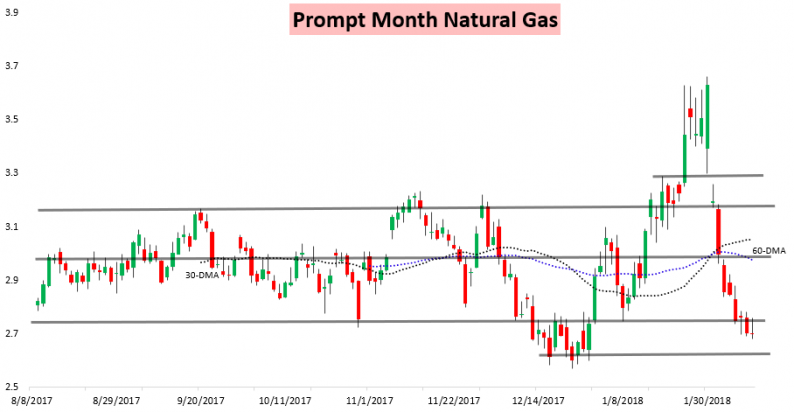

Make it 7 out of the last 8 days that the prompt month March natural gas contract has been down. After rising overnight, prices declined through the day to settle just 5 ticks or .2% lower, trading within a narrow 7.7-cent range today.

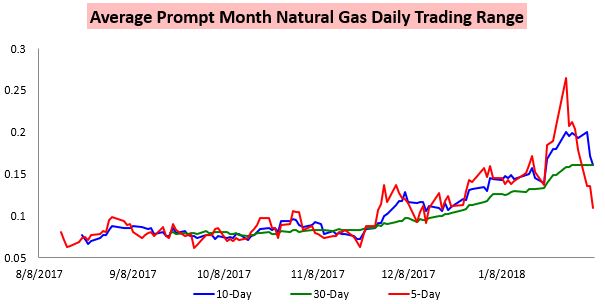

This is the smallest daily trading range for the prompt month natural gas contract since January 22nd, though it does not come as much of a surprise as the daily average trading range has really gone for a tumble recently.

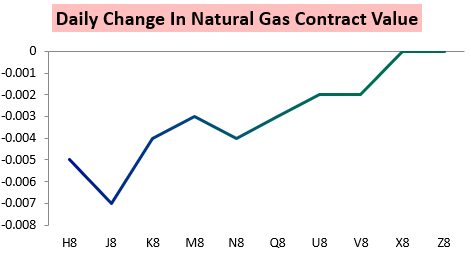

Action was not much more exciting out along the natural gas strip either, with later contracts right around flat as well.

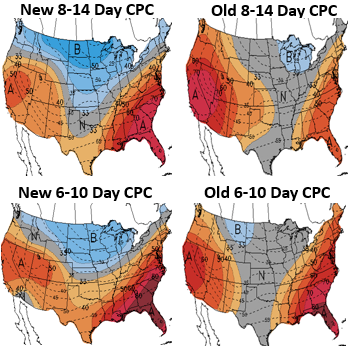

Selling has continued in part because weather models show little cold to scare natural gas traders. Widespread warmth is expected across the Southeast in the medium and long-range which will limit heating demand, as seen on the 6-10 and 8-14 Day CPC forecasts.

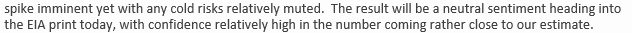

Today’s EIA print gave only limited ammunition for natural gas bulls. The number came in just 1 bcf from our estimate, and in our EIA Rapid Release for clients we classified it as “neutral” for price action today, which verified well.

In our Morning Update we highlighted that confidence was “high” in our EIA estimate, letting clients plan accordingly around the number as it verified our “neutral” sentiment through the day.

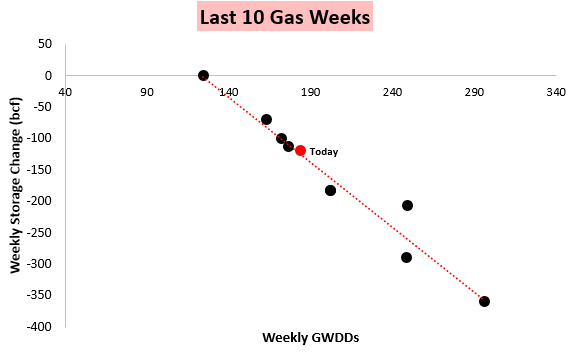

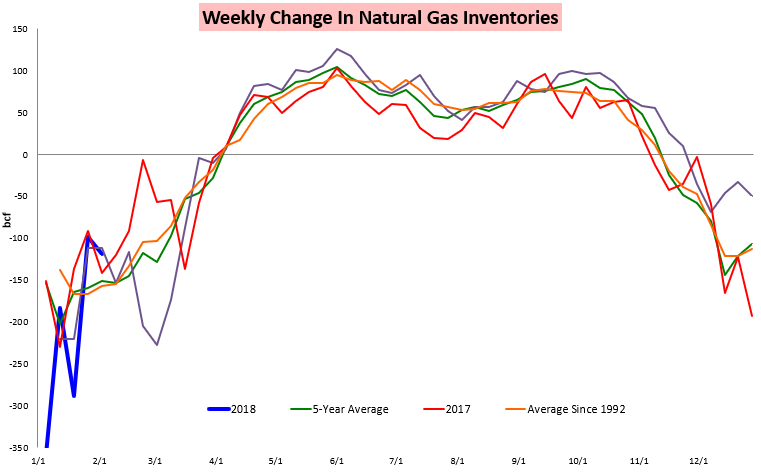

This comes after last week when our estimate was just 2 bcf off the weekly storage report number as well, indicating our modeling has a strong sense of the current natural gas balance. The number was seen as fitting in relatively well with the balance demonstrated in past weeks as well, though it was decently tighter than the loose prints we saw back in November and December.

Despite not being loose, warm weather the past week kept the withdrawal from really even testing the 5-year average.

Leave A Comment