Ignore gold, ignore earnings expectations, ignore the dollar, ignore the yield curve… and…

Video length: 00:02:44

German stocks sum it all up… Buy The F**king German Government Crisis… (even as EUR stays weaker)

Record Highs all around in ‘Murica…

As once again the European Session (green boxes) cominated the ramp…

As VIX was slammed back to a 9 handle…

Here’s a couple things though…

The last 5 days have been quite a ride for ‘shorts’… as “Most Shorted” stocks have soared over 6% – This is the biggest short-squeeze since Dec 8th 2016 (which was followed by a 6% decline)

High yield bond prices rose once again but remain below the 200DMA for the 11th straight day (the longest period since Q1 2016)

But the ultra-sensitive Small Caps love the tiny relief in HY…

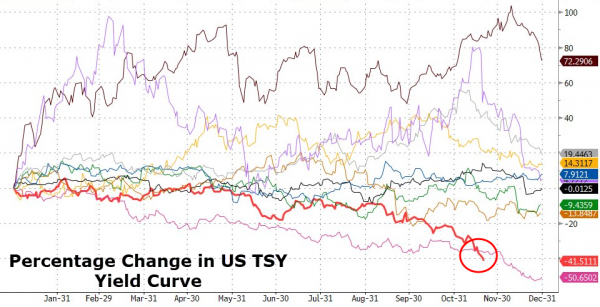

Treasury yields were mixed once again as the long-end rallied (30Y -2bps) and short-end was sold (wY +2bps)…

For the first time since early Nov 2007, the spread between 2Y and 30Y Treasury yields has crashed below 100bps…

In fact the yield is crashing this year at the fastest rate in at least a decade…

The Dollar Index declined once again…

Bitcoin surged to yet another record high…

WTI/RBOB rallied today ahead of tonight’s API data…

Gold and Silver held on to early gains today but faded in the afternoon…

And here is why stocks are rallying to record highs… because earnings expectations are tumbling, silly!!

Leave A Comment