A 23% yield makes income investors’ mouths water.

In a low interest rate world where blue chip stocks pay 3% yields and junk bonds pay 5%, 23% is pretty exciting.

But as I’m sure you know, any investment that yields 23% today has a high degree of risk.

In CVR Refining’s (NYSE: CVRR) case, that attractive yield is going to be lower at some point. It’s practically a guarantee.

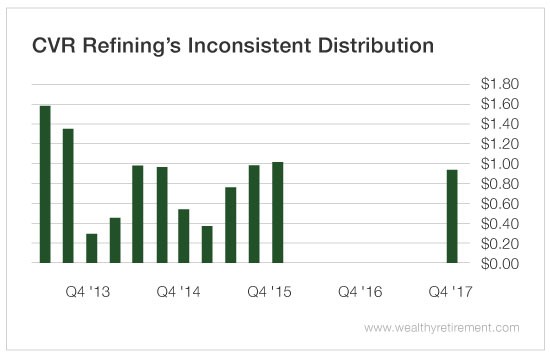

In early February 2016, using SafetyNet Pro, I predicted CVR Refining would cut its distribution.

Not only did it cut the distribution just two weeks later, but it eliminated the distribution entirely until October 2017.

That’s because it generated barely any cash in 2016. As things improved in 2017, the company reinstated the distribution, paying shareholders $0.94 per share. Annualized, that comes out to 23%.

And next year, it could be even higher.

Cash available for distribution is expected to climb from an estimated $164 million in 2017 to $198 million this year.

So what’s the problem?

A Distribution Policy That Guarantees Cuts

CVR Refining’s distribution policy is to pay shareholders all of its cash available for distribution.

When things are going well and the company is generating cash, that’s great for shareholders. They get paid whopping distributions, like the one CVR Refining just paid in October.

However, during the lean times (like when oil prices collapsed in 2016), the company did not generate cash, so shareholders received nothing.

This variable policy ensures that the distribution will be inconsistent.

During strong years, shareholders will be rewarded handsomely. In lean years, they’ll see their distribution slashed or eliminated…

If CVR Refining can generate the kind of cash that Wall Street expects this year, investors could see a big distribution and astronomical yields in 2018.

But they shouldn’t get used to that kind of payout. Unless CVR Refining can continuously grow its cash available for distribution (something it hasn’t been able to do in the past), the distribution will head lower in the future.

Leave A Comment