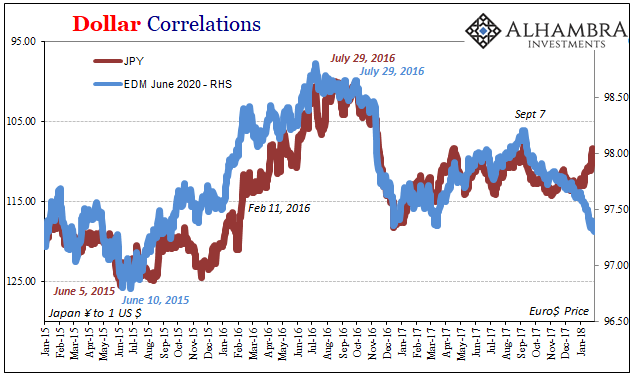

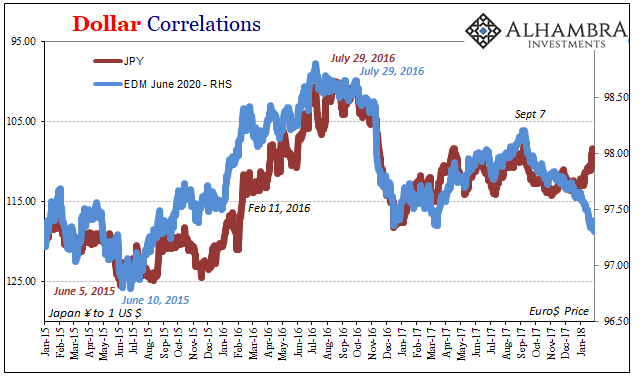

It used to be a big deal, the kind of move that would itself move markets all over the world. Very quietly, JPY has been trading higher over recent weeks and has reached a level of appreciation we haven’t seen since those rocky days in early September.

Only then, a rising yen (falling dollar) was a sign of bad things, an anti-reflation direction tied in with falling UST yields and greater bids on eurodollar futures. It was something of a daily trading rule coming out of Asian sessions; if JPY was up against the dollar, you could bet Treasuries were rallying (in price).

Obviously, we know what changed over the interim. China went in another direction, its currency almost literally. Now eurodollar futures flop as CNY rises, and UST yields move higher inversely to HKD. But is Japan completely out of it?

Another way of asking that question is, does JPY tell us anything important even if it’s not the marginal price setter right now? We can’t forget that even if China might be deriving marginal “dollar” flows from its hidden Hong Kong back channel Japan isn’t outside of “dollars” entirely. Japanese banks are still a major part of the eurodollar system and especially its Asian “dollar” subset no matter how much, or little, European banks get pulled back in.

I look at JPY 108 with what I think is appropriate wariness, a fly in the otherwise booming ointment. This “wrong” yen is indicative, I believe, of the full measure of the curves.

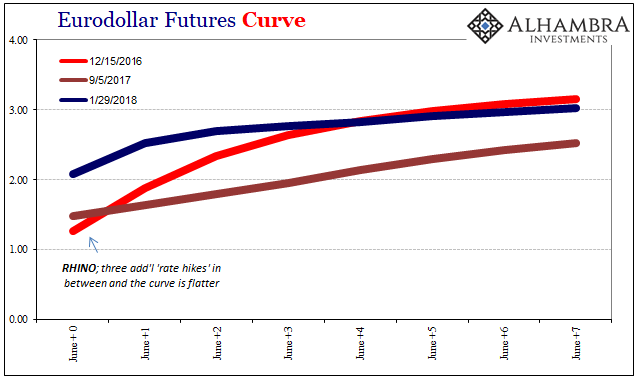

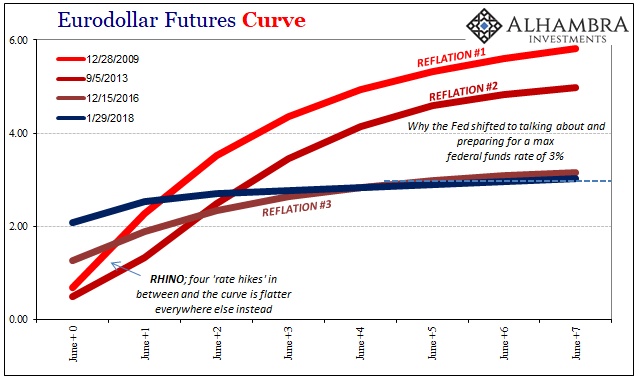

What I mean by that is pretty simple; despite all the noise and movement at the front end of whichever one, eurodollar futures pictured above and below, the back ends remain mostly steadfast. That isn’t to say that they aren’t moving there, only that what gets priced over time is a terminal level that is an overall anathema to the more comprehensive idea of reflation.

You can see it more easily in comparison to past reflation peaks, including the one from December 2016:

The eurodollar curve, as the Treasury curve flattening in its own way, is resisting anything more than a temporary change in monetary policy. That’s it. In other words, these markets are reflecting on possibilities that the Fed may get to do a few more “rate hikes” than the market believed in the middle of last year.

Leave A Comment