The stock market is barely moving anymore in any given day and you need to know why.

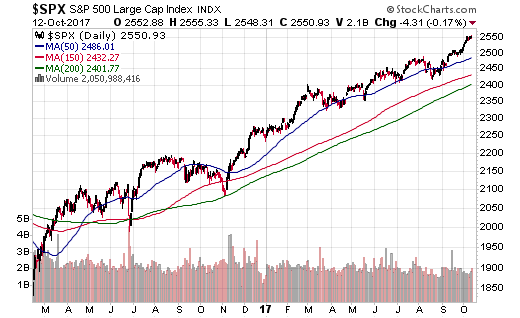

Since November of last year going into the election, there hasn’t even been a 3% drawdown for the S&P 500 from it’s 52-week high.

Most American investors now have the bulk of their money in stock market ETF’s with a little bit of money outside of that in the popular fad stocks like FB, AMZN, GOOG, and Apple.

And then they tend to put a bit into more speculative plays like NVDA and dope penny stocks for action.

But in the end the stock market has been rising without pulling back to give people in ETF’s like SPY a stairway to heaven ride up.

You can see this in the chart:

We are witnessing record low volatility and complete and total complacency shown in indicators such as the VIX.

I did an interview this week on the Jim Goddard show talking about this:

One reason why this is happening is a paradox.

Even though the masses in the stock market are complacent and bullish very few people are actually doing short-term trades in the stock market.

One result is CNBC ratings are in collapse.

Ten years ago every night over 150k people would tune in to watch Jim Cramer at 6:00 PM.

Now I just read a story that says CNBC barely gets over 100,000 unique viewers ALL DAY LONG.

Another result is that the market is barely moving anymore on any given day.

Oh one day this will change (probably next year) but right now you probably have noticed that the market barely goes up and down anymore during a single day.

Why?

The answer is that trading robots are the ones doing almost all market trading now.

They just play for penny decimal gains and jump in and out in seconds.

They don’t care about big moves.

So yes the market action is dull.

It’s like watching paint dry and it’s going to remain that way until a surprise comes.

The masses won’t return to trading until there is a big move or a big surprise.

Leave A Comment