As noted in The Hill, from a letter written by key House and Senate leaders to President Obama:

“The continued misalignment of China’s currency is unsustainable and unacceptable.”

Two observations:

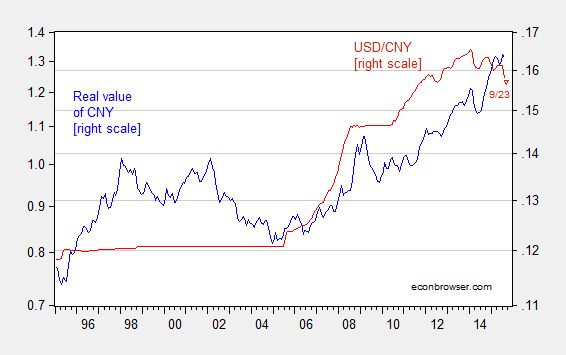

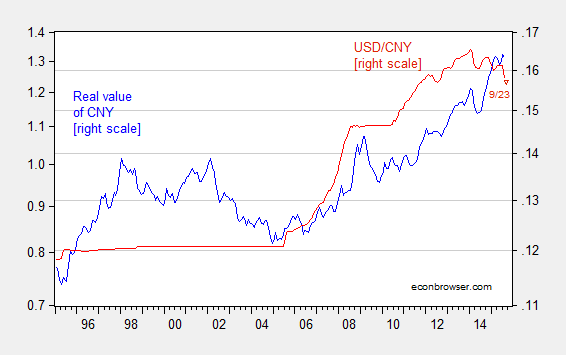

The yuan’s value. While the yuan has depreciated recently, on a trade weighted basis, the real value of the yuan is (still) 14% higher (in log terms) than it was in 2014M06.

Figure 1: Real value of trade weighted yuan, 2010=1 (blue, left log scale), and USD/CNY (red, right log scale).

Source: BIS, Federal Reserve Board.

As of 9/23, the yuan was 0.6% weaker against the dollar than it was in August. That means that the yuan is still substantially stronger than it was in mid-2014.

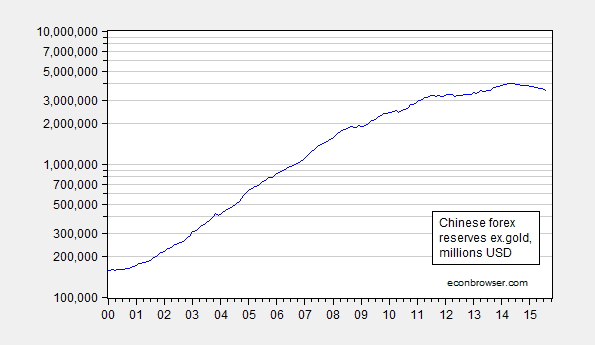

The external balance. Chinese foreign exchange reserves in dollars have been declining for the past year.

Figure 2: Chinese foreign exchange reserves excluding gold, in millions of USD, log scale (blue).

Source: FRED, TradingEconomics.

Capital outflows have been increasing, at least as can be inferred from current account data and changes in fx reserves.

Source: Economist, Sept. 19, 2015.

Put together, these points do not support severe undervaluation, even after the recent yuan devaluation. More on undervaluation here and here.

There are plenty of contentious issue-areas for the US and China to deal with. Severe yuan undervaluation is not one of them (unless much larger devaluations are in the pipeline).

Leave A Comment