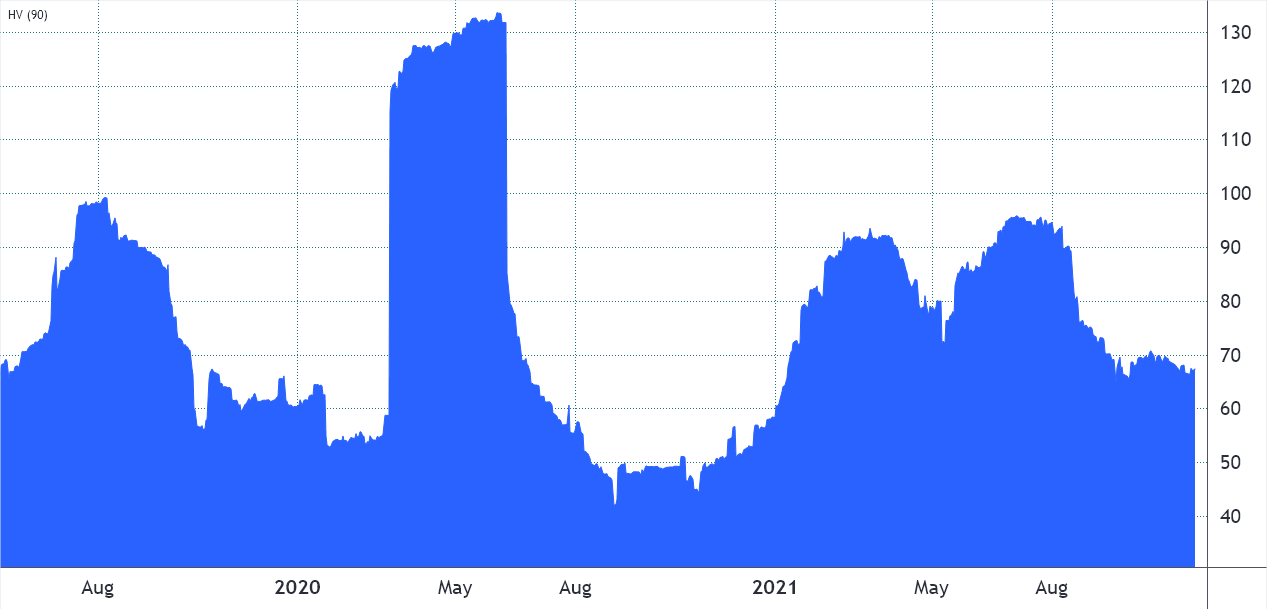

The first rule of Bitcoin (BTC) trading should be “expect the unexpected.” In just the past year alone, there have been five instances of 20% or higher daily gains, as well as five intraday 18% drawdowns. Truth to be told, the volatility of the past 3-months has been relatively modest compared to recent peaks.

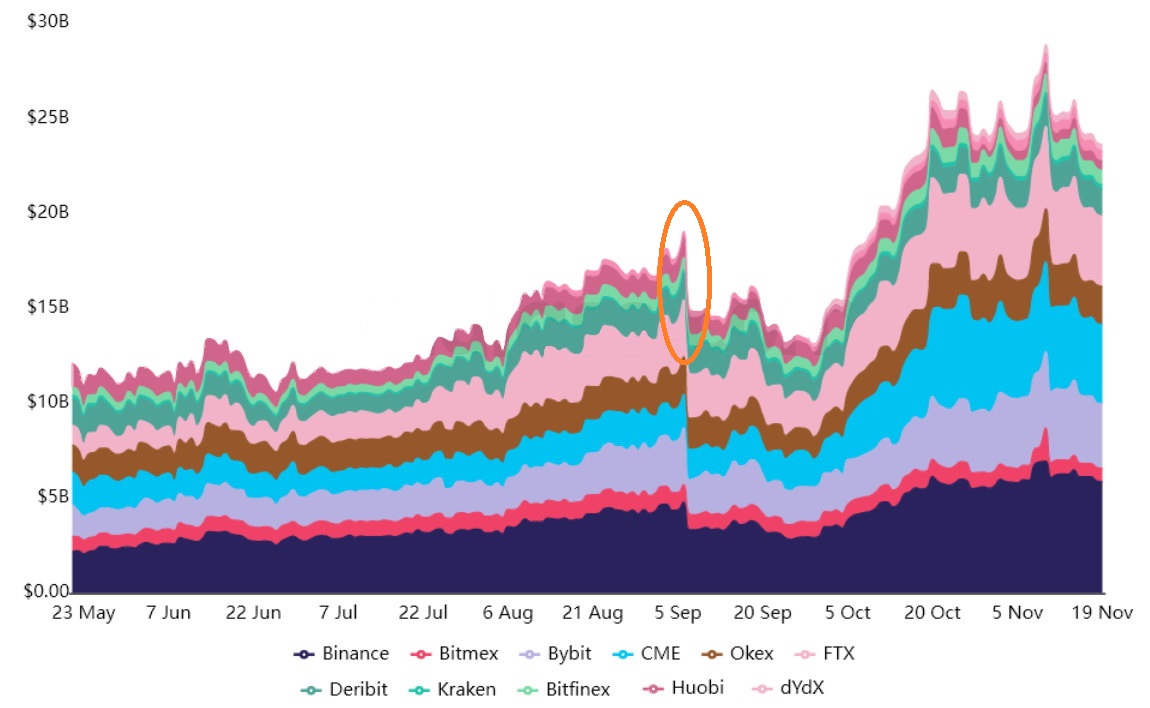

The downside move did not trigger alarming-raising liquidations

Cryptocurrency traders are notoriously known for high-leverage trading and in just the past 4 days nearly $600 million worth of long (buy) Bitcoin futures contracts were liquidated. That might sound like a decent enough number, but it represents less than 2% of the total BTC futures markets.

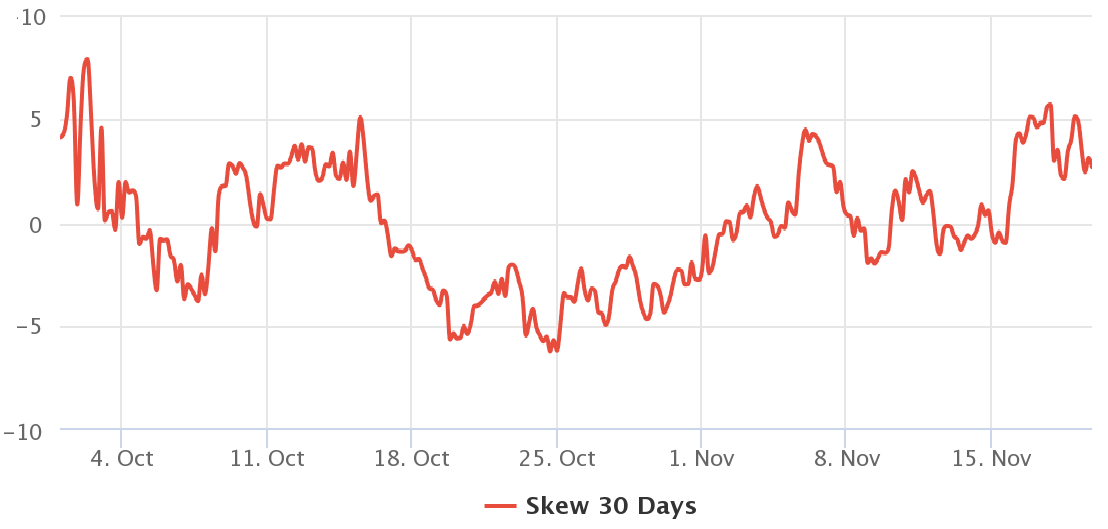

The options markets’ risk gauge remained calm

To determine how worried professional traders are, investors should analyze the 25% delta skew. This indicator provides a reliable view into “fear and greed” sentiment by comparing similar call (buy) and put (sell) options side by side.

This metric will turn positive when the neutral-to-bearish put options premium is higher than similar-risk call options. This situation is usually considered a “fear” scenario. The opposite trend signals bullishness or “greed.”

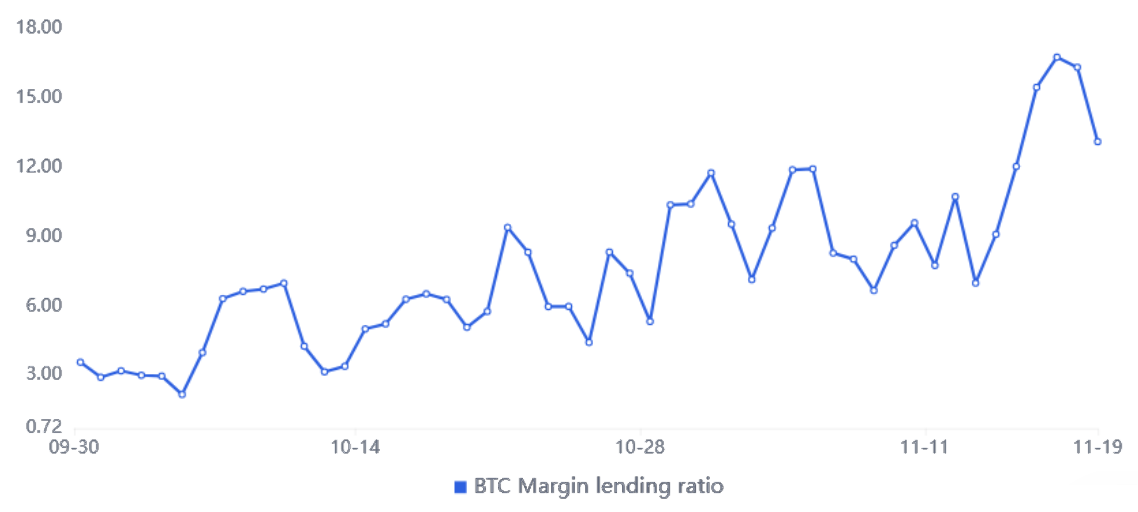

Margin traders are still going long

Margin trading allows investors to borrow cryptocurrency to leverage their trading position, therefore increasing the returns. For example, one can buy cryptocurrencies by borrowing Tether (USDT) and increasing their exposure. On the other hand, Bitcoin borrowers can only short it as they bet on the price decrease.

Unlike futures contracts, the balance between margin longs and shorts isn’t always matched.

All of the above indicators show resilience in the face of the recent BTC price drop. As previously mentioned, anything can happen in crypto, but derivatives data hints that $56,000 was the local bottom.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Leave A Comment