Volatility is a complex statistical measure commonly used by traders and investors. Those unfamiliar with it will likely attribute some sort of special ‘standing’ to analysts whenever the term is used. However, as shown in a recent comment by Binance exchange founder, Changpeng Zhao, most of the time people are clueless about what volatility means.

Expect very high volatility in #crypto over the next few months.

— CZ Binance (@cz_binance) October 21, 2021

This is not the first time that CZ has made an incorrect assumption on that topic. In May, CZ said that volatility was “not unique to crypto,” although multiple sources, including Cointelegraph, showed that excluding Tesla, no S&P 500 stock matched Bitcoin’s (BTC) 70% yearly volatility.

So what is volatility?

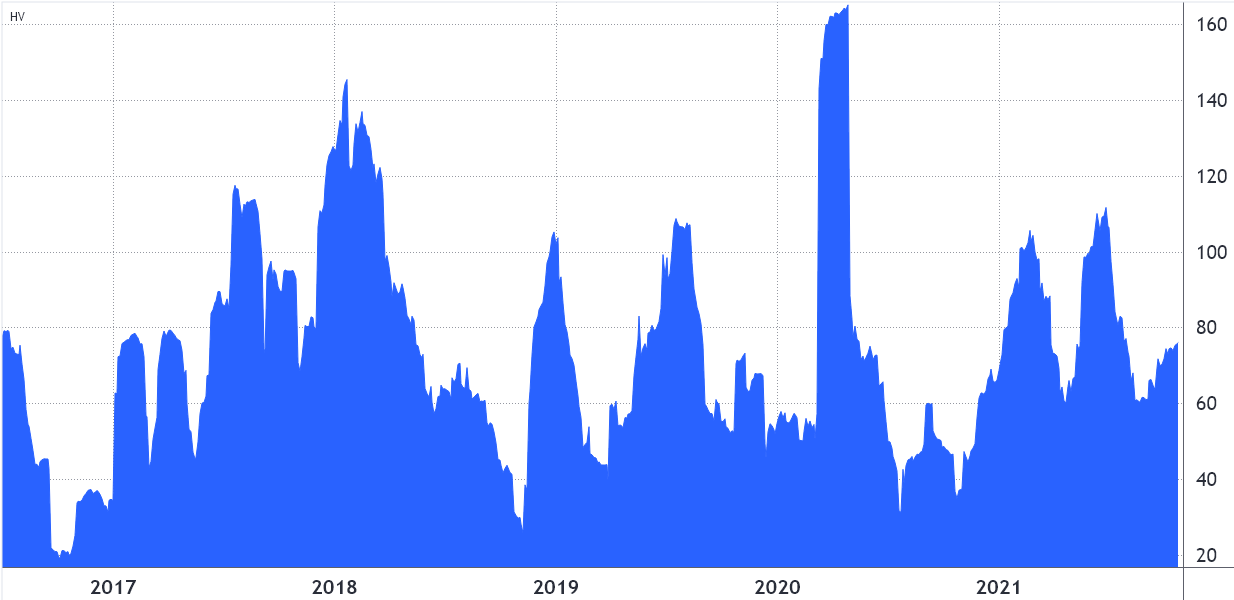

Realized (or historical) volatility measures how large daily price fluctuations are and higher volatility indicates that the price can drastically change over time in either direction.

This indicator might sound counterintuitive, but lower volatility periods represent a more significant risk of explosive moves. That is partially due to realized volatility being a backward-looking indicator. During quieter periods, traders tend to over-leverage, which then causes larger liquidations during sudden price moves.

Volatility does not differentiate bull and bear markets because it exclusively gauges absolute daily oscillations. Furthermore, by itself, a quiet volatility period is not an indicator of an upcoming dump.

What if CZ knows something we don’t?

Considering how well-connected the world’s largest crypto exchange founder is, there’s always a possibility that CZ might have some inside information but if a person was so sure about an upcoming event, the odds are they would likely know whether the impact is positive or negative. Once again, expecting “high volatility” for the “next couple of months” does not indicate someone has confidence in any direction.

Let’s assume that he was correct, and crypto volatility is about to breach the 100% yearly level. There’s an options strategy that fits this scenario and allows investors to profit from a strong move in either direction.

The reverse (short) iron butterfly is a limited risk, limited profit options trading strategy. It’s important to remember that options have a set expiry date; therefore, the price increase must happen during the defined period.

The suggested bullish strategy consists of selling 1.23 BTC contracts of the $52,000 put options while simultaneously selling 0.92 call options with an $80,000 strike. To finalize the trade, one should buy 1.15 contracts of $64,000 call options and another 1.0 contracts of the $64,000 put options.

While this call option gives the buyer the right to acquire an asset, the contract seller gets a (potential) negative exposure. To fully protect from market oscillations, one needs to deposit 0.174 BTC (roughly $11,000), representing the investors’ maximum loss.

The risk to reward is sketchy, so the trader needs conviction

For this investor to profit, one needs Bitcoin price to be below $54,400 on Dec. 31, 2021 (down 14%) or above $75,500 (up 19%). The theoretical risk-reward is not good because the maximum payout is 0.056 BTC and the potential loss is over 3 times that amount.

Nevertheless, if a trader is certain that volatility is right around the corner, a 20% move from $63,000 in 66 days seems feasible. Traders should note that the investor can revert the operation ahead of the options expiry, preferably right after a strong Bitcoin price move. All one needs to do is buy back the 2 options that have been sold, and sell the other 2 that were previously bought.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Leave A Comment