The mood across the cryptocurrency ecosystem has shifted to cautious optimism on Feb. 7, as Bitcoin (BTC) bulls managed to bid its price back above support at $44,000 with the help of several positive developments, including the announcement that “Big Four” auditor KPMG has added BTC and Ether (ETH) to its corporate treasury.

Data from Cointelegraph Markets Pro and TradingView shows that, after hovering around $42,500 during the early morning on Feb. 7, a midday wave of buying lifted the BTC price to a high of $44,500 as short traders scrambled to close their positions.

“Good spot to close longs out”

The sudden move up in BTC has led to a plethora of up-only bullish proclamations by crypto holders, while more seasoned traders, including pseudonymous Twitter user Pentoshi, are using this opportunity to secure some profits and reposition themselves for what comes next.

“Taking the last highs now. Looking for one last spike up but $44,000-$46,300. In my opinion, good spot to close longs out and re-evaluate.”

Traders remain bearish on BTC

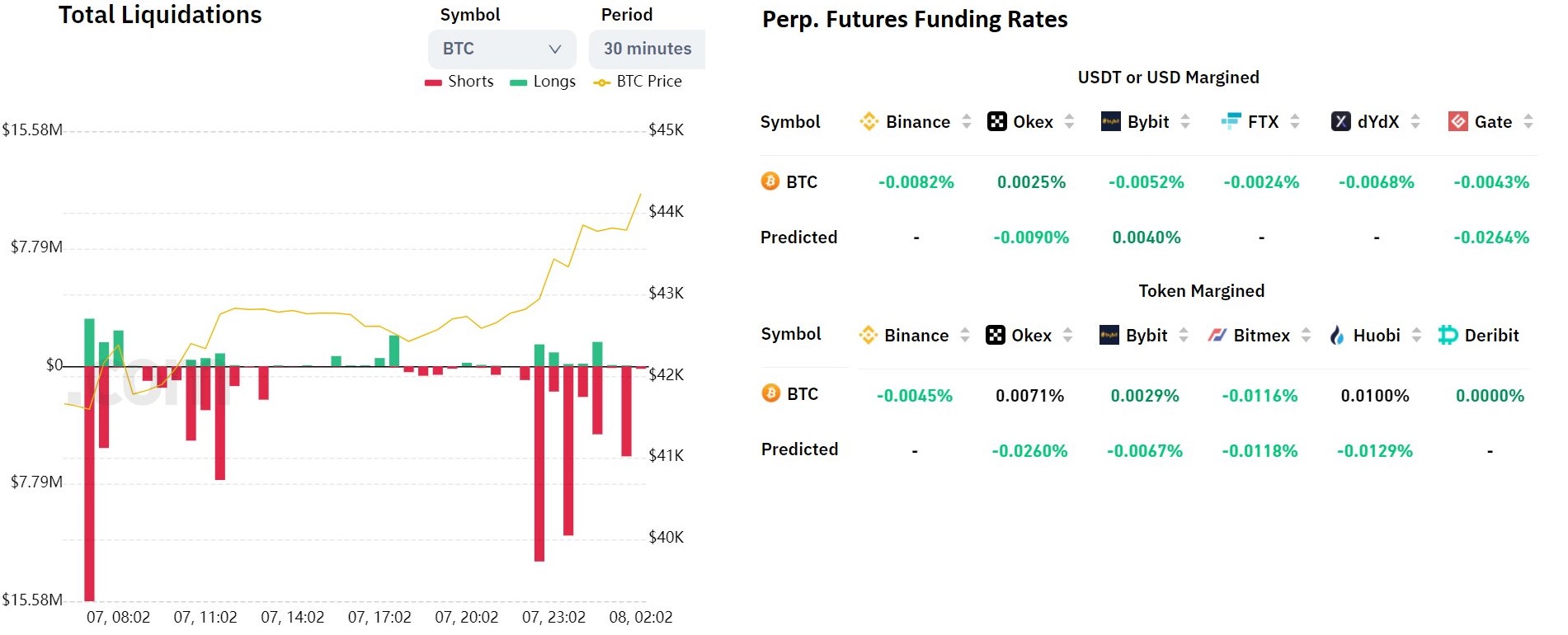

Insight into how active traders are perceiving this latest BTC price move was provided by Bitcoin analyst and Twitter user Allen Au, who posted the following graphic outlining how the futures markets were impacted by Monday’s price action.

“Perpetual futures funding rates are negative despite BTC breaking above $44K. Traders are still bearish about BTC.”

Au highlighted the next major resistance levels for Bitcon at $44,500, $46,500 and $47,500.

Related: Global crypto adoption could ‘soon hit a hyper-inflection point’: Wells Fargo report

$45,000 signals a possible trend reversal

A look at the long-term price action for Bitcoin was provided by crypto analyst and pseudonymous Twitter user Sheldon the Sniper, who posted the following chart showing that BTC has climbed back into the upward trend it’s been on since late 2020.

“$45,000 will give us the first major higher high and will be a great indication of possible trend reversal.”

A slightly different perspective of the longterm BTC price action was offered by crypto analyst and pseudonymous Twitter user TechDev, who posted the following chart and suggested that “Bitcoin has been correcting/consolidating for nearly a year.”

“Likely in a running flat which could turn into a running triangle. The next impulse is poised to be a big one.”

The overall cryptocurrency market cap now stands at $2.024 trillion and Bitcoin’s dominance rate is 41.5%, according to CoinMarketCap.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment