Could retail investors be flocking back to Bitcoin (BTC)? In encouraging signs for a bullish 2022, Glassnode data reveals that 913,000 new BTC addresses were added from November to the start of December this year.

In a boon for BTC, on-chain analyst On-Chain College shared insightful data regarding retail adoption and the potential beginnings of broader adoption trends. The key takeaway to round off the year is that up to one million new entrants joined the Bitcoin network in November.

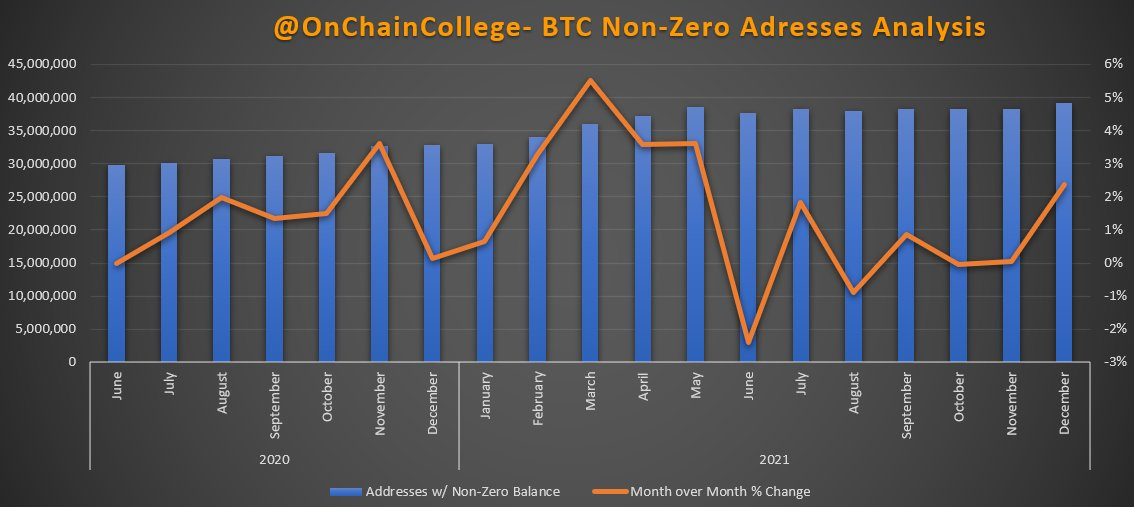

Despite bearish price action in the short term, the Twitter flood shows that the macro outlook for BTC remains sound. According to the chart, from June 2020 to December 2021, the number of wallet addresses with a balance greater than zero has trended up from 30 million wallets to a touching distance of 40 million.

Glassnode describes the non-zero balance metric as the number of unique addresses holding a positive (non-zero) amount of coins. When the number trends up, new users are entering the Bitcoin network.

Glassnode describes the non-zero balance metric as the number of unique addresses holding a positive (non-zero) amount of coins. When the number trends up, new users are entering the Bitcoin network.

When it trends down, as visualized in the orange line on the graph from May to July this year, it shows users are emptying their wallets to zero. By inference, wallet addresses’ fall is a downward price action indicator.

Related: Bitcoin dominance falls under 40%

In light of November’s new entrants, it begs the question, “Was this just an outlier fueled by excitement after recently hitting an ATH? Was it the start of a broader trend?”

It’s heartening to think that with thanksgiving, festive celebrations and Omicron fears in November and December, potential investors have more opportunities to research Bitcoin and potentially invest.

Reporting in December backs up the claim, as the balance changes for wallets holding 1 BTC or less — typically suggesting smallscale investors — reached their highest since March 2020.

However, a note of caution regarding the future of retail. Regular Cointelegraph contributor and BTC analyst William Clemente tweeted a series of graphs with the message “retail interest in Bitcoin is pretty much gone since the Spring.”

More evidence of retail is required. While it was widely reported in October that institutions are buying Bitcoin rather than gold, Google Trends search data for “Bitcoin” is a quarter of what it was during the December 2017 peak. Evidently, retail mania is some ways off.

Leave A Comment