Bitcoin (BTC) derivatives traders on the Chicago Mercantile Exchange (CME) missed out on incredible profits as BTC’s spot price smashed through $55,000 this week.

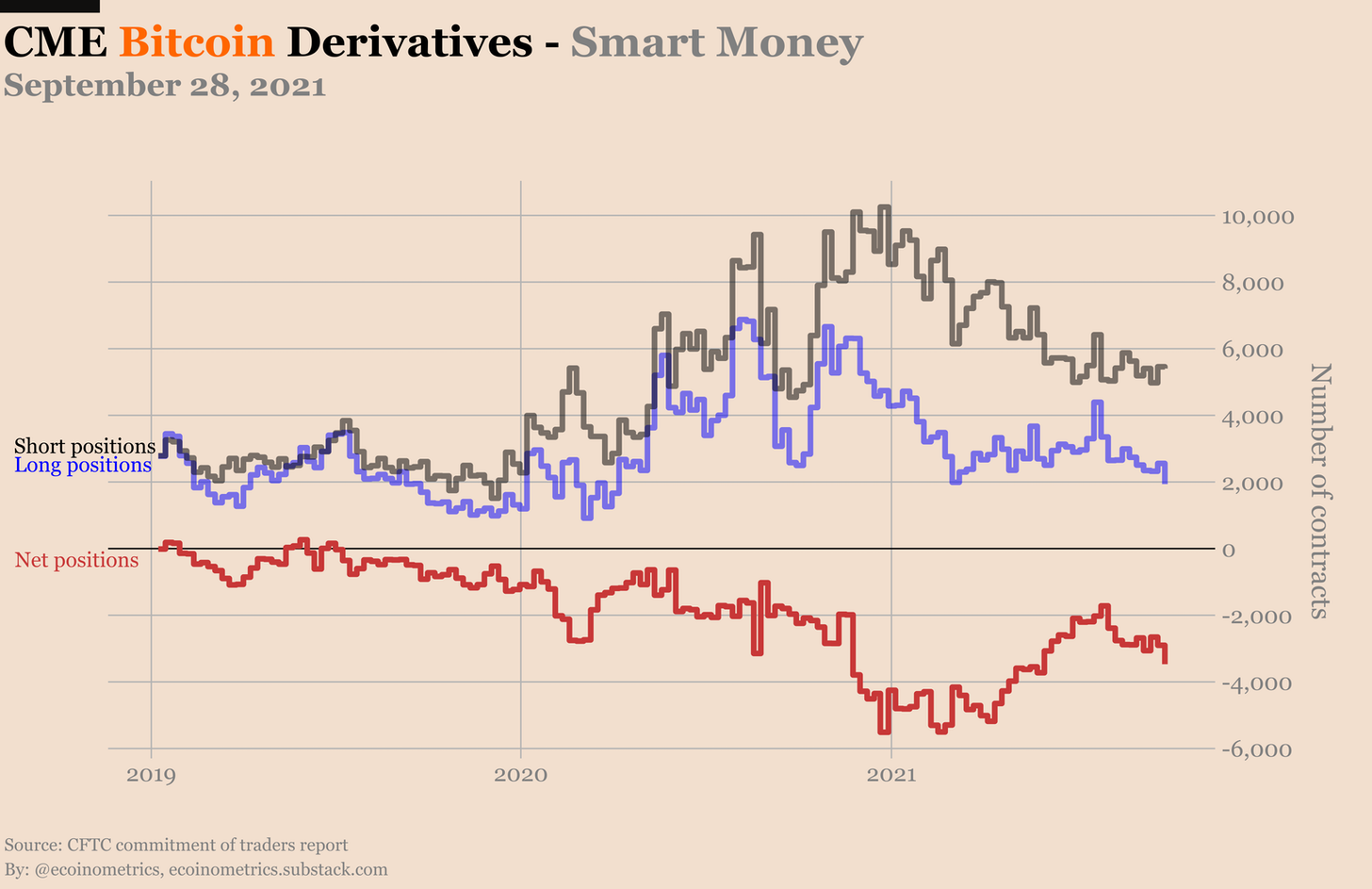

Retail investors reduced their long exposure across the Bitcoin futures and options markets in late September, according to data shared by Ecoinometrics. The amount of open short positions also climbed, indicating that derivative traders anticipated Bitcoin’s price to drop, as shown in the chart below.

“Most likely, this dip is due to a mix of traders not rolling their long positions to the October contract and some outright liquidating when BTC looked like it was going to drop below $40k last week,” said Nick, an analyst at Ecoinometrics.

“Regardless, the overall picture is that the futures traders lack conviction.”

“That’s paper hands 101,” the analyst noted.

Smart money

Institutional investors in the CME Bitcoin futures market also followed retail sentiment as they reduced their long exposure in the market. But, on the other hand, their short positions climbed.

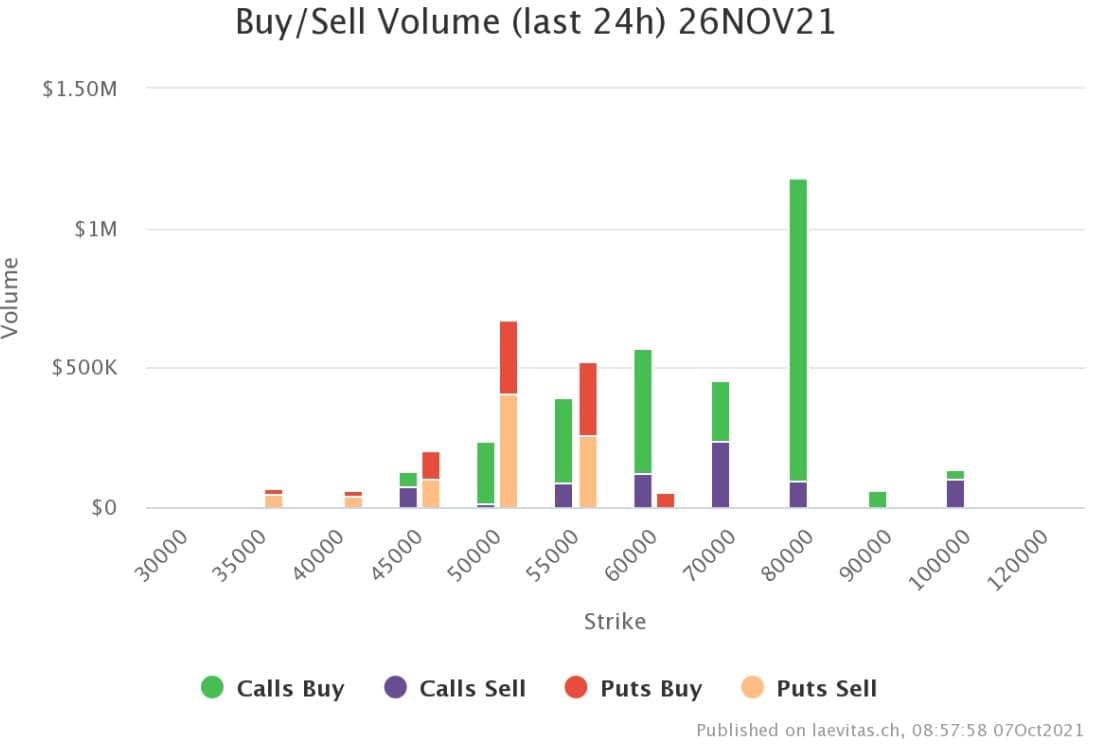

On the other hand, some options traders bet that the spot Bitcoin price would hit $60,000 by the end of October. Additionally, analyst Crypto Hedger highlighted that Bitcoin options expiring on Nov. 26 show bulls’ sentiment skewed toward the $80,000-strike target.

“A break below or above these levels can stir another cataclysmic price reversal or a massive run toward $60,000 in Q4.”

Bitcoin supply squeeze in play

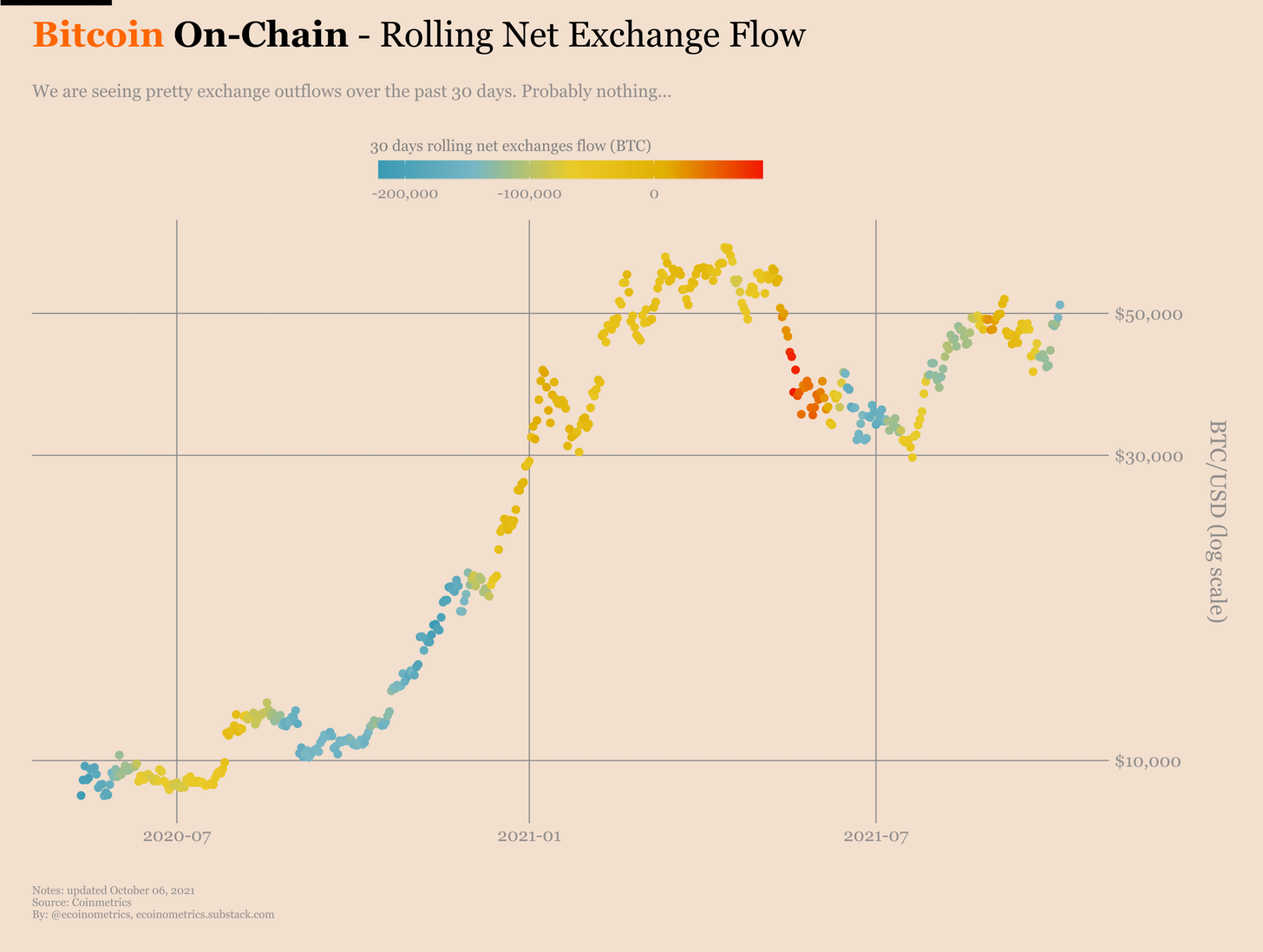

On-chain data shared by Ecoinometrics also showed a higher level of Bitcoin withdrawals from all the crypto exchanges.

In detail, Bitcoin’s 30-day net exchange flow has been rising since July 2020, as noted in the color-coded chart below, with blue and red indicating extreme outflow and inflow, respectively.

Related: Bitcoin ‘heavy breakout’ fractal suggests BTC price can hit $250K–$350K in 2021

“Back then there were indeed periods of net outflows but in terms of size they look much less dramatic than what we have right now,” Ecoinometrics highlighted, adding:

“That’s another sign that we are on course for a liquidity crisis which could drive Bitcoin’s value much higher than it is right now.”

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, and you should conduct your own research when making a decision.

Leave A Comment