Broad-based risk aversion weighed on sentiment-sensitive crude oil prices Wednesday, with the WTI contract following the bellwether S&P 500 downward. Technology shares led the way lower amid concerns that Congress may opt to begin regulating social media. API inventory flow data compounded downside pressure, showing inventories shed a relatively modest 1.17 million barrels last week.

Meanwhile, gold prices corrected higher as the US Dollar pulled back after four days of consecutive gains. The drop echoed a rise in European currencies led the by the British Pound amid reports of a Brexit negotiations breakthrough between the UK and Germany. The greenback’s decline offered a familiar lift to anti-fiat alternatives epitomized by the yellow metal.

SERVICE-SECTOR ISM, EIA INVENTORIES DATA IN FOCUS

From here, EIA inventory flow data is in focus for crude oil prices. Economists expect a draw of 2.38 million barrels. An outcome closer to the API projection may see recent losses compounded. Meanwhile, an uptick in the service-sector ISM gauge may reenergize Fed rate hike speculation and send the US Dollar higher anew, renewing selling pressure on gold prices.

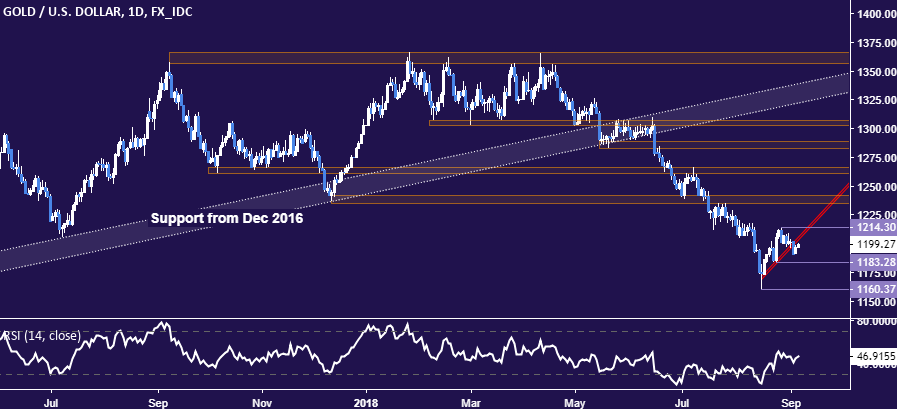

GOLD TECHNICAL ANALYSIS

Gold prices corrected higher but the break of counter-trend support signaling down trend resumption remains intact. From here, a daily close below the August 24 low at 1183.28 exposes the swing bottom at 1160.37. Alternatively, a reversal back above the August 28 high at 1214.30 opens the door for a retest of the 1235.24-41.64 area.

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are pressuring support guiding the upswing from mid-August lows. A break confirmed on a daily closing basis paves the way for a challenge of dominant rising trend support in the 65.18-67.07 area. Alternatively, a push above resistance in the 70.15-41 zone targets the inflection point at 72.88.

Leave A Comment