Fundamental Forecast for : Neutral

FUNDAMENTAL CRUDE OIL PRICE TALKING POINTS:

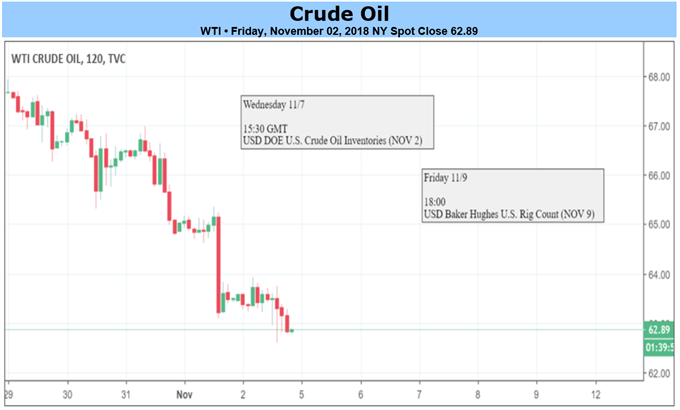

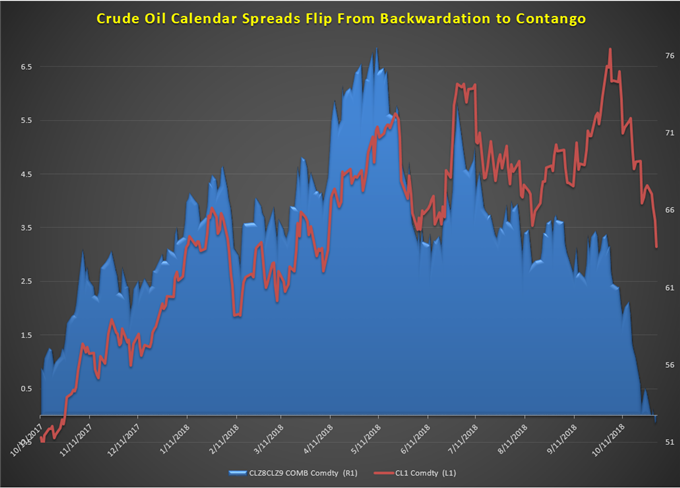

WTI crude oil fell 13.26% over the last month while Brent fell 8.7% and NYMEX Gasoline, a refined oil product has fallen 15.8% while crude calendar spreads have fallen into contango where the front-month futures product trades at a discount to a latter month contract of the same commodity.

BYE-BYE FRONT-MONTH PREMIUM

Data source: Bloomberg

If you went into the month of October bullish crude (I did,) you are likely now questioning what has happened in a little over 20 trading days that have taken the market from four-year highs to a near bear market (I am.) A bear market is defined as a 20% drop in a market, which would happen on a move below $61.45. Currently, crude has fallen as much as 18% from the YTD high on October 3.

This week’s move in crude to six-month lows were backed by multiple negative shifts in narratives underlying the oil market. A key development that caused additionally selling later in the week was news that OPEC output jumped to the highest levels since 2016, which pushed the futures spreads of the December 2018 – December 2019 WTI contract to negative, which has wiped a lot of underlying buying pressure.

Leave A Comment