Dec. 13 will likely be remembered as a “bloody Monday” after Bitcoin (BTC) price lost the $47,000 support, and altcoin prices dropped by as much as 25% within a matter of moments.

When the move occurred, analysts quickly reasoned that Bitcoin’s 8.5% correction was directly connected to the Federal Open Market Committee (FOMC) meeting which starts on Dec. 15.

Investors are afraid that the Federal Reserve will eventually start tapering, which simply put, is a reduction of the Federal Reserve’s bond repurchasing program. The logic is that a revision of the current monetary policy would negatively impact riskier assets. While there’s no way to ascertain such a hypothesis, Bitcoin had a 67% year-to-date gain until Dec. 12. Therefore, it makes sense for investors to pocket those profits ahead of market uncertainties and this could be connected to the current correction seen in BTC price.

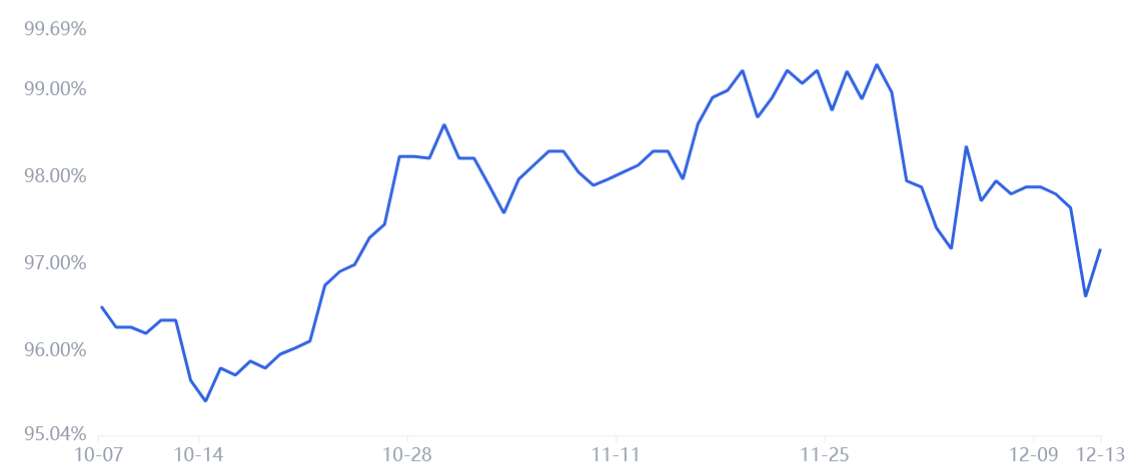

Tether’s discount bottomed at 4%

The OKEx Tether (USDT) premium or discount measures the difference between China-based peer-to-peer (P2P) trades and the official U.S. dollar currency. Figures above 100% indicate an excessive demand for cryptocurrency investing. On the other hand, a 5% discount usually indicates heavy selling activity.

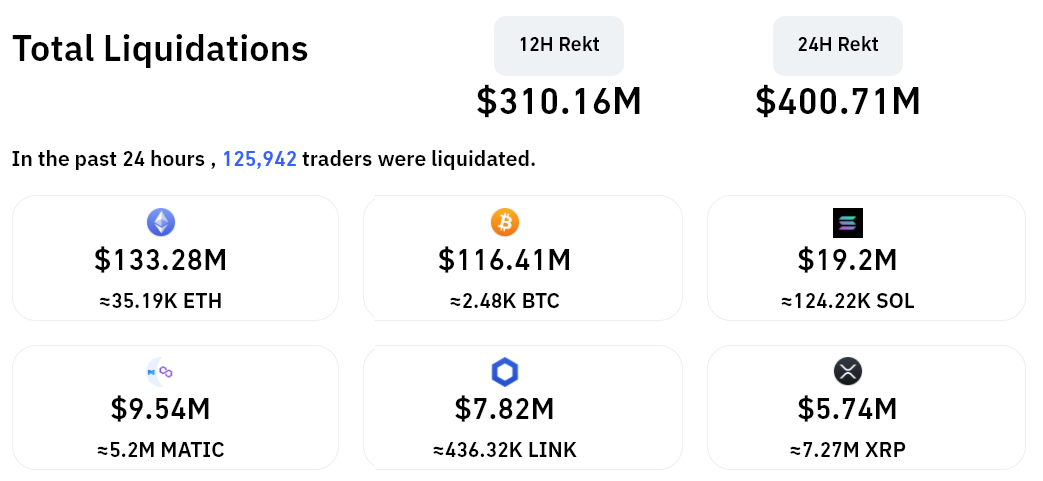

To further prove that the Dec. 13 price crash only slightly impacted investor sentiment, the total liquidations over the 24 hours was $400 million.

There’s no excessive demand from Bitcoin bears, at the moment

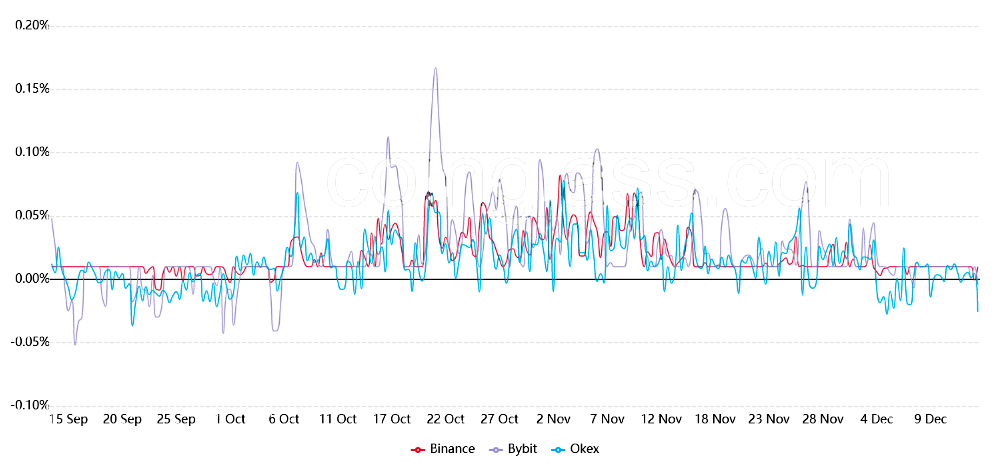

To further prove that the crypto market structure was not strongly affected by the sharp price drop, traders should analyze the perpetual futures. These contracts have an embedded rate and usually charge a fee every eight hours to balance the exchange’s risk.

A positive funding rate indicates that longs (buyers) are demanding more leverage. However, the opposite situation occurs when shorts (sellers) require additional leverage, and this causes the funding rate to turn negative.

Tether trading at a 4% discount in the China-based markets, $300 million in long contract liquidations and a neutral funding rate is not a sign of a bear market. Unless these fundamentals change significantly, there is no reason to call for $42,000 or lower Bitcoin prices.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Leave A Comment