Ether (ETH) price has seen quite a bit of volatility lately and to the surprise of many traders, the $4,000 level continues to present considerable resistance. Currently, the price is respecting the upward channel which started in August but every time the support is tested, the risk of an aggressive correction increases. With that in mind, this Friday’s $340 million options expiry will likely be dominated by neutral-to-bearish put options.

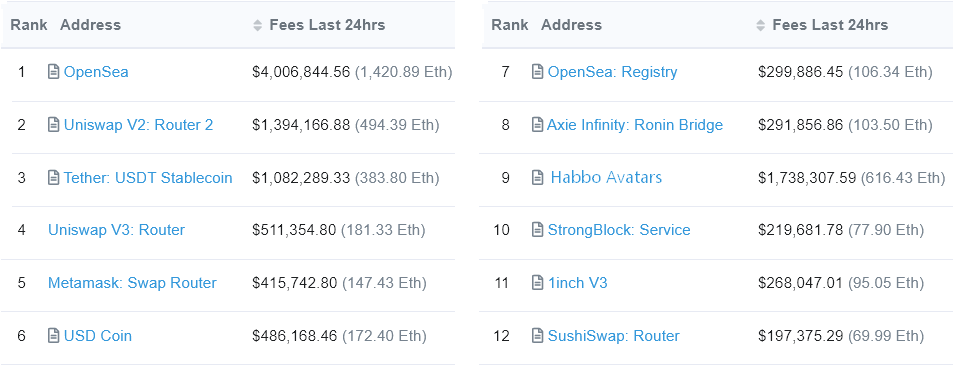

It’s possible that Ether could be a victim of its own success because the demand for decentralized finance (DeFi) applications and the minting of non-fungible tokens (NFT) continue to clog the network. This has caused the average gas fee to surpass $20 over the past ten days.

When analyzing the incredible demand for blockchain transactions, Polygon’s co-founder, Sandeep Nailwal, says it is a matter of time before Ethereum overtakes Bitcoin as the dominant layer-1 protocol.

However, negative news continues to emerge as the fourth-largest Ethereum mining pool will shut down operations in China, citing “regulatory policies.” Furthermore, SparkPool, the second-largest Ether mining pool, will also cease operations this month.

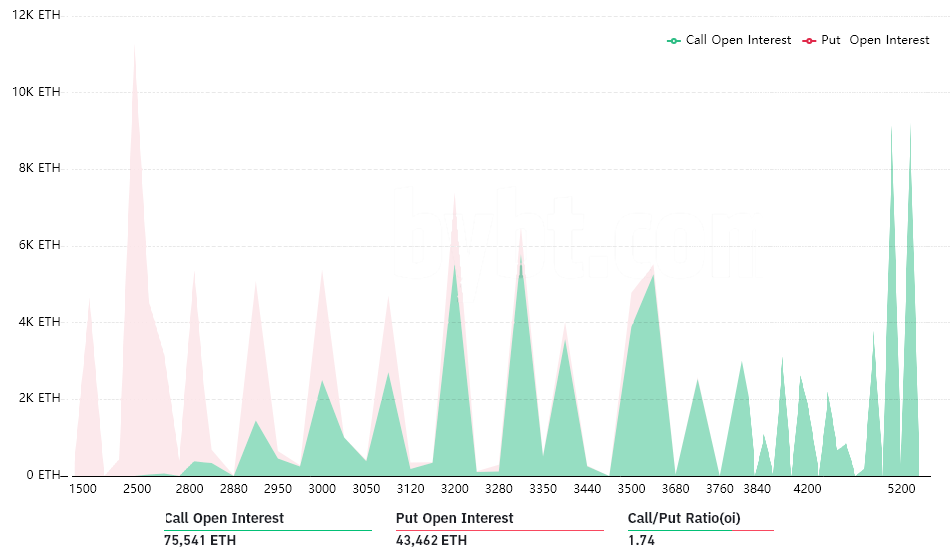

As for the $340 million options expiry on Friday, bulls need to push the price above $3,000 to avoid significant bearish pressure.

This means that a $3,000 put option becomes worthless if Ether remains below that price at 8:00 am UTC on Oct. 1.

Bulls placed more bets, but there’s a catch

The 1.74 call-to-put ratio represents the slight difference between the $215 million worth of call (buy) options versus the $125 million put (sell) options. Although favoring bulls, this broader view needs a more detailed analysis because some of those bets are implausible considering the current $2,800 price.

Below are the four most likely scenarios for Ether price. The imbalance favoring either side represents the theoretical profit from the expiry.

Depending on the expiry price, the quantity of calls (buy) and puts (sell) contracts becoming active varies:

This raw estimate considers call options being exclusively used in bullish strategies and put options in neutral-to-bearish trades. However, investors might have used more complex strategies that typically involve different expiry dates.

Bulls are wrecked one way or another

Bears have absolute control of Friday’s expiry and they have sufficient incentive to keep pressuring the price below $2,800. However, one must consider that during negative price trends, like now for Ether, a seller might cause a 2% negative move by placing large offers and making aggressive sales.

On the other hand, bulls need a 7% positive price swing taking Ether above $3,000 to balance Friday’s options expiry. It is impossible to calculate how much a trader needs to spend to drive the market that way, although it seems a colossal task.

If no surprises come before Oct. 1, Ether’s price should keep trading below $2,800.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment