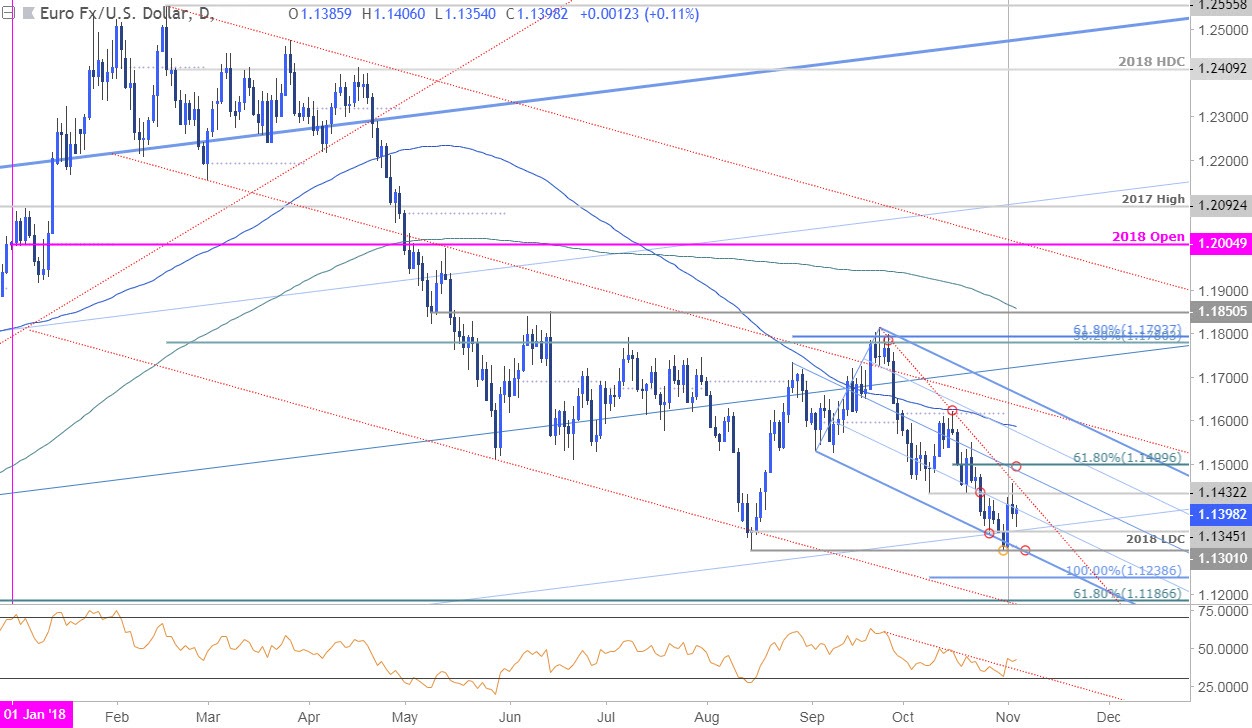

Euro has rallied more than 0.75% against the US Dollar since the start of the month with price reversing from a critical support confluence at the yearly lows. Here are the updated targets and invalidation levels that matter on the EUR/USD charts this week.

EUR/USD DAILY PRICE CHART

Technical Outlook: In my latest EUR/USD Weekly Technical Perspective we highlighted the threat of a recovery in price as Euro tested confluence support around 1.13 – a region defined by the November 2016 swing high, the 2018 swing low and the 200-week moving average. Price registered a low at 1.1302 last week before rebounding sharply with an RSI resistance trigger giving way last week. The near-term focus remains weighted to the topside while above the yearly low-day close at 1.1345 with a breach above the 1.15 handle needed to suggest a more significant low is in place.

EUR/USD 120MIN PRICE CHART

Notes: A closer look at price action shows EUR/USD breaching the topside of a multi-week descending slope formation with an ascending pitchfork off the November lows governing price into the start of the week. Near-term resistance stands at 1.1424/32 with a topside breach targeting 1.1462 backed by trendline confluence at ~1.1480 and the 61.8% retracement at 1.15 – look for a bigger reaction there IF reached.

Interim support is eyed at 1.1361 with our near-term bearish invalidation level at 1.1345 – weakness beyond this threshold would leave price vulnerable for a drop back towards the yearly low at 1.1301 backed by the 100% extension of the September decline at 1.1239.

Bottom line: EUR/USD is setting its monthly opening-range just above the yearly lows/confluence support – look to the break for guidance. From a trading standpoint, I’ll favor fading weakness while within this formation with a breach/close above 1.15 needed to keep the reversal play viable. Keep in mind that there is significant event risk over the next 48 hours with US Mid-term Elections tomorrow and the FOMC interest rate decision on Wednesday – expect volatility.

Leave A Comment