EURO TALKING POINTS

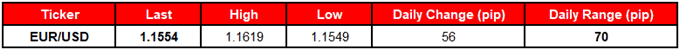

The recent rebound in EUR/USD unravels ahead of the updates to the U.S. Consumer Price Index (CPI), with the exchange rate at risk of making a run at the June-low (1.1508) as it snaps the series of higher highs & lows from earlier this week.

EUR/USD REBOUND UNRAVELS AHEAD OF UPDATES TO U.S. CONSUMER PRICE INDEX (CPI)

The Euro is back under pressure even as the European Central Bank’s (ECB) economic bulletin highlights expectations for ‘solid and broad-based economic growth,’ and the single-currency stands at risk of facing headwinds over the remainder of the year as the Governing Council remains in no rush to move away from its easing-cycle.

Even though the quantitative easing (QE) program is set to expire in December, the ECB may keep the door open to further support the monetary union as the central bank struggles to achieve its one and only mandate for price stability. After adjusting the exit strategy in June, it seems as though President Mario Draghi & Co. will deliver additional details at the next quarterly meeting in September as the asset-purchase program gets throttled down to EUR 15B/month starting in October, but the central bank may continue to strike a dovish forward-guidance for monetary policy as officials pledge to ‘ensure the ample degree of monetary accommodation necessary for the continued sustained convergence of inflation towards levels that are below, but close to, 2% over the medium term’.

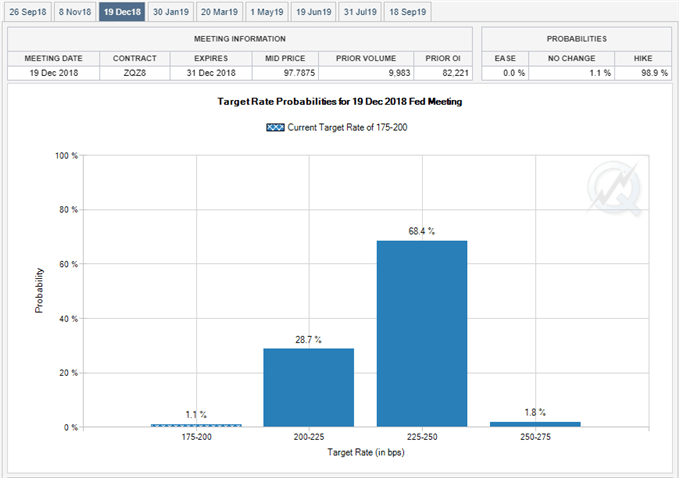

With that said, the diverging paths for monetary policy continues to cast a long-term bearish outlook for EUR/USD especially as Fed Fund Futures continue to reflect expectations for four rate-hikes in 2018, but updates to the U.S. Consumer Price Index (CPI) may keep euro-dollar in its current range as both the headline and core rate of inflation are expected to hold steady in July.

Leave A Comment