BRITISH POUND TALKING POINTS

GBP/USD trades on a firmer footing amid an unexpected rebound in U.S. Retail Sales, but the current environment keeps the downside targets on the radar as the Relative Strength Index (RSI) continues to sit in oversold territory.

GBP/USD REMAINS VULNERABLE AS RSI SITS IN OVERSOLD TERRITORY

GBP/USD pares the decline from earlier this week as U.K. household spending expands 0.9% in July, and signs of stronger consumption may keep the Bank of England (BoE) on track to further normalize monetary policy as ‘recent data appear to confirm that the dip in output in the first quarter was temporary, with momentum recovering in the second quarter’.

In turn, the BoE may continue to strike a hawkish tone at the next meeting on September 13 as ‘an ongoing tightening of monetary policy over the forecast period would be appropriate to return inflation sustainably to the 2% target at a conventional horizon,’ but Governor Mark Carney & Co. appear to be in no rush to deliver another rate-hike in 2018 as ‘the economic outlook could be influenced significantly by the response of households, businesses and financial markets to developments related to the process of EU withdrawal’.

With that said, the ongoing negotiations surrounding the Brexit process may continue to sway the exchange rate as the BoE delivers a dovish rate-hike earlier this month, and the British Pound remains at risk of facing headwinds over the remainder of the year as the Monetary Policy Committee (MPC) warns that ‘any future increases in Bank Rate are likely to be at a gradual pace and to a limited extent’.

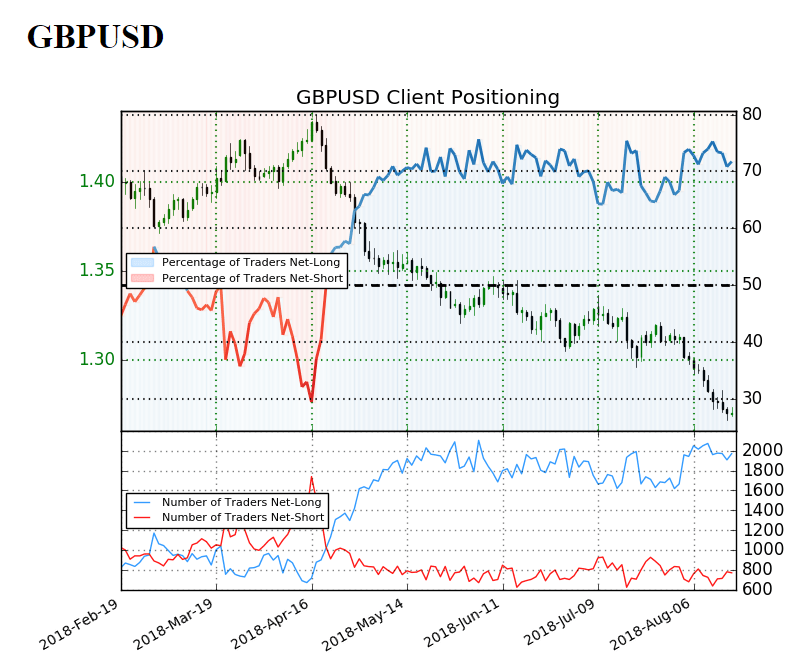

At the same time, the IG Client Sentiment Report still shows retail sentiment near extremes, with 71.7% of traders are net-long GBP/USD as the ratio of traders long to short stands at 2.54 to 1. Traders have remained net-long since April 20 when GBP/USD traded near the 1.4050 regioneven though price has moved 9.6% lower since then. The number of traders net-long is 0.3% higher than yesterday and 4.3% lower from last week, while the number of traders net-short is 0.4% higher than yesterday and 1.1% lower from last week.

Leave A Comment