Gold prices turned higher Friday as improving risk appetite triggered a reversal of haven-seeking capital flows buoying the US Dollar, sending the currency lower and offering a lift to the perennially anti-fiat yellow metal. Investors’ rosier disposition reflected hopes for de-escalation in the trade war between the US and China.

Crude oil prices attempted to rally intraday but the move failed to find follow-though, with the WTI contract heading into the weekend little-changed. Early gains seemed to be sentiment-driven, with commodities as an asset class enjoying an improvement in broader risk appetite.

MARKET SENTIMENT TRENDS, HEADLINE RISK IN FOCUS

Looking ahead, a lull in scheduled event risk sees likely to keep risk on/off dynamics as the leading driver of price action. A clear-cut lead is absent here as well however, with FTSE 100 and S&P 500 futures trading conspicuously flat before markets in London and New York come online.

On balance, this might translate into a consolidative session. Traders would be wise to remain vigilant however. A step back toward the brink of broader trade wars or renewed turmoil in emerging market assets may be no more than a single headline away. Proceeding with caution seems prudent.

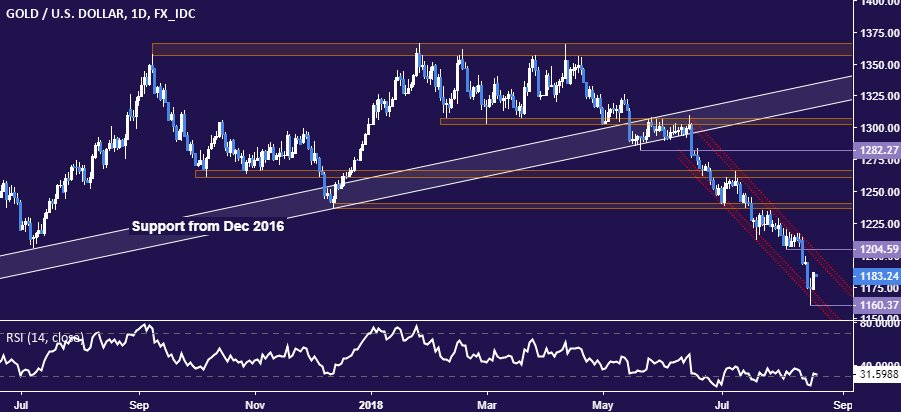

GOLD TECHNICAL ANALYSIS

Gold prices are attempting a tepid recovery after finding support below the $1200/oz figure. A daily close above former support at 1204.59 would break the near-term down trend, paving the way for a retest of the 1236.66-40.86 area. Immediate support is at 1160.37, the August 16 low.

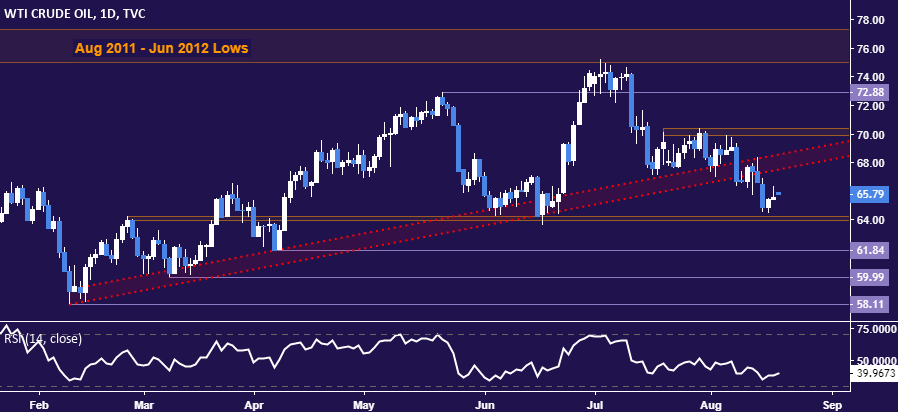

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices continue to mark time above support in the 63.96-64.26 area. A daily close below this barrier initially exposes 61.84. Alternatively, a turn back above trend line support-turned-resistance at 68.57 opens the door for another challenge of the 69.89-70.41 zone.

Leave A Comment