Fundamental Forecast for Gold: Bearish

GOLD TALKING POINTS:

Gold struggles to retain the advance from the 2018-low ($1160) as the U.S. Non-Farm Payrolls (NFP) report sparks a bullish reaction in the dollar, and the current environment keeps the precious metal at risk for further losses as the Federal Reserve appears to be on course to implement higher interest rates over the remainder of the year.

Looking ahead, attention now turns to the U.S. Consumer Price Index (CPI), with the updates anticipated to show the headline reading narrowing to 2.8% from 2.9% in July.

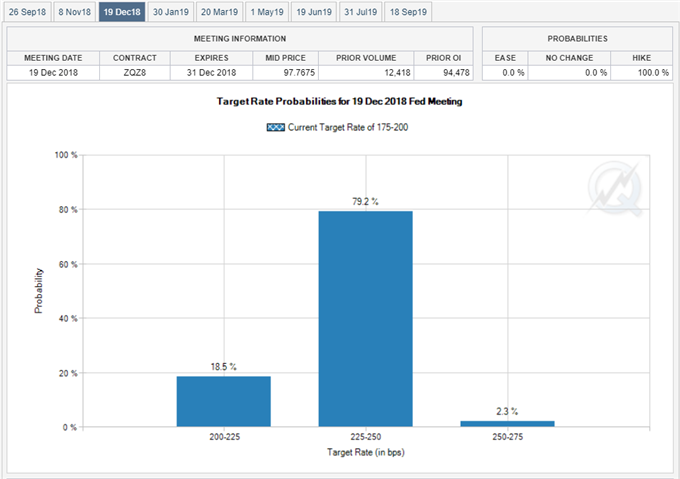

However, stickiness in the core rate of inflation may encourage the Federal Open Market Committee (FOMC) to increase the benchmark interest rate to a fresh threshold of 2.00% to 2.25% on September 26 as the gauge is expected to hold steady at 2.7% per annum in August.

In addition, the Retail Sales report is projected to show another 0.5% expansion during the same period, and a batch of positive developments may fuel bets for four Fed rate-hikes in 2018 as ‘participants generally expected that further gradual increases in the target range for the federal funds rate would be consistent with a sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective over the medium term.’

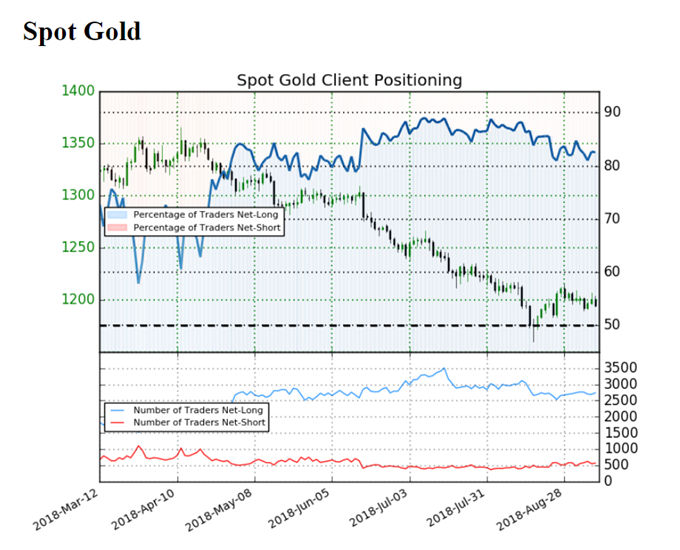

In turn, gold remains vulnerable to further losses as the inverse relationship between the precious metal and the greenback continues to materialize, with the IG Client Sentiment Report still showing retail sentiment near extremes as 82.6% of traders are still net-long bullion.

The ratio of traders long to short sits at 4.74 to 1 asthe number of traders net-long is 2.0% higher than yesterday and 0.8% higher from last week, while the number of traders net-short is 12.0% lower than yesterday and 3.0% higher from last week.

The slant in retail positioning offers a contrarian view to crowd sentiment, with current conditions warning of a further decline in gold as both price and the Relative Strength Index (RSI) snap the bullish formations carried over from the previous month.

Leave A Comment