GOLD TALKING POINTS

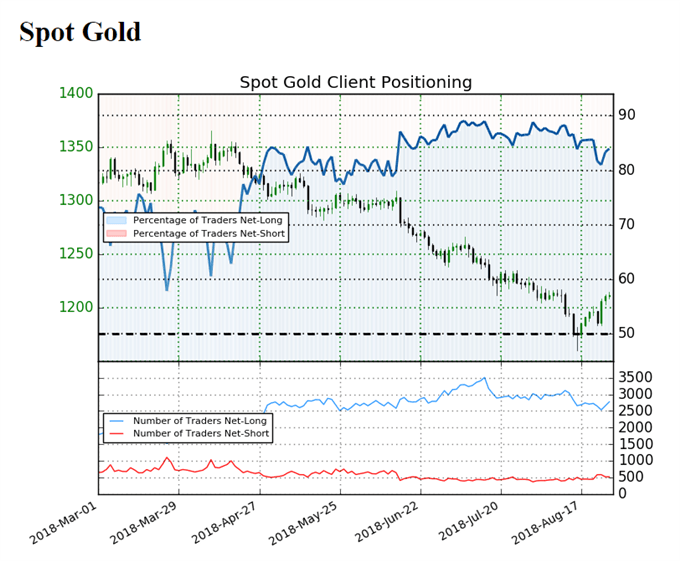

The recent rebound in gold appears to be losing steam following an unexpected uptick in the U.S. Consumer Confidence survey, but recent price action warns of a larger recovery as the precious metal initiates a fresh series of higher highs & lows.

GOLD REBOUND FIZZLES AS U.S. CONSUMER CONFIDENCE UNEXPECTEDLY IMPROVES

Gold pulls back from a fresh weekly-high ($1214) as the Conference Board’s U.S. Consumer Confidence survey climbs to 133.4 in August from a revised 127.9 the month prior, and the ongoing improvement in households spending may keep the Federal Reserve on track to further normalize monetary policy as it instills an improved outlook for private-sector spending, one of the biggest drivers of growth.

The positive development may encourage the Federal Open Market Committee (FOMC) to deliver four rate-hikes in 2018 as ‘it would likely soon be appropriate to take another step in removing policy accommodation,’ but recent remarks from Chairman Jerome Powell suggests the central bank is in no rush to alter the monetary policy outlook as the central bank head talks down the risk for above-target inflation.

With that said, market participants are likely to pay increased attention to the Fed’s Summary of Economic Projections (SEP) as officials note ‘that it would likely be appropriate in the not-too-distant future to revise the Committee’s characterization of the stance of monetary policy in its postmeeting statement,’ and projections for a neutral rate of 2.75% to 3.00% may ultimately dampen the appeal of the U.S. dollar as it dampens bets for an extended hiking-cycle.

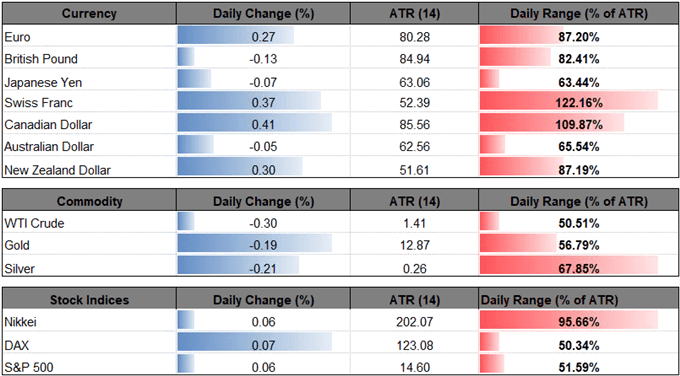

Keep in mind, the IG Client Sentiment Report continues to show retail sentiment near extremes as 84.0% of traders remain net-long gold, with the ratio of traders long to short at 5.23 to 1. The number of traders net-long is 6.6% higher than yesterday and 1.4% higher from last week, while the number of traders net-short is 14.1% lower than yesterday and 9.5% higher from last week.

Leave A Comment