The bullish optimism seen earlier in the week was dialed back on Nov. 4 after recent comments from U.S. Federal Reserve Chairman Jerome Powell confirmed that the central bank would soon start to taper its monetary policy of easing and bond buying.

These statements appear to have kicked off a series of price decreases across the crypto market and both Bitcoin (BTC) and Ether (ETH) are under pressure at the moment.

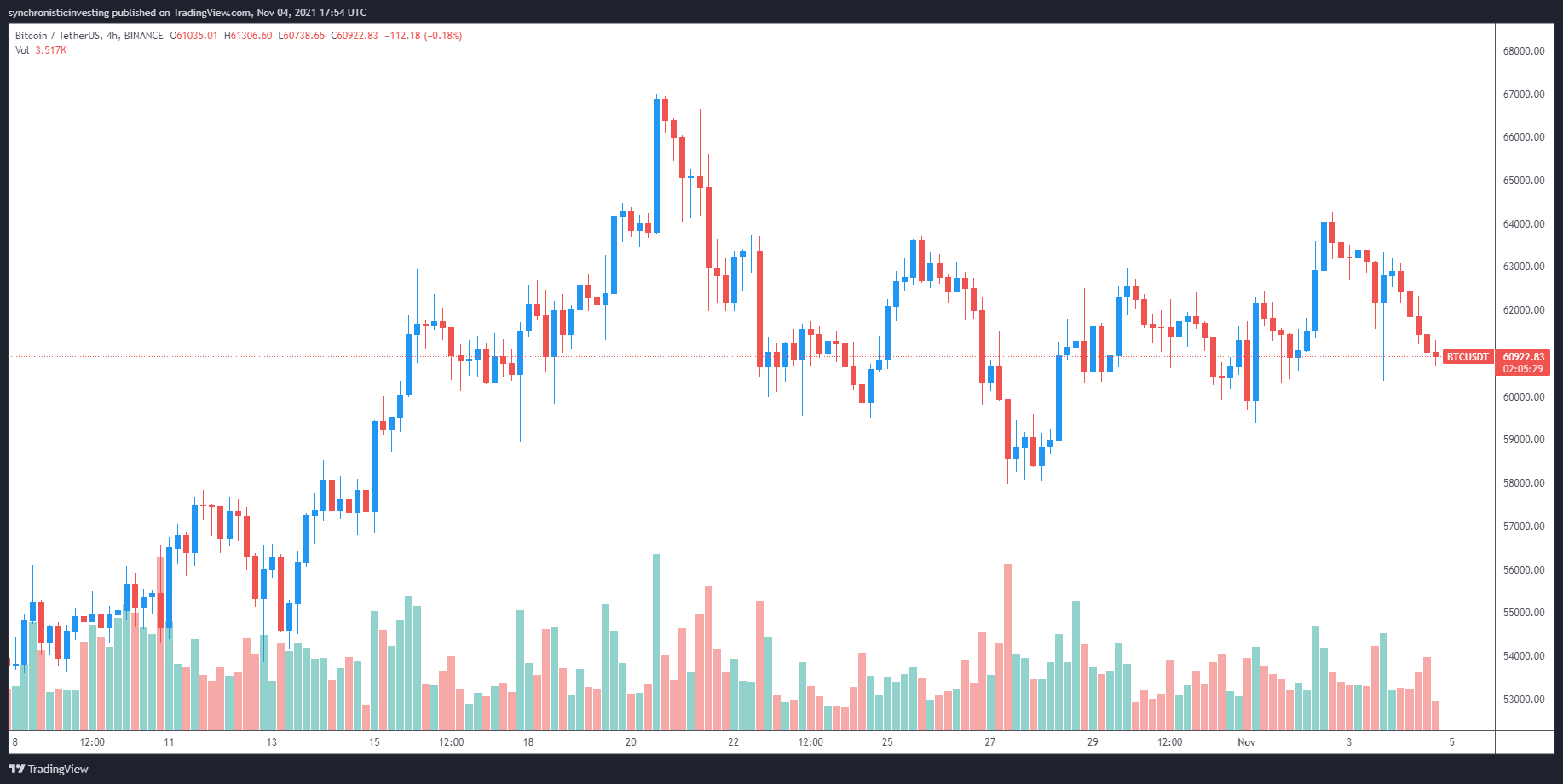

Data from Cointelegraph Markets Pro and TradingView shows that the price action for BTC flashed a warning when the price briefly dipped to $60,400 on Nov. 3 and currenlty BTC is struggling to hold the $61,000 level.

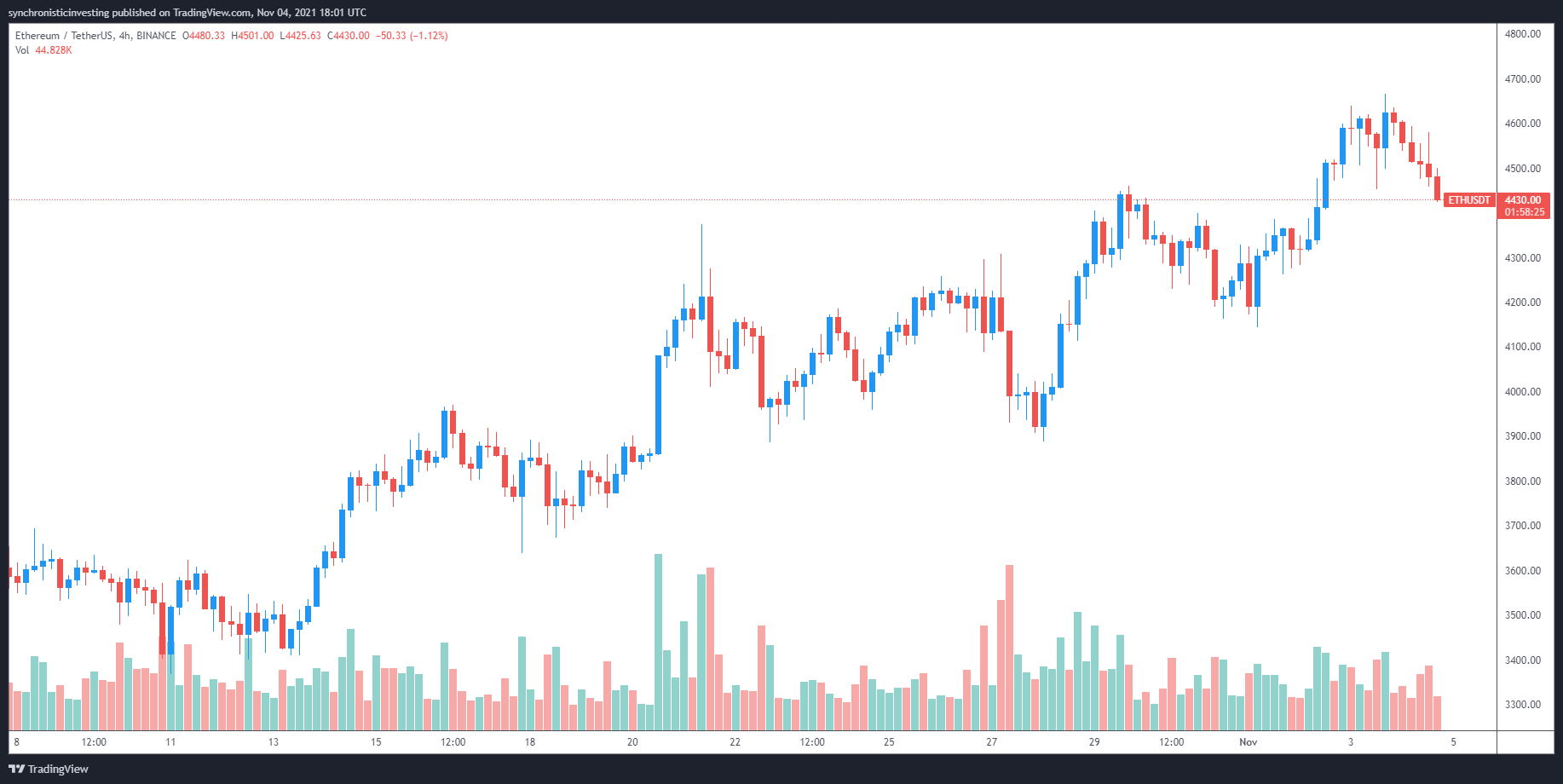

$ETH made a new All Time High this week

All ETH needs to do to continue this positive momentum is Weekly Close above it previous ATH (blue)

This way, ETH would be able to flip its old ATH into support in an effort to springboard into Price Discovery again#Crypto #Ethereum pic.twitter.com/0ivLGveetP

— Rekt Capital (@rektcapital) November 4, 2021

Related: Chainlink’s total value secured surpasses $75B as DeFi continues to surge

High flying altcoins take a beating

The pullback in BTC and Ether has hit the altcoin market hard and pushed a majority of the tokens in the top-200 into the red.

There are, however, a few bright spots in the market amidst today’s sea of red. The AI-powered delegated proof-of-stake protocol Velas (VLX) has seen its token gain 30.4% on the day and now trades at $0.4341, while Chromia (CHR) has gained 26.47% and Amp has saw its price increase by 20.53%.

The overall cryptocurrency market cap now stands at $2.686 trillion and Bitcoin’s dominance rate is 43%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment