The pain trade has been an unwelcome sight across the cryptocurrency market since the start of 2022 and over the past 24 days Bitcoin (BTC) and the altcoin prices have drifted, leading some analysts to suggest that a bear market is at hand.

Despite traders’ concern that another extended crypto winter could be starting, it times like these when investors can capitalize on great opportunities to pick up fundamentally sound cryptocurrencies at a discount.

Polygon (MATIC)

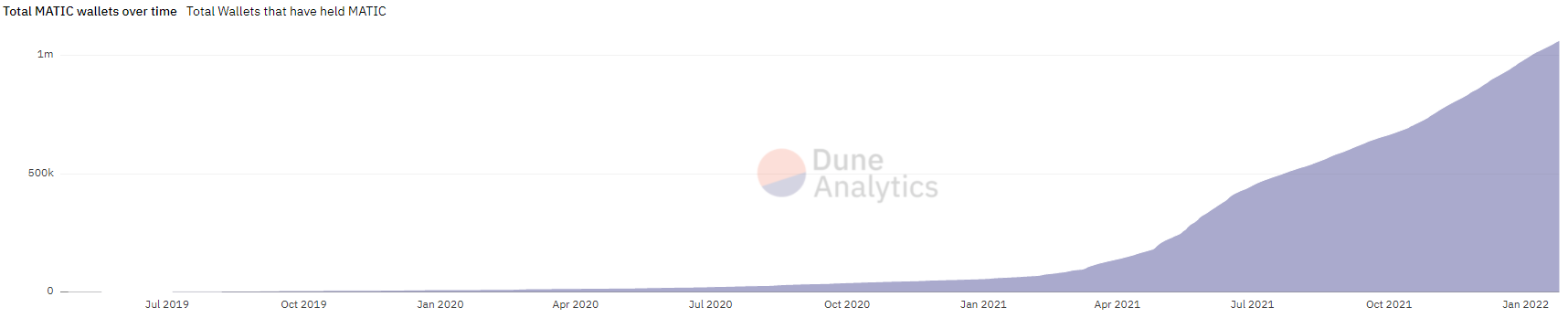

The Ethereum (ETH) layer-two scaling solution Polygon (MATIC) is currently down 50.76% from its all-time high of $2.92 which was established on Dec. 27, 2021.

With the capabilities and final date for the rollout of Eth2 still unknown, layer2 solutions like Polygon are likely to continue to see increased engagement as users seek lower-fee transactions.

Fantom (FTM)

Fantom (FTM) is a layer-one blockchain protocol that also rose in prominence over 2021 as its low fee environment and Ethereum Virtual Machine (EVM) Compatibility helped attract new users and protocols to the network.

The bullish case for FTM is backed by the continued rise total value locked (TVL) on the Fantom network despite the market-wide pullback, with data from Defi Llama showing that the Fantom TVL is currently at an all-time high of $12.07 billion.

TVL of #Fantom and #Solana are nearly the same now (10.67B vs 10.31B)

Buy $FTM now like buy $SOL at 23$#fantomseason #solanawinter #fantomnews pic.twitter.com/eeUop6biZJ

— Fantom News (@fantomnews) January 15, 2022

With the current price of SOL standing at roughly $90, the price of FTM would need to be $18.10 to have a matching market cap, suggesting that Fantom is undervalued relative to its layer-one competitors and has the potential to close that gap as 2022 progresses.

Polkadot (DOT)

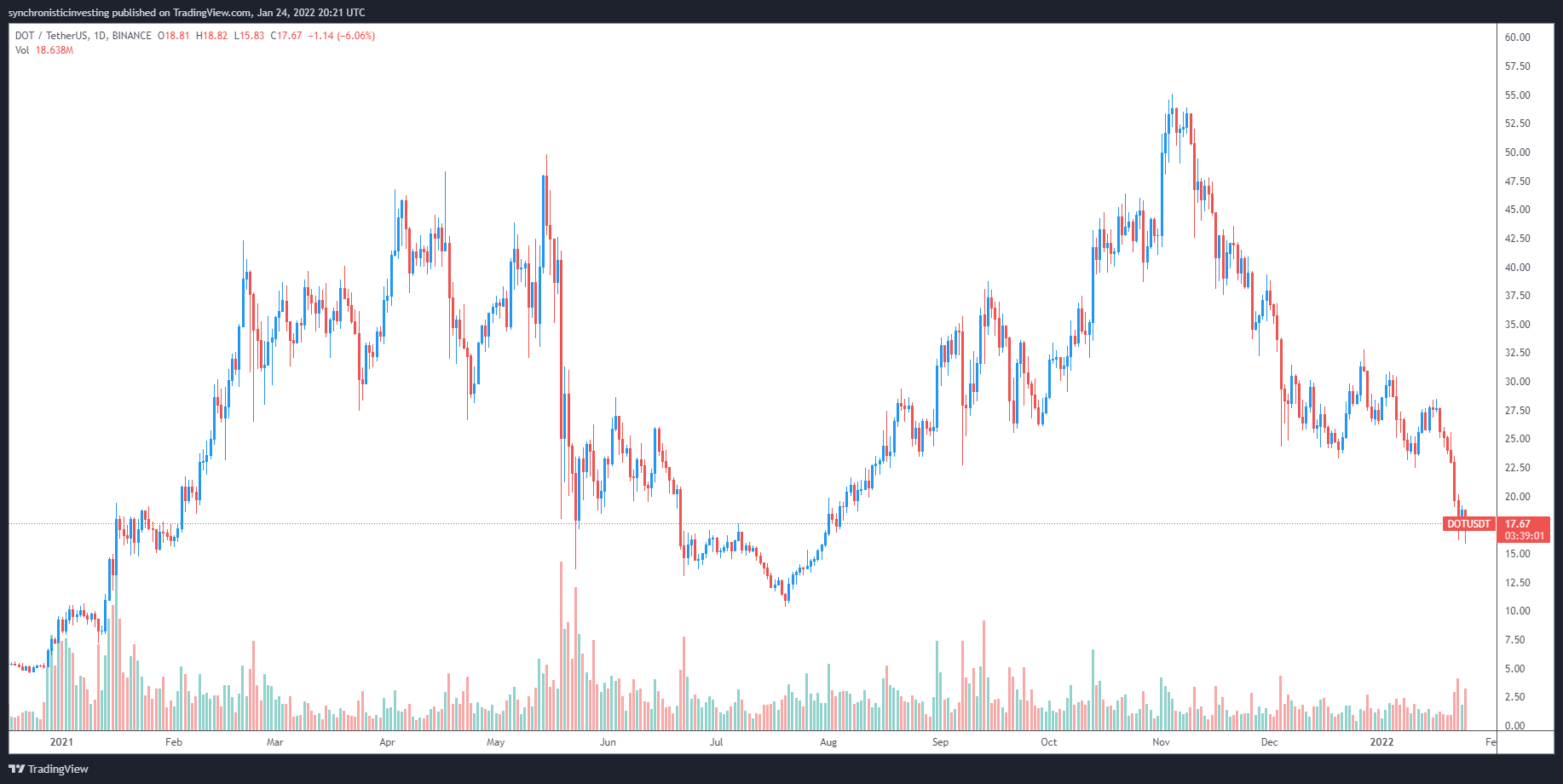

Another token that could potentially be in a good accumulation zone is Polkadot (DOT), a sharded multi-chain protocol whose goal is to facilitate the cross-chain transfer of any data or asset types across multiple blockchain networks.

Data from Cointelegraph Markets Pro and TradingView shows that the price of DOT has been on the decline since early November 2021 as the token underperformed its cohort of layer-one projects possibly due to the lack of a functioning bridge to Ethereum.

As other parachains officially launch on Polkadot in the months ahead, DOT has the potential to see a rise in demand and token price as users look to get involved with the Polkadot network.

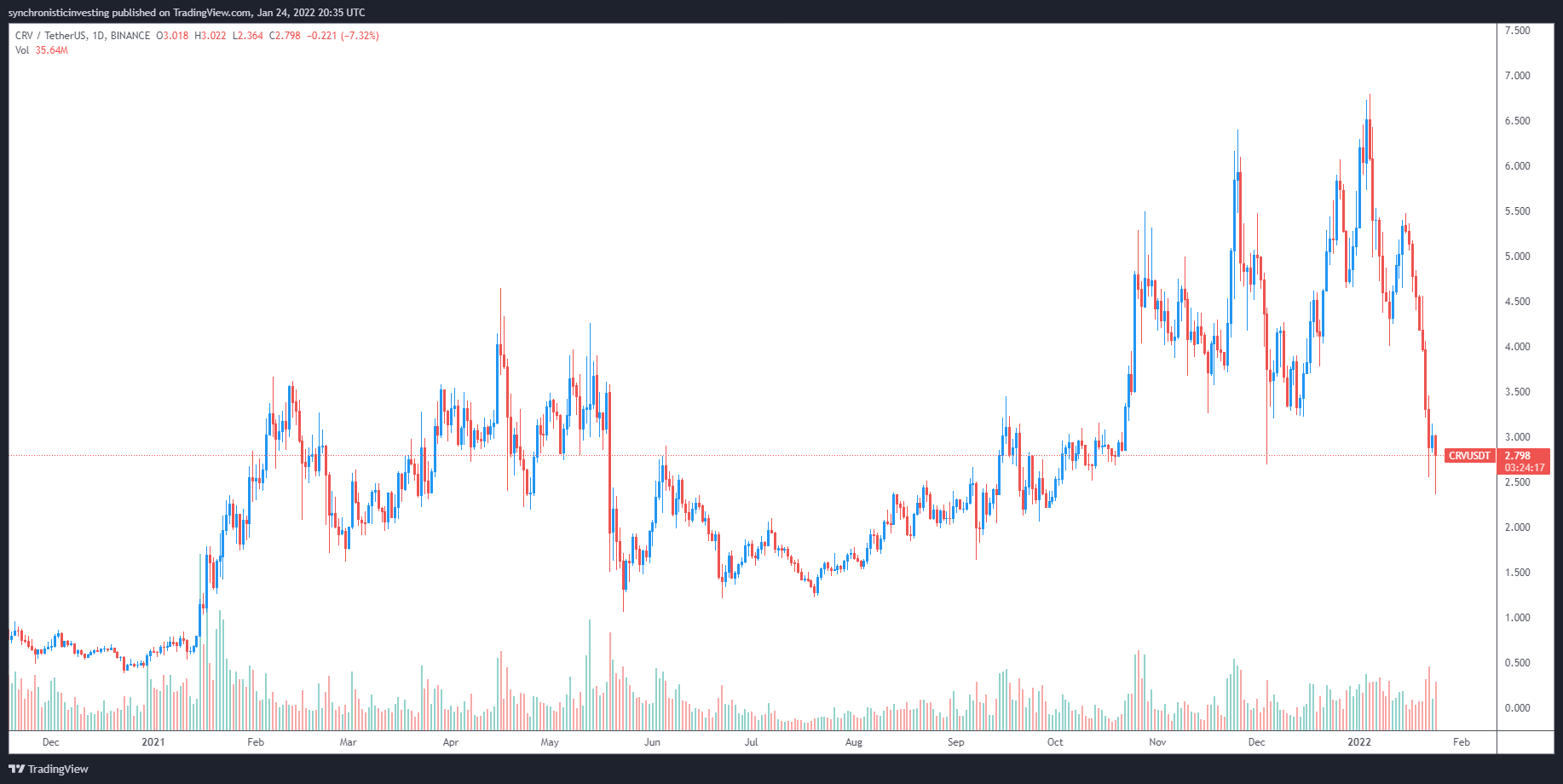

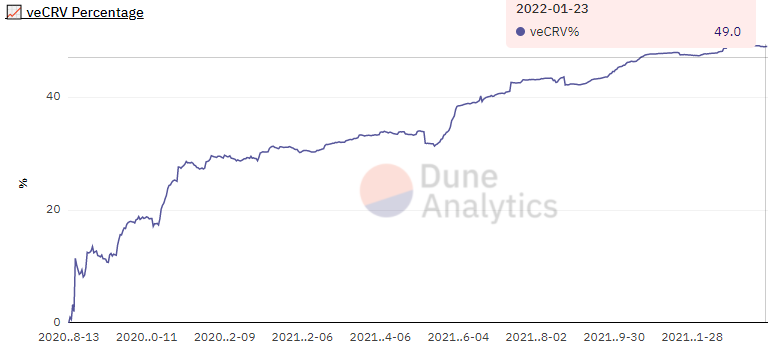

When it comes to the increasing importance of the stablecoins in the crypto market, Curve DAO token has emerged as one of the most sought-after tokens by investors and protocols who have been vying for control of governance on the platform.

Even with the drop in CRV price, the ongoing ‘Curve Wars’ suggest that demand for the token is likely to rise once the current weakness in the market subsides as decentralized finance projects attempt to accumulate governance powers over the Curve ecosystem.

At the time of writing, a total of 49% of the circulating supply of CRV is locked in veCRV, the voting token for the Curve protocol.

Frax Share (FXS)

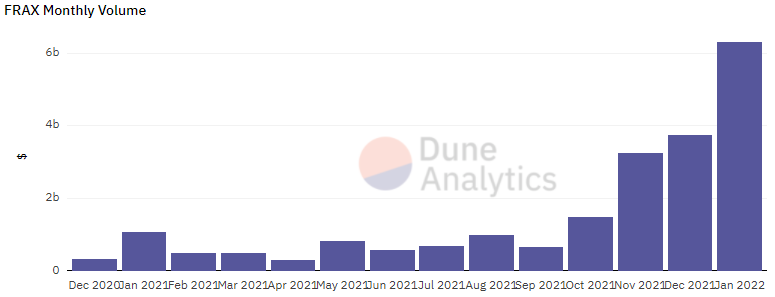

Another protocol that looks to play a larger role in the stablecoin sector is Frax Share (FXS), the first fractional-algorithmic stablecoin system in the crypto sector that began to gain traction near the end of 2021.

As a result of its adoption, the total volume of FRAX transacted has risen over the past six months and is currently at an all time high of $6.3 billion.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment