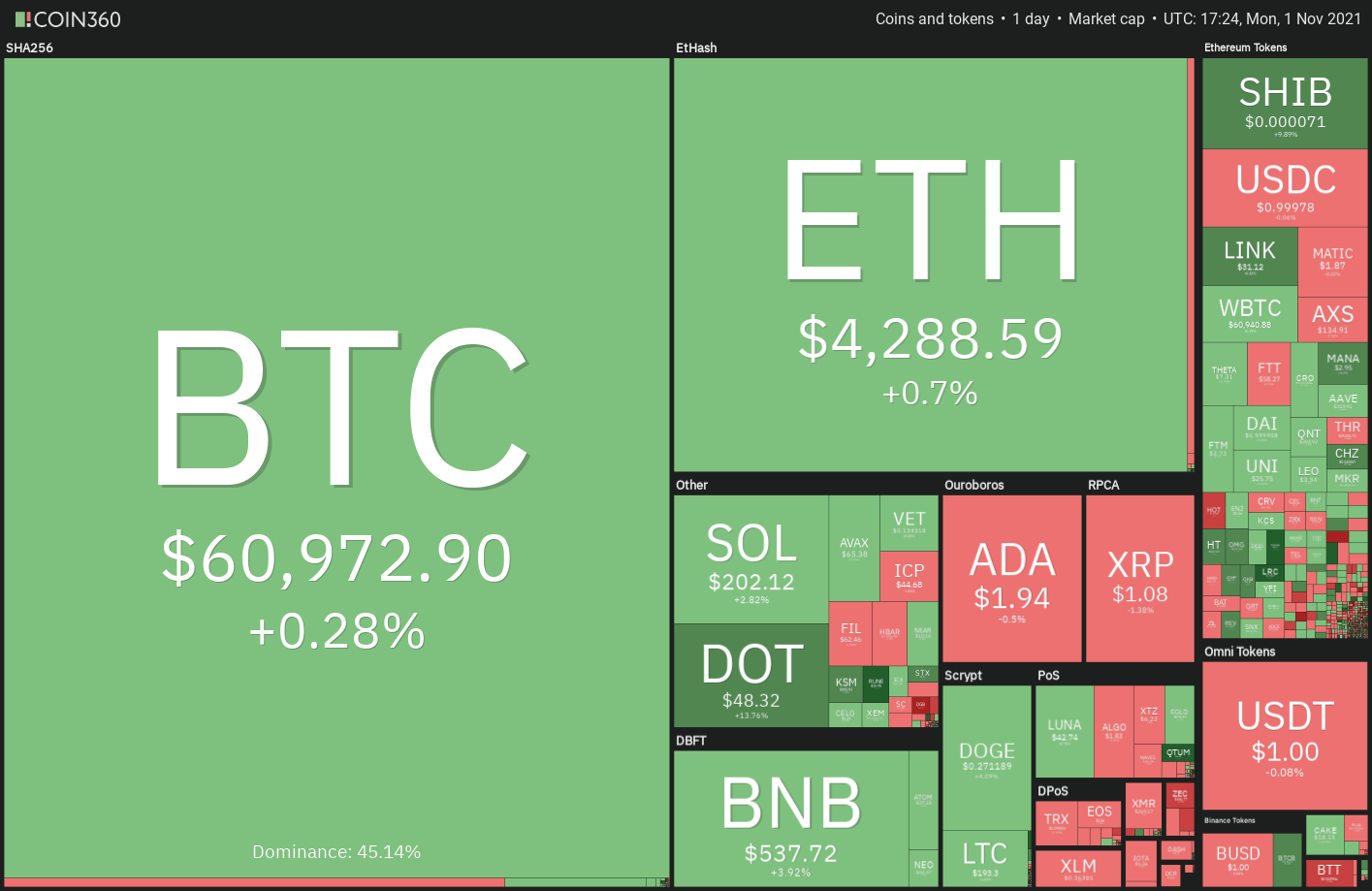

Bitcoin (BTC) and Ether (ETH) had their highest monthly close ever in October, indicating strong momentum that favors buyers. The focus now shifts to November, which has largely been bullish for Bitcoin.

Since 2013, Bitcoin has closed November in the red on only two occasions, in 2018 and 2019. Another positive impetus for Bitcoin could be the tailwinds from the U.S. stock markets, which also have an enviable record in November.

The S&P 500 has recorded a median rise of 2% in November, the only month of the year to achieve such impressive median returns.

Could Ether lead the altcoins higher or will Bitcoin remain in the driver’s seat? Let’s analyze the charts of the top-10 cryptocurrencies to find out.

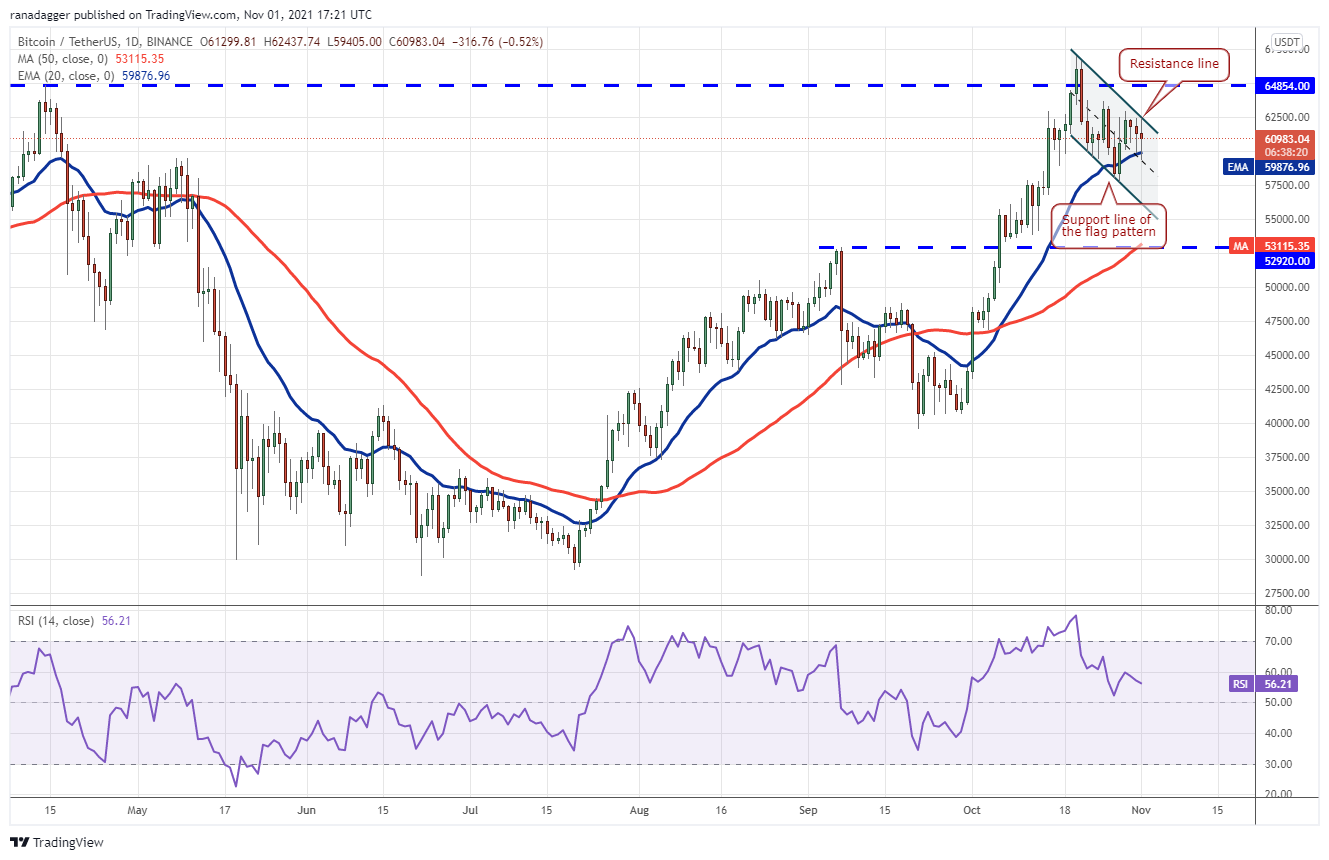

BTC/USDT

Bitcoin turned down from the resistance line of the flag pattern on Oct. 31 but the bulls did not allow the price to sustain below the 20-day exponential moving average ($59,876). This is a positive sign as it shows that traders are buying on dips.

The rising moving averages and the relative strength index (RSI) in the positive zone indicate that bulls have the upper hand. The first sign of weakness will be a break and close below the 20-day EMA. Such a move could result in a decline to the support line of the pattern.

The selling could accelerate if bears sustain the price below the flag. The pair could then drop to the 50-day simple moving average ($53,115).

ETH/USDT

The long tail on Ether’s candlestick today shows that bulls are buying on dips with vigor. The bulls have not allowed the price to dip and sustain below the 20-day EMA ($4,042) since Oct. 1, which suggests that sentiment remains positive.

Contrary to this assumption, if the price turns down from the overhead resistance, the bears will try to pull the pair to the 20-day EMA. This is an important support to watch out for because a break below it could prompt short-term traders to book profits.

BNB/USDT

The bears attempted to pull Binance Coin (BNB) back below $518.90 for the past two days but the long tail on the candlestick shows bulls had other plans. Lower levels are attracting strong buying and the bulls will now try to resume the uptrend.

Conversely, if the price turns down and breaks below the 20-day EMA, it will suggest aggressive selling at higher levels. That may trap several aggressive bulls, pulling the pair to the critical support at $392.20.

ADA/USDT

The bulls have successfully defended the strong support at $1.87 for the past few days but they are struggling to push Cardano (ADA) above the 20-day EMA ($2.07). This indicates a lack of demand at higher levels.

Contrary to this assumption, if the price rises from the current level and breaks above the moving averages, it will indicate strong accumulation at $1.87. The pair could then rally to the overhead resistance at $2.47.

SOL/USDT

Solana (SOL) rebounded off the 20-day EMA on Oct. 31, signaling strong buying at lower levels. The bulls will now try to push the price above the overhead resistance zone at $216 to $218.93.

The rising 20-day EMA ($185) and the RSI in the positive zone indicate that bulls have the upper hand. This positive view will be negated if the price turns down from the overhead resistance and plummets below the 20-day EMA. That could pull the price down to the trendline.

XRP/USDT

XRP is stuck between the downtrend line and the $1 support as the bears are selling on rallies and bulls are buying on dips. The bulls tried to push the price above the downtrend line on Oct. 31 but the long wick on the candlestick shows selling at higher levels.

If bulls drive the price above the downtrend line, the pair could rally to the overhead resistance at $1.24. The flat moving averages and the RSI near the midpoint do not give a clear advantage either to the bulls or the bears.

DOT/USDT

Polkadot (DOT) bounced off the 20-day EMA ($41.93) on Oct. 31 as seen from the long tail on the day’s candlestick. This is a positive sign as it shows that traders are accumulating on dips.

If the price turns down from the current level or the overhead resistance and finds support at $46.30, it will improve the prospects of the resumption of the up-move toward the pattern target at $53.90.

The first sign of weakness will be a close below $46.39. The pair could then drop to the 20-day EMA.

Related: Bitcoin whale indicator detects multi-month accumulation trend as BTC eyes $67K-retest

SHIB/USDT

SHIBA INU’s (SHIB) long tail on the Oct. 31 candlestick suggests that bulls aggressively bought the dip to the 50% Fibonacci retracement level at $0.00005778.

A break and close above $0.00008854 could indicate the resumption of the uptrend that may reach the 300% Fibonacci extension level at $0.00010349. Conversely, a break and close below $0.00005778 may pull the price down to the 20-day EMA ($0.000048).

DOGE/USDT

Dogecoin (DOGE) bounced off the 20-day EMA ($0.25) on Oct. 31 but the bulls are struggling to sustain the price above $0.27. This suggests that bears are selling on rallies.

This positive view will invalidate in the short term if bears pull the price below the 20-day EMA. The pair could then decline to the 50-day SMA ($0.23). If this support is breached, the down move could extend to $0.19.

LUNA/USDT

Terra protocol’s LUNA token has been trading between the resistance line of the symmetrical triangle and the 20-day EMA ($41.65), which is a positive sign. This suggests that traders are buying on dips to the 20-day EMA.

If bears pull the price below the 20-day EMA, the pair could slide to the 50-day SMA ($38.89) and later to the support line of the triangle. A break and close below this support will indicate that bears have overpowered the bulls. The pair may then drop to $33 and next to $22.40.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.

Leave A Comment