Talking Points:

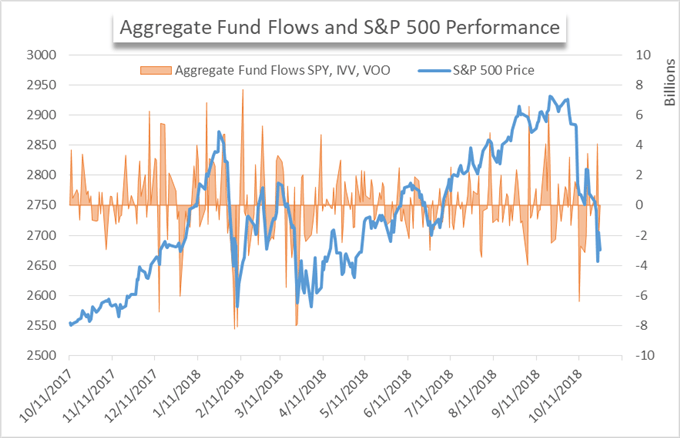

What began as a few days of sustained losses for the S&P 500 now borders a full-scale correction with the index down just under 10% from its peak. With its close at 2,658 on Friday, the S&P 500 forfeited all year-to-date gains. Despite the continued sell-off, exchange traded funds that track the main indices realized net-inflows for the week.

S&P 500 Hourly Price Chart October 2018

In total, the three ETFs saw $2.2 billion in inflows. While rather insignificant relative to their cumulative market capitalizations, the flows are noteworthy given the market’s climate. This week saw four of the five trading days close red with substantial losses on Wednesday and Friday. For the month of October, Thursday marked just the fourth green close. With that in mind, Thursday’s inflow of $4.1 billion is evidence that at least some investors remain optimistic.

Optimism in the equity market may be waning but opportunities to generate more are abound. This week in particular had key earnings in the second and third largest US corporations by market cap, Amazon and Microsoft. The reports presented an excellent opportunity to help stage a broader rebound if the results impressed. Further, this could have contributed to Thursday’s inflows if some investors bet strong earnings would mark the bottom of the dip. Unfortunately those who wagered on such a result were left out to dry with both the mega-cap tech companies missing forecasts.

Aggregate Fund Flows versus S&P 500 Performance

Still, earnings season presses on. Next week Apple is accompanied by Ford, General Motors, Daimler and Exxon. Investors will now look to these key earnings to help spur a rebound or at least create a floor for equities.

Leave A Comment