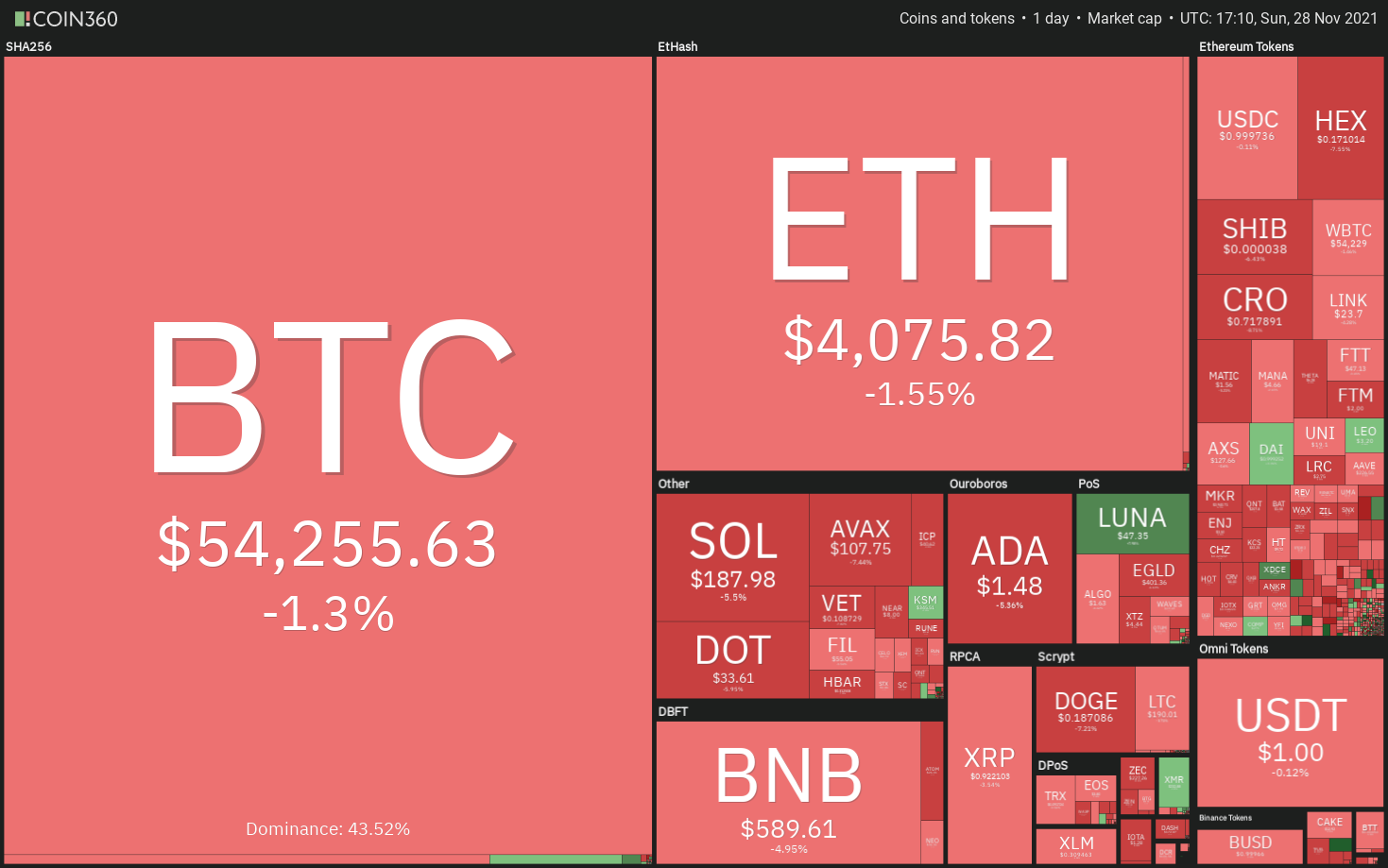

Bitcoin (BTC) and most major altcoins have been struggling to recover from the sharp fall seen on Nov. 26. This indicates that traders may be nervous to buy at current levels due to the uncertainty regarding the new heavily-mutated coronavirus strain detected in South Africa.

According to a CryptoCompare report, Bitcoin’s assets under management decreased 9.5% to $48.70 billion in November. On the other hand, the AUM of altcoin-based crypto funds increased 5.4% to $16.60 billion.

This indicates that traders may have booked profits in Bitcoin and rotated part of that money into altcoins.

If Bitcoin recovers from the current level, select altcoins may also attract investor attention. Let’s analyze the charts of the top-5 cryptocurrencies that may remain in focus in the next few days.

BTC/USDT

Bitcoin has been correcting in a descending channel for the past few days. The bulls are attempting to defend the 100-day simple moving average ($54,064) for the past two days but the shallow bounce indicates a lack of urgency to accumulate at the current level.

If the price again turns down from the 20-day EMA, it will increase the prospects of a break below the 100-day SMA. The pair could then challenge the support line of the channel. A break below the channel could intensify selling and sink the BTC/USDT pair to $40,000.

The bulls will have to push and sustain the price above the channel to signal that the correction may be over. The pair could pick up bullish momentum on a break and close above $61,000.

This is an important resistance for the bulls to overcome because the previous two recoveries faltered near this level.

If the price turns down from the current level or the overhead resistance and breaks below $53,500, the selling could accelerate. The pair could then drop to the strong support at $50,000.

BNB/USDT

Binance Coin (BNB) is witnessing a tussle between the bulls and the bears near the 20-day EMA ($590). Although the price dipped and closed below the 20-day EMA on Nov. 26, the bears could not build upon this advantage.

If bulls push the price above $621.30, the BNB/USDT pair could again rally to the overhead resistance zone at $669.30 to $691.80.

Alternatively, if the price turns down and closes below the 20-day EMA, the pair could drop to the 50-day SMA ($546). A break and close below this support could extend the pullback to the 100-day SMA ($487) and then to $440.

If they can pull it off, the pair could drop to the support zone between $564.20 and $553.80. A break below this zone could result in a sharper decline to $510.

Conversely, if bulls push and sustain the price above the 20-day EMA, the pair could rise to $621.30 and pick up momentum above it.

LUNA/USDT

Terra’s LUNA token is trading inside an ascending channel pattern. The bulls successfully defended the support line of the channel between Nov. 24-26 and have pushed the price above the 20-day EMA ($44.33) today.

Contrary to this assumption, if the price fails to sustain above the 20-day EMA, it will indicate that traders are selling on rallies.

The bears will then again try to sink the price below the channel. If they manage to do that, it will signal a possible change in trend. The pair could then drop to $32 and later to $24.

The 20-EMA has turned up and the RSI is in the positive zone, indicating that bulls have a slight advantage. If the price rises from the current level or rebounds off $45.54, it will suggest accumulation on dips.

Conversely, a break and close below the moving averages could tilt the short-term advantage in favor of bears. The pair could then drop to $38.

Related: The Holy Grail for crypto traders: Consistent average returns over 5%

MANA/USDT

Decentraland (MANA) turned down from $5.90 on Nov. 25 but the long tail on the candlesticks of the past two days shows that bulls are attempting to defend the zone between the 38.2% Fibonacci retracement level at $4.48 and the 50% retracement level at $4.05.

The rising moving averages and the RSI in the positive territory indicate that bulls have the upper hand.

This bullish view will invalidate in the near term if the price turns down and breaks below the 20-day EMA ($3.88). Such a move will indicate that supply exceeds demand. The pair may then dip to $3.10.

On the contrary, if the price turns up from the current level or the 50-SMA, the bulls will attempt to thrust and sustain the price above $5. That could accelerate buying and the pair may rally to $5.50 and then to $5.90.

SAND/USDT

The Sandbox (SAND) has been correcting the strong up-move of the past few days. The bulls are attempting to arrest the pullback in the zone between the 38.2% Fibonacci retracement level at $$6.02 and the 50% retracement level at $5.26.

If they succeed, the SAND/USDT pair could resume its up-move with the next target objective at $10.52. This bullish view will invalidate in the short term if the price turns down from the current level and breaks below the 20-day EMA ($4.84).

Contrary to this assumption, if the price turns down from the current level or the overhead resistance and breaks below the 50-SMA, it will signal that traders may be booking profits on relief rallies. That could open the doors for a deeper fall to $4.50.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment